On June 28, Annie shares (SZ002235, stock price 4.78 yuan, market value 2.8 billion yuan) announced that the company had received a "Notice of Response".

The "Daily Economic News" reporter noticed that the lawsuit involved about 100 million yuan, and the cause was related to Beijing Changyuan Guoxun Technology Co., Ltd. (hereinafter referred to as Changyuan Guoxun), which was previously acquired by Annie.

According to the announcement of Annie Shares, the plaintiff claimed that Annie Shares maliciously prevented Changyuan Guoxun from completing the agreed performance bet.

Changyuan Guoxun has not fulfilled the promised performance

In 2016, Annie shares acquired 100% equity of Changyuan Guoxun at a consideration of 1.138 billion yuan, and thus confirmed a goodwill of about 1.04 billion yuan.

According to the agreement at that time, the six original shareholders of Yang Chao, Lei Jian, Mao Zhicai, Jiang Yong, Chen Zhaobin and Lu Wuying promised that the net profit of Changyuan Guoxun in 2016, 2017 and 2018 should not be less than 76 million yuan, 100 million yuan, 130 million yuan.

However, Changyuan Guoxun only fulfilled its performance commitment in 2016, and failed to fulfill its performance commitment in 2017 and 2018.According to the announcement of Annie Shares, from 2016 to 2018, Changyuan Guoxun achieved net profits of about 79.2475 million yuan, 61.5571 million yuan and 92.2969 million yuan respectively.

As a result, in 2017 and 2018, six former shareholders of Changyuan Guoxun, including Yang Chao and Lei Jian, made corresponding performance compensation.

After 2018, Changyuan Guoxun's profitability began to decline sharply, with a loss of more than 60 million yuan in 2020.Due to the failure of the performance to meet expectations and the subsequent decline in performance, Annie shares repeatedly accrued goodwill impairments for Changyuan Guoxun, which has also seriously affected the profits of Annie shares.

The "Daily Economic News" reporter noticed that in addition to large asset impairments, Changyuan Guoxun still has pending lawsuits.

In August last year, Perfect World (Beijing) Software Technology Development Co., Ltd. (hereinafter referred to as Perfect Beijing) sued Changyuan Guoxun and Shenzhen Xiaohou in the Haidian District People's Court of Beijing on the grounds of "copyright infringement and unfair competition disputes". Jump Jump Network Technology Co., Ltd. (hereinafter referred to as Shenzhen Monkey).

According to Annie’s announcement, Perfect Beijing said it exclusively owns the rights to adapt, develop, distribute and operate game software products related to the novels of Jin Yong’s “Swordsman” and “Eternal Dragon Slayer”.

Perfect Beijing alleges that the game "Place Jianghu", which was developed and marketed by Shenzhen Xiaohou in 2016 and will be licensed by Changyuan Guoxun in 2021, uses a lot of elements from the above novels, with more than 50% of the content. From the novel involved, the game is operated by Shenzhen Little Monkey.

Accused of maliciously preventing the completion of the agreed performance bet

The trouble that Changyuan Guoxun has brought to Annie is more than that.

In April of this year, Annie shares announced that it received the "Notice of Response" served by the Xiamen Intermediate People's Court and the "Notice of Response" served by the Xiamen Jimei District People's Court. The reason is that Lei Jianhe Yang Chao sued Annie shares.

The amount of compensation claimed by Lei Jian was about 100 million yuan, and he requested a judgment to confirm that Annie shares "violated legal provisions and agreements in the process of performing the "Agreement on Issuing Shares and Paying Cash to Purchase Assets" and the "Supplementary Agreement for Issuing Shares and Paying Cash to Purchase Assets" It is agreed that the conditions for maliciously preventing the plaintiff from obtaining shares (that is, maliciously preventing Changyuan from completing the agreed performance bet) shall be deemed to have been fulfilled for the plaintiff to obtain shares.”

Yang Chao claimed that Annie shares should be ordered to go to Shenzhen Stock Exchange and Zhongdeng Company immediately to go through the procedures for lifting the restriction on the sale of the 5,341,351 Annie shares held by them, and to compensate about 10 million yuan for related economic losses.

At the end of May this year, Lei Jian applied to the court to withdraw the lawsuit.However, on June 28, Annie shares announced that it had received a "Notice of Response".The plaintiff of this "Notice of Responding to Litigation" is Lei Jian, and the content and amount of the lawsuit are consistent with those previously announced.

In addition to the above disputes, Annie shares are also involved in contract disputes and securities misrepresentation cases.

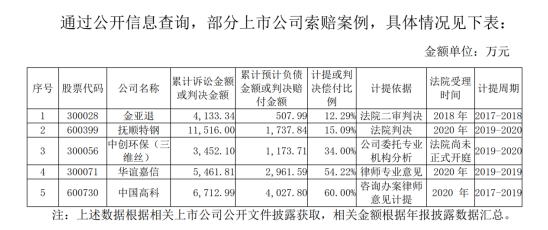

In April last year, Annie shares received the "Administrative Penalty Decision" issued by the Xiamen Securities Regulatory Bureau, and found that it involved illegal information disclosure.Some investors demanded compensation from Annie Shares on the grounds that they suffered economic losses in securities transactions due to misrepresentation of the securities of Annie Shares.As of December 31, 2021, the amount of claims in litigation involved in the company's securities misrepresentation liability dispute was approximately RMB 38.77 million.

Image source: Screenshot of Annie Shares Announcement

In response to the above-mentioned disputes over securities misrepresentation liability, Annie shares confirmed the estimated liabilities of about 5.82 million yuan.

"The company has consulted experts and lawyers, combined with the actual situation of the case, and based on similar cases and relevant experience, it is estimated that the range of the litigation compensation amount to the total amount of claims is 0-30%. The claim amount is the base, and the company accrues 15% of the estimated liabilities according to the compensation ratio." In May this year, Annie shares said in reply to the 2021 annual report inquiry letter.

Every reporter Zhao Linan every editor Wei Guanhong

(Editor in charge: Jiang Ninglu)