Every reporter Chen Mengyu every editor Cheng Pengwei Literary Gai Yuanyuan

This year, shortly after the A-share market closed on the evening of March 16, Tahoe Group made a sudden announcement that Huang Qisen, the company's chairman and general manager, was assisting relevant authorities in their investigation.

On the evening of June 24, ST Taihe (SZ000732, stock price of 1.37 yuan, market value of 3.41 billion yuan) issued a reply to the Shenzhen Stock Exchange's annual report inquiry letter and an updated 2021 annual report.

"After investigation, except for Huang Qisen, the company's chairman and general manager, who is assisting the relevant authorities in the investigation, other directors, supervisors, and senior management personnel of the company have not been assisting or cooperating with the relevant authorities' investigation, etc., and are unable to perform their duties normally."

Tahoe said that the group has not repaid 35.5 billion yuan of debts due and has not been insolvent.As of May 31, 2022, the balance of interest-bearing debt was 91.745 billion yuan; the expected balance due in the next year is 40.234 billion yuan, and there is a liquidity risk in the repayment of due debt.

For the much-watched Vanke stake, Tahoe has no relevant new progress announcements.However, on June 22, an investor asked Vanke A about this, and Vanke said that "the prerequisites for the relevant transaction have not yet been reached."

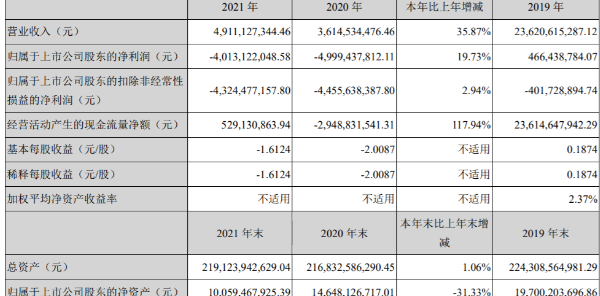

Source: Tahoe Announcement

No insolvency

The previous inquiry letter pointed out, "Tahoe Group has suffered large losses for two consecutive years due to difficulties in capital turnover, a large number of debts have been overdue and cannot be repaid, and many lawsuits have been involved. Matters or situations that may cause major doubts about the ability to continue as a going concern still exist. significant uncertainty".

In terms of the most concerned debt issue, Tahoe replied that as of May 31, 2022, the balance of interest-bearing debt was 91.745 billion yuan, and the expected balance due in the next year was 40.234 billion yuan.Among them, the amount that has expired but not returned is 35.564 billion yuan.As of December 31, 2021, the amount of loans that had expired but not repaid was 35.219 billion yuan. From January to May 2022, an additional 830 million yuan was due and an additional 485 million yuan was repaid.As of May 31, 2022, the amount of loans that have expired but not repaid is 35.564 billion yuan, which has not changed much compared to the amount as of December 31, 2021.

Tahoe admitted in the announcement that the company was affected by the epidemic, and sales and collections were greatly affected, resulting in a decline in solvency. As of May 31, 2022, the loan amount due in the next year was 40.234 billion yuan, and the balance of monetary funds was 40.234 billion yuan. 1.9 billion yuan, and there is liquidity risk in the repayment of due debts.

As of December 31, 2021, Tahoe's current assets were about 171.6 billion yuan, higher than its current liabilities of 144.7 billion yuan, and its net assets were 14.8 billion yuan. "There is no insolvency."

It is worth noting that in terms of asset liquidity, Tahoe's inventory accounts for more than 70% of its total assets, which are mainly real estate development projects.Tahoe still has sufficient land reserves in key core cities. According to the announcement, as of May 31, the inventory balance of real estate projects developed by Tahoe exceeded 150 billion yuan. The projects are mainly distributed in Beijing, Xiamen, Shenzhen, Guangzhou, Fuzhou and Nanjing. and other first- and second-tier core cities.There are a total of 18 self-owned property projects, involving shopping malls, LOFTs, bottom shops, office buildings and other business types, all of which are located in the core areas of the city.

Tahoe stated that "according to the needs of the company's strategic deployment, we can consider selling for cash or replacing corresponding loans as debt restructuring assets to alleviate debt repayment risks."According to the data disclosed in the announcement, the fair value of the above-mentioned self-owned properties totaled about 25.7 billion yuan, and the book value of the remaining hotels totaled about 2.7 billion yuan.

