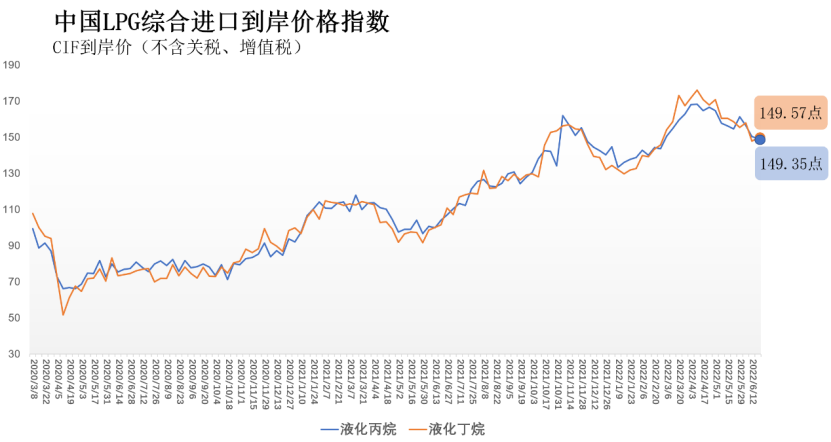

On June 22, the China liquefied petroleum gas (LPG) comprehensive import CIF index released by the Global Trade Monitoring and Analysis Center of the General Administration of Customs and the Shanghai Petroleum and Natural Gas Trading Center showed that from June 13 to 19, China’s liquefied propane was comprehensively imported to The CIF price index was 149.35 points, down 0.67% month-on-month and up 43.40% year-on-year; China's comprehensive import CIF price index for liquefied butane was 149.57 points, up 1.18% month-on-month and 47.13% year-on-year.

In terms of international pricing benchmarks, according to the data released by Saudi Aramco in June 2022, the propane contract price (CP) in June was US$750/ton, down by US$100/ton from the previous month, down 11.76% from the previous month, and up from the same period last year. 41.51%; the June butane contract price (CP) was US$750/ton, down by US$110/ton from the previous month, down 12.79% from the previous month, and up 42.86% from the same period last year; Saudi CP continued its sharp decline in June. And the boosting force of the domestic LPG market has slowed down significantly.

In terms of international prices, the international price of LPG has a high positive correlation with the price of crude oil.From the perspective of crude oil prices, the central banks of many countries around the world have demonstrated their determination to deal with high inflation. The Federal Reserve and the Swiss National Bank took the lead in stating that they may implement a larger interest rate hike plan. The single largest interest rate hike will still be followed by a high probability of substantial interest rate hikes to curb inflation, and the risk of U.S. economic recession may continue to intensify; international oil prices have fallen sharply, and U.S. oil prices have fallen even more strongly.As of the close of last Friday (June 17), the main contracts of WTI and Brent crude oil futures were reported at US$109.56/barrel and US$113.12/barrel, respectively, down 9.21% and 7.29% from the previous week.The recent drop in international oil prices is obvious, which may hinder the further strengthening of international and domestic LPG prices to a certain extent.Due to the trade pricing cycle, my country's LPG import CIF price often lags behind the international market futures price and spot price for a period of time.

In the domestic market, the supply side maintained stability, the demand side declined, and the market trading atmosphere was general.From the perspective of the supply side, the actual arrival volume of domestic imported LPG increased slightly from the previous week last week, and the arrivals were mainly concentrated in East China and Shandong; the domestic gas volume mainly came from local refineries, and the LPG production during the week fell slightly from the previous week; overall From the point of view, the total domestic LPG supply continued to stabilize compared with the previous week, and the fundamentals of the supply side remained neutral.From the perspective of demand, the high temperature in summer is coming, and the temperature rise in many places is obvious. The higher temperature reduces the demand for civil fuel combustion to a low level; the industrial demand is basically stable compared with the previous week.Specifically, in terms of chemical deep processing: in the field of deep processing of propane, the operating rate of PDH units increased slightly from the previous week, but still did not reach 80%, and the demand for propane chemical industry rose steadily; in the field of deep processing of butane, the operating rate of alkylation units increased from the previous There was a slight increase in the week, while the operating rate of MTBE units decreased slightly from the previous week, and the demand for butane chemical industry was stable.On the whole, the amount of resources arriving in Hong Kong rose slightly last week, the domestic gas volume fell slightly compared with the previous week, and the overall downstream supply in the short term was not much different from the previous week; the rising temperature weakened the demand for civil fuel combustion; the industrial demand was stable and moderately strong. In the short term, the demand for propane is stable and rising, but the demand for butane is stable, and the overall downstream demand has declined; last week, the prices of domestic LPG industry chain products mostly fell due to the decline in international oil prices.

The compilation of China's LPG comprehensive import CIF index is completed by the Global Trade Monitoring and Analysis Center of the General Administration of Customs and the Shanghai Petroleum and Natural Gas Exchange Center. / ton, the price index is 100; the comprehensive import CIF price of China’s liquefied butane this week is 3535 yuan / ton, and the price index is 100) which comprehensively reflects the CIF price level of my country’s LPG imports last week.This is a beneficial exploration of my country's preparation of its own LPG benchmark price, which is conducive to improving market transparency, providing an important reference for the marketization of LPG chemical industry, and is conducive to the timely and effective connection between the domestic market and the international market, and further enhances my country's presence in the international LPG market. influence.