After 12 days and 11 boards, Zhejiang Shibao was pressed the "pause button".

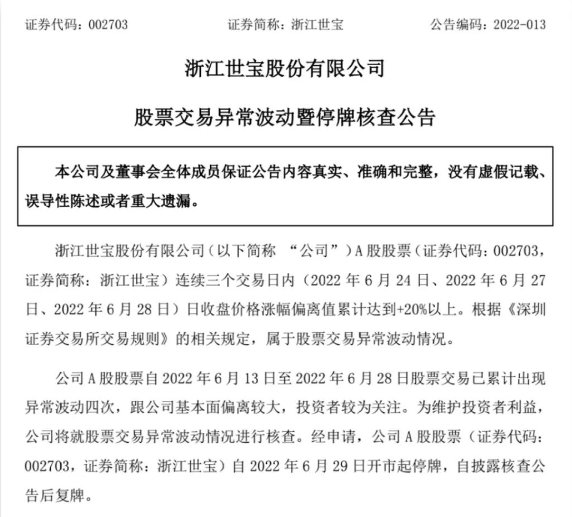

On the evening of June 28, Zhejiang Shibao once again issued a stock price change announcement saying that from June 13 to 28, the company's stock trading has experienced four abnormal fluctuations in total, which deviates greatly from the fundamentals. The trading suspension will be checked from the opening of the market on June 29.

Source: Company Announcement

Affected by this news, as of the close on the afternoon of June 29, Zhejiang Shibao's Hong Kong stock fell more than 20% to HK$2.17 per share.

Previously, the Shenzhen Stock Exchange had issued a letter of concern to Zhejiang Shibao regarding stock movements.On June 27, Zhejiang Shibao just replied to the notice of the notice and reminded the relevant risks.

The abnormal surge in Zhejiang Shibao's share price this round has attracted market attention.On the one hand, Zhejiang Shibao issued a reduction announcement a few days ago, and its controlling shareholder repeated the high-level and precise cash-out similar to that in November 2016; loss.

"Frenzy" bull stocks were pressed the "pause button"

Zhejiang Shibao's current round of surge began on June 13.After pulling the daily limit for 10 consecutive days, it took a short "rest" on the 27th, and the increase on the day was 4.27%.On June 28, it closed again at the daily limit.

Before the suspension, Zhejiang Shibao had risen by nearly 200%, winning 11 boards in 12 trading days.Wind data shows that since June, the share price of Zhejiang Shibao Hong Kong stock has continued to rise.As of the close on June 28, Zhejiang Shibao Hong Kong shares rose 7.84% to HK$2.75.In the 19 full trading days since June, the cumulative increase was 76.28%.

On June 23, Zhejiang Shibao received a letter of concern issued by the Shenzhen Stock Exchange, requesting to check whether the recent increase in the company's share price matches the changes in fundamentals such as production and operation, and compare the company's operating performance and share price changes with listed companies in the same industry. Valuation, and give adequate risk warnings on abnormal fluctuations in the company's stock trading.

On the afternoon of June 27, Zhejiang Shibao issued a reply announcement to the above letter of concern.The announcement elaborated on the company's operating losses in the first quarter, and also provided relevant risk warnings.The announcement stated that the company's stock price has changed, but the internal and external operating environment has not changed significantly, and the company's price-earnings ratio is significantly higher than the average price-earnings ratio of the automobile manufacturing industry.

According to market rumors, Zhejiang Shibao's big rise this round is due to the concept of new energy vehicles. Some investors have also asked questions about Zhejiang Shibao's driverless project and new energy vehicle business on the interactive platform.In this regard, the company stated that there is no mass production project for intelligent steering products on driverless vehicles, and the business of supporting new energy vehicles also accounts for a small proportion of the company's overall business.

High-level and precise "cash-out" of controlling shareholders

On the one hand, Zhejiang Shibao's stock price has skyrocketed, and on the other hand, major shareholders are cashing out precisely at a high level.

After the company's stock price went up for 7 consecutive days, on the evening of June 21, Zhejiang Shibao issued a holding reduction announcement saying that the company's controlling shareholder, Zhejiang Shibao Holding Group Co., Ltd., reduced its holdings by 2% of its shares through a block transaction on June 20.After the completion of this reduction, Zhejiang Shibao Holding Group still holds 41.28% of the shares of Zhejiang Shibao.

Source: Company Announcement

Wind data shows that on June 20, Zhejiang Shibao had a total of 5 large transactions, the average transaction price was 7.59 yuan, the average premium rate was -18.12%, the total transaction volume was 15.7928 million shares, and the total transaction value was 120 million.That is to say, on June 20, the controlling shareholder sold 15.7928 million shares at a discount of over 18% through 5 block transactions, cashing out 120 million yuan.

It is worth noting that this is not the first time that Zhejiang Shibao's controlling shareholder has accurately cashed out.The reporter reviewed the previous announcements. On November 30, 2016, Zhejiang Shibao issued a holding reduction announcement.According to the announcement, Zhejiang Shibao Holding Group Co., Ltd., the controlling shareholder of the company, reduced its holdings of the company's 11 million A shares unrestricted tradable shares through a block transaction, accounting for 3.48% of the company's total share capital.According to the average transaction price at that time, the reduction of holdings was about 450 million yuan, which happened to be the highest point in the history of the company's stock price after its listing.

Source: Company Announcement

The reporter learned that the above-mentioned two shareholding reductions are quite "similar", both of which were carried out by the controlling shareholders through block transactions, and neither of them made pre-disclosure of the holdings reduction in advance.Data show that after the controlling shareholder of the company reduced its holdings in 2016, the company's stock price continued to slump for many years, with the largest drop of more than 85% at one point.

Performance continues to "reverse"

Zhejiang Shibao is principally engaged in the research and development, manufacturing and sales of automotive steering gears and other key components of steering systems.The company is a first-class supplier of automobile manufacturers, and its products are mainly used in various types of vehicles. Therefore, changes in market demand for the company's main business products are closely related to changes in automotive market demand.The 2021 annual report shows that the company's main business income accounts for 94.36% of its operating income.

The reporter checked the company's past financial data and found that Zhejiang Shibao was listed in 2012. In 2010 and 2011 before the listing, the company's operating income was 546 million yuan and 626 million yuan respectively, an increase of 49.46% and 14.65% year-on-year, respectively, attributable to the listing. The net profit of the company's shareholders was 103 million yuan and 113 million yuan respectively, an increase of 55.83% and 9.16% year-on-year respectively.

In recent years, Zhejiang Shibao's performance has not been satisfactory.From 2017 to 2019, the company achieved operating income of 1.154 billion yuan, 1.133 billion yuan, and 982 million yuan respectively, with year-on-year changes of 1.57%, -1.83%, and -13.30%, respectively.Net profit in the same period was 33 million yuan, 0.07 billion yuan, and -177 million yuan, down 48.56%, 77.71%, and 2527.90% year-on-year, showing a sharp decline.

In 2020, the company turned losses into profits, with a net profit of 41 million yuan; in 2021, the net profit fell to 34 million yuan.In the first quarter of this year, the company achieved operating income of 261 million yuan, a year-on-year decrease of 11.23%; net profit and non-net profit were -04 million yuan and -12 million yuan, respectively, a year-on-year decrease of 119.85% and 253.97%.

Asset size is also considered an important indicator of company development.According to public data, in 2014, Zhejiang Shibao conducted a fixed increase fundraising, and the company's total assets were 2.101 billion yuan; by the end of March this year, the total assets were still 2.1 billion yuan, and the asset size had not increased in the past 8 years.

(Editor in charge: Guan Jing)