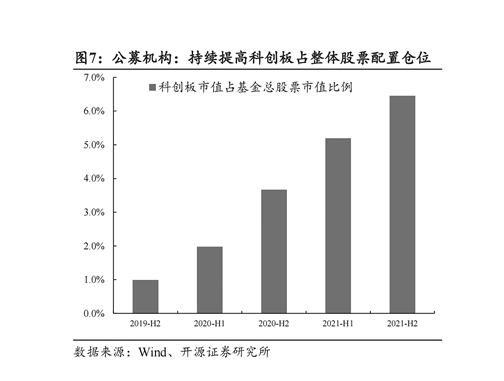

The Sci-tech Innovation Board accounts for the overall stock allocation of public funds. Data source: Wind, Open Source Securities Research Institute

With the recent recovery of the A-share market, the STAR Market has performed strongly.Since the launch of the Sci-tech Innovation Board, as a new force for high-quality development, the company's "hard technology" background has continued to show, and its performance has continued to improve.Institutions and industry experts said that the Sci-tech Innovation Board has strong growth potential and its valuation is at a historically low level. With the continuous advancement of high-quality economic development, the Sci-tech Innovation Board is expected to benefit the most from the development of "hard technology" industries and the dividends of economic transformation and upgrading. Frontier plate positioning.

Domestic and foreign investment have increased their positions on the Science and Technology Innovation Board and rebounded strongly

On June 6, the Science and Technology Innovation Board once again became the focus of the market.On the same day, the Science and Technology 50 Index continued to open stronger, closing up 3.86%, and many individual stocks rose by the daily limit.It is worth noting that since May, the cumulative increase of the Science and Technology 50 Index has exceeded 18%, significantly outperforming the three major indexes, and more than 60% of the stocks in the sector have risen by more than 20%.

Driven by individual stocks, many ETFs with the theme of science and technology innovation also rose on the same day. Many 50 ETFs for entrepreneurship and innovation rose by more than 4% that day, and the 50 ETFs for science and technology innovation rose by more than 3.8%.

From the perspective of capital flow, since the beginning of this year, the inflow of science and technology-themed ETF funds has been obvious.Wind data shows that as of the close on the 6th, the shares of 22 science and technology-themed ETFs including the Science and Technology Innovation 50ETF and the Science and Technology Innovation Board 50ETF have increased by more than 19 billion shares during the year, and the net inflow of funds during the year totaled 18.939 billion yuan. Chuang 50 ETF is one of the most "gold-absorbing" ETFs this year, with a net inflow of 12.668 billion yuan during the year.Newly issued ETFs with the theme of science and technology innovation are also favored by the market.Among them, Harvest SSE Science and Technology Innovation Board New Generation Information Technology ETF, Huaan SSE Science and Technology Innovation Board New Generation Information Technology ETF and Shanghai Investment Morgan China Securities Innovative Drug Industry ETF raised 1.397 billion yuan, 599 million yuan and 209 million yuan respectively in 5 days.

Foreign capital is also aggressively adding stocks on the STAR Market.Wind data shows that as of the close on the 6th, more than 100 stocks on the Science and Technology Innovation Board have been held by foreign institutions.According to data from the Hong Kong Stock Exchange, on May 31, 34 of the 44 stocks on the Sci-Tech Innovation Board of Shanghai Stock Connect were added by foreign investors. On the same day, the overall net purchase of northbound funds was 1.062 billion yuan, setting a record when the Sci-tech Innovation Board was included in the northbound in February 2021. The largest single-day net purchase since the target.

In terms of public fund allocation, Industrial Securities pointed out that as of the first quarter of 2022, the allocation of public funds to the Science and Technology Innovation Board has risen to 5.4%, which is still underweight.But on the whole, the direction of public offering to increase warehouses on the Science and Technology Innovation Board is clear.Especially since the second half of 2021, under the circumstance that the Science and Technology Innovation Board has suffered a significant adjustment, public funds are still increasing their positions against the trend.In the future, as the performance of the Science and Technology Innovation Board continues to increase at a high rate, institutional investors are expected to further accelerate the addition of the Science and Technology Innovation Board.Kaiyuan Securities also stated that the influence and attractiveness of the Science and Technology Innovation Board is continuing to increase, as foreign capital continues to flow into the Science and Technology Innovation Board and mainland public offering institutions increase the proportion of the Science and Technology Innovation Board in the overall equity allocation position.

