Fake money received by mistake!This bank was fined for two consecutive years, what happened?To curb the circulation of counterfeit money, banks should do it

Guo Bohao

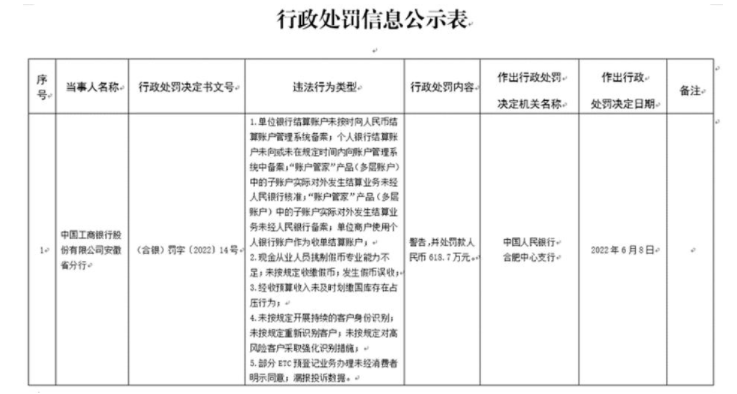

A few days ago, the administrative punishment information on the website of the Hefei Central Sub-branch of the People's Bank of China showed that the Anhui Branch of the Industrial and Commercial Bank of China was warned and fined 6.187 million yuan for 5 major violations, including the wrongful collection of counterfeit currency.

The ticket shows that the bank failed to file with the RMB settlement account management system in the corporate bank settlement account on time; the personal bank settlement account failed to file or failed to file with the account management system within the specified time; the "Account Manager" product (multi-layer account) The actual external settlement business of the sub-account has not been approved by the People's Bank of China; the actual external settlement business of the sub-account in the "Account Manager" product (multi-layer account) has not been recorded by the People's Bank of China; the unit merchant uses the personal bank account as the acquiring settlement account.

At the same time, the bank also has cash practitioners who lack the professional ability to pick out counterfeit currency, fail to collect counterfeit currency as required, and miscollect counterfeit currency; the collected budget revenue is not transferred to the national treasury in a timely manner, and the bank does not carry out continuous customer identification. Failure to re-identify customers in accordance with regulations, and failure to take enhanced identification measures for high-risk customers in accordance with regulations; some ETC pre-registration businesses handle illegal acts of omitting complaint data without the explicit consent of consumers.

Article 44 of the "Regulations of the People's Republic of China on the Administration of RMB" states that financial institutions that handle RMB deposits and withdrawals and business institutions of wholly state-owned commercial banks authorized by the People's Bank of China violate Articles 34 and 3 of these Regulations. Articles 15 and 36 shall be given a warning by the People's Bank of China and a fine of 1,000 to 50,000 yuan; the directly responsible persons in charge and other directly responsible persons shall be subject to disciplinary sanctions according to law.

The reporter noticed that this is not the first time that ICBC Anhui Branch has been administratively punished for misreceiving counterfeit money.In June last year, the bank failed to approve the opening of a bank settlement account or filed a record as required; failed to collect counterfeit money as required; miscollected counterfeit money; failed to perform customer identification obligations as required; Seven violations including information rights were fined 1.147 million yuan.

Banks should play a key role in curbing the circulation of counterfeit currency, but some banks have received and even mispaid counterfeit currency by mistake, and have been subject to administrative penalties.So, how should banks collect counterfeit money in accordance with formal procedures?

Articles 33, 34 and 36 of the "Regulations of the People's Republic of China on the Administration of Renminbi" stipulate that counterfeit currency shall be confiscated by the People's Bank of China or a business institution of a wholly state-owned commercial bank authorized by the People's Bank of China.The bank shall hand over the seized counterfeit and altered RMB to the local People's Bank of China.

Regarding the collection and management of counterfeit currency, Article 6 of the Measures for the Administration of the Collection and Identification of Counterfeit Currency of the People's Bank of China stipulates that if a financial institution finds counterfeit currency during business transactions, two or more business personnel of the financial institution shall collect it in person.Counterfeit RMB banknotes should be stamped with the word "counterfeit"; for counterfeit foreign currency banknotes and various counterfeit coins, they should be sealed with a special bag in a uniform format, and the seal should be stamped with the word "counterfeit" and placed in the special bag. Details such as currency, voucher type, denomination, number of sheets (pieces), serial number, consignee, and reviewer's name and seal are indicated on it.

If the individual finds that he has received counterfeit money, he should promptly hand it over to the People's Bank of China and the public security organ.After the bank receives the counterfeit money, if the amount is large, it should immediately report it to the public security organ. If the amount is small, two or more staff members of the bank will collect it in person, stamp it with the word "counterfeit money", register it in a register, and report it to the holder of the counterfeit money. The person shall issue a collection certificate uniformly printed by the People's Bank of China.The collected counterfeit currency shall be handed over to the local branch of the People's Bank of China at the end of each quarter, and the People's Bank of China shall uniformly destroy it, and no department shall handle it by itself.

【Editor: Shao Wanyun】