Every reporter Zhang Huaishui Every editor Chen Xu

On June 7, the Ministry of Human Resources and Social Security released the 2021 Statistical Bulletin on the Development of Human Resources and Social Security (hereinafter referred to as the Bulletin).

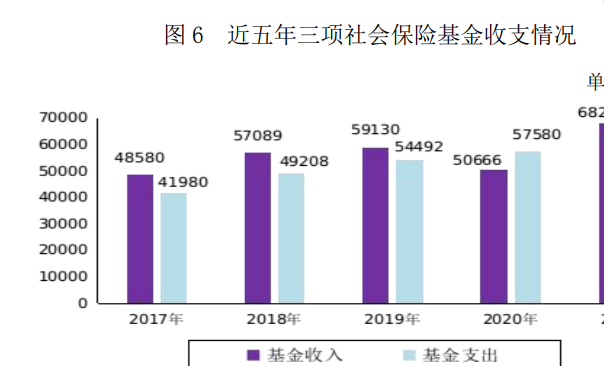

The "Communiqué" shows that for the whole year of 2021, my country's basic pension insurance, unemployment insurance, and work-related injury insurance will generate a total of 6,820.5 billion yuan in income from the three social insurance funds, an increase of 1,753.8 billion yuan or 34.6% over the previous year; An increase of 510.7 billion yuan over the previous year, an increase of 8.9%.

Why did the income of the three social security funds increase by 34.6% last year?Zheng Bingwen, director of the World Social Security Research Center of the Chinese Academy of Social Sciences, said in a telephone interview with the "Daily Economic News" reporter that since 2019, my country's pension insurance has ushered in the "double-down" policy of reducing the rate and the base, and the income of social security funds is year-on-year. That's only a 3.6% increase.In 2020, due to the impact of the epidemic, there was a double-digit negative growth.Last year, the income end of the social security fund should be said to have returned to a normal state, but due to the low base in the previous two years, the income end in 2021 will experience a relatively large year-on-year growth.

In 2021, the total income of the three social insurance funds is 6,820.5 billion yuan, an increase of 34.6% over the previous year. Source: Ministry of Human Resources and Social Security

The cumulative balance of pension insurance funds is nearly 6.4 trillion

According to the "Communiqué" statistics, by the end of 2021, the number of people participating in the basic old-age insurance nationwide was 1,028.71 million, an increase of 30.07 million over the end of the previous year.The annual basic pension insurance fund income was 6,579.3 billion yuan, and the fund expenditure was 6,019.7 billion yuan.At the end of the year, the accumulated balance of basic pension insurance funds was 6,397 billion yuan, of which: the fund investment and operation scale was 1.46 trillion yuan, and the investment income for the year was 63.2 billion yuan.

The "Communiqué" shows that by the end of 2021, the number of people participating in the basic pension insurance for urban employees nationwide was 480.74 million, an increase of 24.53 million over the end of the previous year.Among them, there were 349.17 million insured employees and 131.57 million insured retirees, an increase of 20.58 million and 3.95 million respectively over the end of the previous year.At the end of the year, 422.28 million people participated in the basic old-age insurance for urban employees under the enterprise system, an increase of 23.2 million people over the end of the previous year.

In addition, the "Communiqué" pointed out that the total income of the basic pension insurance fund for urban workers was 6,045.5 billion yuan, and the fund expenditure was 5,648.1 billion yuan.At the end of the year, the accumulated balance of basic pension insurance funds for urban employees was 5,257.4 billion yuan.In 2021, the central adjustment ratio of basic pension insurance funds for enterprise employees will increase to 4.5%, and the fund adjustment scale will be 932.7 billion yuan.

On May 26, 2022, the Ministry of Human Resources and Social Security and the Ministry of Finance announced the "Notice on Adjusting the Basic Pensions of Retirees in 2022", clarifying that starting from January 1 this year, the retirement procedures have been completed according to the regulations before the end of 2021 and monthly Retirees from enterprises, government agencies and institutions that receive basic pensions will increase the level of basic pensions, and the overall adjustment level will be 4% of the monthly per capita basic pensions for retirees in 2021.

Zheng Bingwen said that pensions will help prosper the capital market and provide long-term capital.This is reflected in institutional investors where pensions can increase long-term funding and can also provide long-term equity capital.In addition, pensions help to hedge against the negative effects of aging.

Unemployment insurance fund spending slightly more than income for the year

The "Communiqué" shows that at the end of 2021, the number of people participating in unemployment insurance nationwide was 229.58 million, an increase of 12.68 million over the end of the previous year.At the end of the year, the number of people receiving unemployment insurance benefits nationwide was 2.59 million, a decrease of 110,000 from the end of the previous year.A total of 6.08 million unemployed persons were paid out unemployment insurance benefits of different durations throughout the year, an increase of 930,000 over the previous year.The monthly per capita level of unemployment insurance benefits was 1,585 yuan, an increase of 5.2% over the previous year.The policy of phased expansion of the coverage of unemployment insurance was continued for one year, and unemployment subsidies were issued to 4.26 million newly insured unemployed in that year.

In addition, according to the "Communiqué" statistics, a total of 12.9 billion yuan of basic medical insurance premiums were paid for those receiving unemployment insurance benefits throughout the year, an increase of 33.0% over the previous year.Throughout the year, 92.34 million employees were benefited by rebates for job stabilization, and 1.79 million employees were benefited from skill improvement subsidies.

The annual unemployment insurance fund income was 146 billion yuan, and the fund expenditure was 150 billion yuan.At the end of the year, the accumulated balance of unemployment insurance funds was 331.3 billion yuan.

The "Daily Economic News" reporter found that since 2019, my country's unemployment insurance fund has spent more than its income for three consecutive years.Among them, in 2020, the annual unemployment insurance fund income was 95.2 billion yuan, and the fund expenditure was 210.3 billion yuan.At the end of the year, the accumulated balance of unemployment insurance funds was 335.4 billion yuan.

Zheng Bingwen said in an interview with the "Daily Economic News" reporter that from the "Announcement" last year, the income and expenditure of the unemployment insurance fund are basically the same.In 2020, the reason why the unemployment insurance fund exceeds 200 billion yuan is mainly because the state has allocated 100 billion yuan to support job stabilization and training."If the 100 billion yuan used for training is removed, the revenue and expenditure in 2020 will also be roughly the same."

The reporter noticed that this year's "Government Work Report" also clearly requires that the policy of returning unemployment insurance to stabilize jobs should be continued, and the 100 billion yuan unemployment insurance fund should be used to support job stabilization and training.

Recently, the Ministry of Human Resources and Social Security, the Ministry of Finance and the State Administration of Taxation jointly issued the "Notice on Doing a Good Job in Unemployment Insurance, Stabilizing Posts, Improving Skills and Preventing Unemployment".

Yu Jiadong, Deputy Minister of the Ministry of Human Resources and Social Security, emphasized when interpreting the above notice that the notice fully considered the needs of the situation and the expectations of the people, and on the basis of maintaining the continuity and stability of the policy, it further enhanced the pertinence and effectiveness. Based on the principles of benefit and special support, coordinated policy strengthening and fund security, the policy framework for assisting enterprises to stabilize jobs, upgrading skills, and unemployment protection has been clarified, and 8 concrete measures have been proposed.

"In these policies, there are not only institutional arrangements to help market players always exist, but also phased measures to solve urgent problems. They not only do their best to serve the overall situation, but also do their best to hold the bottom line. They are implemented nationally and fully authorized. The place expands and extends according to the actual local situation." Yu Jiadong said.