Chen Li, chief economist of Chuancai Securities and director of the research institute, said that "focusing on building China's hard-core technology" is the original intention of the establishment of the Science and Technology Innovation Board. Achieving the independent and controllable domestic industrial chain is the responsibility and goal of the Science and Technology Innovation Board.In recent years, domestic policy has also given the greatest support to science and technology enterprises, helping them to become better and stronger.The simultaneous addition of domestic and foreign capital to stocks on the STAR Market represents recognition of domestic high-end manufacturing companies.

Institutions are optimistic about the growth space of the Sci-tech Innovation Board after a substantial adjustment in valuation

It has been nearly three years since the opening of the STAR Market, and the innovative system of the STAR Market has been continuously implemented, attracting more than 400 hard technology companies to list, with a total market value of more than 5 trillion.As a new force for high-quality development, the Sci-tech Innovation Board Company is based on technological innovation and deeply cultivates the main business of sci-tech innovation.The role of the science and technology board in serving the national innovation-driven strategy and the high-quality development of the real economy is gradually emerging.

According to data from the Shanghai Stock Exchange, in 2021, the Sci-tech Innovation Board companies will achieve a total operating income of 834.454 billion yuan, a year-on-year increase of 36.86%; the net profit attributable to the parent company will be 94.841 billion yuan, a year-on-year increase of 75.89%; in the first quarter of 2022, the Sci-tech Innovation Board will achieve business operations The income was 216.286 billion yuan, a year-on-year increase of 45.60%; the net profit attributable to the parent was 26.804 billion yuan, a year-on-year increase of 62.42%, and the R&D investment continued to maintain a high level.

Kaiyuan Securities believes that judging from recent financial data, the growth of the Science and Technology Innovation Board is far superior to other sectors.Industrial Securities also stated that the performance growth rate of the Science and Technology Innovation Board has continued to be higher than that of other sectors in recent years, and according to profit forecasts, the growth rate of the sector will continue to lead the market in 2022.

Zhang Qiyao, an analyst at Industrial Securities, believes that, first of all, in terms of the macro environment, the economy is going through a process from downturn to stabilization.The Science and Technology Innovation Board is expected to become a frontier sector that benefits to the greatest extent from the development of "hard technology" industries and the dividends of economic transformation and upgrading; secondly, in terms of profitability, the performance of the Science and Technology Innovation Board has continued to lead the market since 2021, and it is more sustainable; finally, it is estimated that At the level of value, after a substantial adjustment, nearly 40% of the stocks on the Science and Technology Innovation Board are lower than the issue price, and the valuation of the Science and Technology Innovation 50 Index is at a historical low.

In addition, the Science and Technology Innovation Board has also ushered in a series of favorable policies recently.On the one hand, the market maker system on the STAR Market will be implemented soon, and the market liquidity and trading activity on the STAR Market are expected to increase. On the other hand, the SSE STAR Market Chip Index will be released soon.Kaiyuan Securities said the move is expected to introduce more institutional funds to the STAR Market.

Regarding the market outlook, Chen Li said that in the short term, companies on the Science and Technology Innovation Board are more inclined to technological innovation companies and grow faster, so they can give a higher premium in terms of valuation. Relative caution is required; in the medium and long term, as companies on the STAR Market become better and stronger and release their performance in the future, and at the same time, the STAR Market will further introduce liquidity (market maker system and issuance of science and technology innovation funds), companies listed on the STAR Market are expected to be Ushered in the "Davis Double Click" with both performance and valuation rising at the same time.

(Editor in charge: Guan Jing)