Recently, CATL plans to use 23 billion yuan of "spare money" to invest in wealth management products, which has attracted heated discussions in the market.

In order to keep "leisure money" and improve the efficiency of capital use, many listed companies are keen to buy financial management.According to statistics from China Securities Journal reporters, in the first half of this year, a total of 906 listed companies purchased wealth management products, with a total subscription amount of 525.099 billion yuan.

However, compared with the same period last year, listed companies' purchase of wealth management has cooled down.In the same period last year, a total of 1,058 A-share listed companies purchased wealth management products, with a total subscription amount of 688.965 billion yuan.In terms of subscription product types, structured deposits are still the most sought-after category by listed companies.

906 companies in the first half of the year

Subscribing over 500 billion yuan of wealth management products

On the evening of June 29, Societe Generale and Kanghong Pharmaceutical successively issued announcements on using their own funds to purchase wealth management products.

Societe Generale stated that as of June 28, the company had used a total of 154.25 million yuan of its own funds to purchase wealth management products, and the highest single-day balance reached more than 10% of the company's latest audited net assets.The type of wealth management products purchased by them are bank wealth management products.

Kanghong Pharmaceutical stated that recently, its subsidiary, Honghe Biological, used its own funds to purchase wealth management products with an amount of 60 million yuan, and the product type was structured deposits.

The data shows that as of June 30, based on the subscription date (the same below), a total of 906 A-share listed companies have purchased wealth management products this year, with a total subscription amount of 525.099 billion yuan.

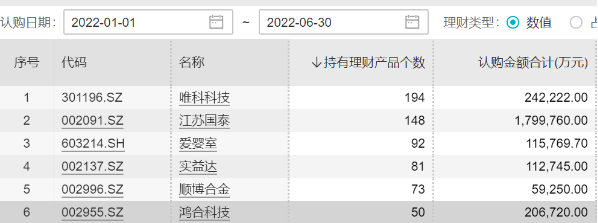

Judging from the number of wealth management products held, 75 companies hold more than 20 wealth management products.Among them, there are 6 companies holding 50 or more wealth management products, namely Weike Technology (194), Jiangsu Guotai (148), Aiying Room (92), Shiyida (81), Shunbo Alloy ( 73), Honghe Technology (50).

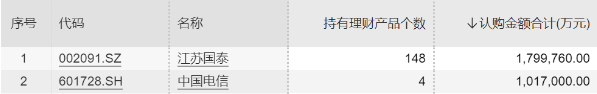

Judging from the subscription amount, 131 companies subscribed for more than 1 billion yuan, of which two companies subscribed for financial products with an amount of more than 10 billion yuan, namely Jiangsu Guotai (17.998 billion yuan) and China Telecom (10.17 billion yuan).

In addition, there are many companies on the way that plan to spend tens of billions to subscribe for wealth management products.On the evening of June 27, Ningde Times announced that the board of directors agreed that the company will use no more than 23 billion yuan to issue stocks to specific objects to raise idle funds for cash management, and invest in capital-guaranteed investment products with high security and good liquidity.In May, Shanxi Fenjiu said it planned to use its idle self-owned funds of no more than 20 billion yuan to purchase structured deposits.

Structured deposits are the most sought after

The China Securities Journal reporter noticed that among the wealth management products purchased by listed companies, deposits, fixed deposits, structured deposits, call deposits, bank wealth management products, securities company wealth management, investment company wealth management, trust, reverse repurchase, etc. are involved.

In terms of product types, structured deposits are very popular, with a total of 735 listed companies purchasing them, with a total subscription amount of 346.88 billion yuan, accounting for more than 66%.

It is worth mentioning that many banks have also launched customized structured deposit products for large customers.According to the announcement of Kanghong Pharmaceutical, the “Furong Jincheng” unit structured deposit purchased by its subsidiary is a customized type.

For listed companies to purchase wealth management products, ensuring the safety of funds and a certain rate of return is the primary appeal.Industry insiders pointed out that after the release of the new asset management regulations, capital-guaranteed bank wealth management products were withdrawn from the arena.Listed companies use idle raised funds to purchase wealth management products, the first premise is to ensure the safety of raised funds, so structured deposits with high security, good liquidity and low risk become the first choice.

Zhou Maohua, a macro researcher at the Financial Market Department of China Everbright Bank, told reporters: "Listed companies need to balance security, yield and liquidity when choosing wealth management products. Structured deposits are favored by some listed companies, mainly structured deposits (deposits + derivatives). Funds are basically guaranteed, the investment portfolio is flexible, and there is a chance to obtain higher returns, while the term is more flexible.”

Subscription scale of bank wealth management products is halved

Bank wealth management products are the product category that is subscribed by listed companies with the largest amount in addition to structured deposits.Subscriptions for this product category halved in the first half of this year compared to the same period last year.

In the first half of this year, a total of 218 listed companies purchased bank wealth management products, with a total subscription amount of 58.952 billion yuan, accounting for 11%.

In the first half of last year, a total of 306 listed companies purchased bank wealth management products, with a total subscription amount of 116.547 billion yuan, accounting for 17%.

"In the first half of this year, listed companies' purchase of bank wealth management products has slowed down year-on-year. On the one hand, the yield of bank wealth management products has declined, and this year, bank wealth management products have been fully netted, and A shares have fluctuated greatly in the first half of the year, so that the net value of some wealth management products has been generated. On the other hand, affected by the epidemic, some listed companies pay more attention to the stability of cash flow." Zhou Maohua told reporters.

Some analysts pointed out that the use of idle funds for financial management by listed companies can amplify the efficiency of capital use and obtain additional benefits.However, if you alienate your main business and invest too much in wealth management products, it will be detrimental to the long-term healthy development of listed companies.