Financial Associated Press, July 7 (Reporter Wu Hao and Huang Jingsi) Due to various violations, the third-party fund sales agency, Magpie Wealth Fund Sales Co., Ltd. (“Magpie Fortune”), was ordered by the Tibet Securities Regulatory Bureau to suspend the processing. Related business for 6 months.

In the fines disclosed on July 7, the Tibet Securities Regulatory Bureau directly pointed out more than ten violations of Magpie Wealth in terms of operation management, internal control and information technology.In particular, when the legal representative, chairman, general manager and other relevant senior management personnel are changed, license renewal, senior management personnel filing, resignation audit, etc. have not been carried out simultaneously; incumbent personnel are not up to the standard in terms of obtaining professional qualifications; and information technology The lack of relevant executives, personnel in key positions, systems and other equipment has been the focus of the Tibet Securities Regulatory Bureau.

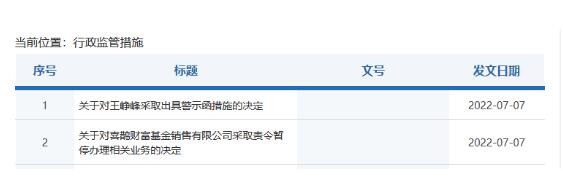

It is worth noting that in this penalty case, the Tibet Securities Regulatory Bureau also implemented the "double penalty" mechanism and issued a warning letter to the company's chairman and legal representative Wang Zhengfeng.

According to the website of the China Association for Fundraising, there are currently 101 independent third-party sales agencies that have obtained institutional membership, and Magpie Fortune is the only third-party agency that has obtained a fund sales license within the jurisdiction of Tibet.It is worth mentioning that Magpie Wealth is also an important part of Country Garden’s financial business segment, and together with Biyouxin, another Country Garden’s self-financing platform, jointly undertakes the sales and services of insurance, wealth management and other products.After the equity penetration, Yang Meimei, the sister of Country Garden's chairman, was also shown to be an important shareholder and beneficiary of Magpie Fortune.

Three types of violations, magpie wealth and its chairman were "double fined"

On July 7, the Tibet Securities Regulatory Bureau issued administrative supervision measures for Magpie Fortune, pointing out that the company has various problems in operation management, internal control and information technology.

Tibet Securities Regulatory Bureau believes that in terms of operation and management, the main problems of magpie wealth are:

The first is to fail to renew the license from the China Securities Regulatory Commission within 5 working days from the date of the change of the items recorded in the business license (legal representative).According to Tianyancha, the latest industrial and commercial registration approval date of Magpie Fortune is September 24, 2021, and the legal representative, general manager and chairman of the board displayed in the industrial and commercial information are still Wang Jianzheng.In fact, Wang Jianzheng's tenure is from October 24, 2019 to September 24, 2021.At present, the chairman and legal representative of the company has been changed to Wang Zhengfeng.

Second, the former general manager Zhang Jian worked as a manager in Beijing Rongwei Tongda Technology Co., Ltd. (referred to as “Rongwei Tongda”) during his tenure (resigned in March 2022), and did not file with the Tibet Securities Regulatory Bureau.Tianyancha shows that Rongwei Tongda is the wholly-owned controlling shareholder of Magpie Fortune. The company was established on January 13, 2009, and its legal representative is Zhang Jian.

The third is that in December 2021 and January 2022, 18 and 17 of the incumbents obtained fund qualifications respectively, which were lower than the statutory requirements and did not report to the Tibet Securities Regulatory Bureau.

Fourth, some personnel in the marketing department and information technology department have not obtained the qualifications for fund practitioners.

In terms of internal control, the main problems of Magpie Wealth are: first, the former chairman resigned, and no exit audit was carried out; second, the compliance and risk control personnel did not issue a special compliance and risk assessment report on the sales access of private funds sales of private fund products; third, the sales person in charge and compliance risk control personnel did not conduct internal compliance review on the fund promotion and recommendation materials used for sales, and did not issue compliance review opinions; fourth, no supervision and audit were conducted in 2021 and form a report.

In terms of information technology, the main problems of Magpie Fortune are: first, there is no chief information officer; second, the personnel in key positions are not regularly organized to carry out emergency drills according to the emergency plan; third, the disaster backup system has not been established; fourth, the risk monitoring has not been carried out. Effectiveness assessment of mechanisms and implementation.

The Tibet Securities Regulatory Bureau stated that in response to the above behavior, it has decided to take supervision and management measures against the company by ordering it to suspend relevant business for 6 months.

At the same time, the Tibet Securities Regulatory Bureau implemented the "double punishment" and issued a warning letter to Wang Zhengfeng.In addition to the similar problems mentioned above, the Tibet Securities Regulatory Bureau also believes that during Wang Zhengfeng’s tenure as chairman and legal representative, he still established branches engaged in fund sales business in terms of operation and management, and failed to perform the filing procedures in accordance with regulations. There are cases where the organization conducts business beyond the geographical scope.

The Tibet Securities Regulatory Bureau pointed out that Wang Zhengfeng, as the company's chairman and legal representative, was responsible for the above-mentioned behavior of Magpie Fortune, and therefore decided to take supervision and management measures by issuing a warning letter.

It is the wealth management platform of Country Garden

Magpie Wealth was established in 2015 with a registered capital of 57.55 million yuan. It is registered in Lhasa, Tibet, and is the only third-party fund sales agency in Tibet.On February 27, 2017, approved by the China Securities Regulatory Commission, Magpie Wealth officially obtained the "License for Operating Securities and Futures Business". Its products cover public funds, trusts, asset management, private equity and other fields. , bond, hybrid, index and other types.

At present, the number of senior executives registered with the Fund Industry Association is 2. The legal representative, general manager and chairman of the board are still displayed as Wang Jianzheng, and the deputy general manager is Sun Baodong.In addition, the number of registered employees of the company is 25, and the main operation team covers securities research services, Internet operations, telemarketing, WeChat marketing, live broadcast team and customer service team.

Magpie Fortune is wholly-owned by Rongwei Tongda.Rongwei Tongda was established in 2009 and belongs to the technology promotion and application service industry. Zhang Jian is the legal representative and chairman of the company.According to the introduction of magpie wealth, its shareholder company is mainly engaged in real estate design and technology development, search optimization and operation of Internet financial platforms.

The two major shareholders of Rongwei Tongda are Beijing Magpie Fortune Technology Co., Ltd. (holding 55%) and Guangdong Boyi Architectural Design Institute (holding 45%).It is worth noting that Guangdong Boyi Architectural Design Institute is wholly-owned by Haoda Enterprise Management Co., Ltd., Shunde District, Foshan City. After layer-by-layer penetration, Tianyancha shows that the ultimate beneficiary of Magpie’s wealth is Yang Meimei.