Regarding the introduction of strategic investors, the announcement stated that the controlling shareholder Tahoe Investment Group Co., Ltd. is still actively promoting the introduction of strategic investors. The introduction of strategic investors will help promote the follow-up debt communication work, help the company to enhance liquidity and ease debt repayment. pressure, optimize the capital structure, and help realize the long-term value of the company.

However, on June 22, when an investor asked Vanke A how to view the cooperation between the company and Tahoe Group, Vanke said that “the prerequisites for the relevant transaction have not yet been reached”.

Source: Tahoe Annual Report 2021

According to the financial report, Tahoe Group's operating income in 2021 and 2020 will be 4.911 billion yuan and 3.615 billion yuan respectively, and the net profit attributable to shareholders of listed companies will be -4.013 billion yuan respectively.-4.999 billion yuan.Data in the first quarter of this year showed that the operating income was 246 million yuan, and the net profit attributable to shareholders of the listed company was -405 million yuan.In more than two years, the company lost 9.417 billion yuan.

Debt restructuring made some progress

On May 6 this year, Tahoe Group was put on "ST" because the internal control audit report of the last year was issued with a negative opinion. The net profit before and after deducting non-recurring profits and losses in the last three fiscal years was the lower of the audited profit and loss. It is a negative value, and the audit report of the latest year shows that there is uncertainty in the company's ability to continue as a going concern.

The inquiry letter shows that during the reporting period, the cash received by Tahoe from selling goods and providing labor services was 3.597 billion yuan, a year-on-year decrease of 61%; the cash paid for purchasing goods and receiving labor services was 2.154 billion yuan, a year-on-year decrease of 78%. The net cash flow of 529 million yuan.

Tahoe responded to the decline in major core financial indicators, mainly due to changes in bank supervision account funds, judicial freezing and performance bonds.In 2021, due to changes in the regulatory environment, regulatory funds can be directly used for the payment of construction funds, so there is a significant decrease compared to the same period of the previous year.

In the announcement, Tahoe stated that in 2021, the company will continue to deepen the layout of its original projects in cities, and will not undertake new land acquisition and regional expansion.The company's real estate project launch pace has slowed down, and it is facing greater pressure to de-escalate. At the same time, due to the company's huge debt scale and debt collection and other problems, the company's short-term liquidity is difficult, resulting in slow project progress and prolonged construction period. As a result, during the reporting period, the company's "cash paid for purchasing goods and accepting labor services" dropped significantly year-on-year.

The "Daily Economic News" reporter noticed that during the reporting period, the settlement amount of many Tahoe projects was negative, such as Tahoe No. 1 Block, Tahoe Hongyu and Nanchang Courtyard.Tahoe said that these three projects were checked out sporadically, and the total settlement amount was 6.03 million yuan. Due to the small amount, the current operating income and operating costs were directly offset.However, projects such as Beijing Jinfu Courtyard and Nanjing Courtyard were all loss-making during the reporting period. The total carry-over income of loss-making projects was 843 million yuan, accounting for 20.54% of the real estate industry revenue; the carry-over operating cost was 1.550 billion yuan, accounting for 39.99% of the real estate industry cost.

Tahoe said that due to rising engineering costs and a long development cycle, some profit-making projects had shown signs of impairment in the previous fiscal year, so the gross profit margin of real estate dropped significantly during the reporting period.

On the other hand, Tahoe's creditors are accelerating the release of related assets.

On June 6, Cinda officially auctioned the debt project of Shishi Taihe Plaza Investment Co., Ltd. in Fujian, with a total principal and interest of 1.187 billion yuan, of which the principal was 840 million yuan, the restructuring grace compensation was 10.8074 million yuan, and the liquidated damages was 336 million yuan.This creditor's right is guaranteed by the joint and several guarantees provided by Tahoe Group, Huang Qisen and his wife Ye Li.

On June 13, China Huarong launched a special promotion of 8 high-quality assets of Shanghai Branch in 2022. One of the assets to be promoted, Shanghai Hongyu Real Estate Development Co., Ltd. (hereinafter referred to as Shanghai Hongyu), should pay the total debt of China Huarong It is 830 million yuan, of which the principal is 640 million yuan and the interest is 190 million yuan.The collateral of Shanghai Hongyu is the entire office + business building on Hengfeng Road, Jing'an District, Shanghai, and the collateral is 10 million shares of Shanghai Hongyu.The guarantors of this debt are Tahoe and Huang Qisen.

Tahoe said that since 2021, more than 20 batches of projects have been delivered.Up to now, the company's debt restructuring work has made some progress, and has signed an extension memorandum with some major creditors, and plans to adopt more credit enhancement measures to protect the interests of creditors.