Data source: Wind

The "mid-term exam" of public funds in the first half of the year officially ended.In terms of performance, crude oil-themed funds led the market, and some "small but beautiful" funds with a scale of less than 1 billion yuan performed well.Although most equity funds have not yet "recovered" their losses, there are still some active equity funds holding positions in coal and real estate that have achieved higher returns.In terms of quantity and scale, the number of funds in the entire market in the first half of the year has exceeded 10,000, and the total size has rebounded to 26 trillion yuan.

The fund's performance is multi-faceted

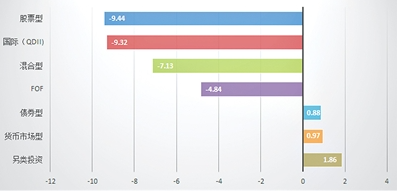

Wind data shows that, excluding the second new funds established this year, as of June 30, the average performance of stock funds, hybrid funds, international (QDII) and FOF during the year was -9.44%, -7.13%, -9.32% respectively. And -4.84%, bond funds, money market funds and alternative investment funds closed up, with an average performance of 0.88%, 0.97% and 1.86% respectively.

In the first half of 2022, commodity prices rose strongly, leading to the largest increase in the net value of related themed funds.Wind data shows that as of June 30, Harvest Crude Oil, Cathay Pacific Commodities, E Fund Crude Oil A RMB, and Southern Crude Oil ranked the top four in the fund's income list, with annual returns above 50%, 58.35%, 54.60%, and 54.32% respectively. and 54.26%.However, the performance of other QDII products was not good. In the first half of this year, more than 80% of QDII products still had negative revenue.

For active equity funds, the top three in terms of income since the beginning of this year are Wanjia Macro Timing and Multiple Strategies, Wanjia Xinli, and Wanjia Select A, all of which are managed by fund manager Huang Hai. 52.63%, 46.80% and 40.77%.From the perspective of holdings, as of the end of the first quarter, the above three funds all held a number of coal stocks such as Shaanxi Coal Industry and some real estate stocks such as Poly Development and Vanke A.Wanjia Yihe, managed by Zhang Heng, another fund manager of Wanjia Fund, ranked fourth among active equity funds in terms of income during the year, at 30.60%.

In addition, since May, with the recovery of the market, the net value of active equity funds in new energy, automobile, advanced manufacturing and other fields has rebounded significantly.Wind data shows that from the beginning of May to June 30, the power equipment and automobile industry indexes rose by more than 35%, and the machinery equipment, non-ferrous metals, and defense and military industry indexes rose by more than 20%.At the same time, the net value growth rate of more than 3,900 funds in the range reached 10%, and the range of net value of 26 funds including Huitian Fuyingxin Flexible Allocation and New Huaxin Power increased by 40%.

"Small but beautiful" with excellent grades

It is worth noting that "small and beautiful" has become a prominent feature of blue-chip funds in the first half of the year.

Wind data shows that among the top ten active equity funds in the first half of the year, only one fund reached 5.8 billion yuan by the end of the first quarter. The yield was 15.84%.The latest scale of the remaining blue-chip products is less than 1 billion yuan.For example, the scale of Wanjia's macro timing and multiple strategies with a revenue of 50% during the year is only 267 million yuan, while the scale of Wanjia Xinli and Wanjia Select A is 260 million yuan and 763 million yuan respectively, and Jinyuan Shun'an Yuanqi is among them. The largest product, its scale is only 773 million yuan.

In addition, on the whole, most active equity funds have not yet "recovered" their losses.Wind data shows that as of June 30, among the 736 common stock funds, only 38 had positive returns, and there were still 353 with a total return of more than 10% during the year; 176 of the 2,682 partial equity hybrid funds There are 1,362 funds with only positive returns and a total return of more than 10% during the year, of which 103 funds have a return of more than 20% during the year; among the 2,226 flexible allocation funds, a total of 314 have positive returns, and the total return during the year has fallen by more than 10%. % of a total of 771.

The number of public offerings exceeded 10,000 and the scale increased

In the first half of the year, the whole market fund achieved two breakthroughs in quantity and scale.According to the latest data released by the Asset Management Association of China, as of the end of May, the total number of public funds was 9,872, with a total management scale of 26.26 trillion yuan.According to Wind data, 138 funds were newly established in June, and another 94 funds are still being issued.Taken together, the total number of products has exceeded 10,000.

Wind data shows that in the first half of this year, a total of 709 new funds were established, with a total issuance share of 683.5 billion.In terms of product types, the proportion of equity funds is still the main force. There are more than 6,000 stock and hybrid funds in total, while bond funds "played the leading role" in the issuance market in the first half of the year.As of June 30, 132 equity funds were newly established during the year, with a share of 40.725 billion; 292 hybrid funds were issued with a share of 166.315 billion; the share of bond funds has increased month by month since the beginning of this year, and the issuance in the first half of the year The cumulative issuance share of 205 products was 444.698 billion, accounting for more than 60% of the total share of all newly established funds.In addition, there were 4 alternative investment funds with 1.285 billion issued shares; 10 QDII funds with 2.926 billion issued shares; 2 REITs funds with 1.5 billion issued shares; and 64 FOF funds with 26.051 billion issued shares.Industry insiders pointed out that in the first half of the year, the equity market continued to fluctuate, and investors' risk aversion increased, and relatively stable products such as bonds were more in line with investors' preferences.

Specifically, interbank certificates of deposit funds and public REITs are highly sought after by funds.In the first half of the year, the issuance share of inter-bank certificate of deposit funds was very impressive.For example, the 7-day holding of the Invesco Great Wall Interbank Deposit Index and the 7-day issuance share of the Huaxia Interbank Deposit Index are all close to 10 billion copies, and the 7-day issuance share of the Yinhua Interbank Deposit Index is also over 8 billion.The same hot public REITs are also "hard to find a foundation".The total amount raised before the proportional placement of China AMC China Communications Construction REIT reached 152.412 billion yuan, and the final placement ratio of the public offering was only 0.84%; on June 27, Penghua Shenzhen Energy REIT’s offline inquiry showed that all placement objects intend to subscribe The total number is 13.7528 billion, which is 109.15 times the initial offline sales share, setting a record for the currently issued public REITs.

Looking forward to the market in the second half of the year, with the continuous emergence of innovative themes such as carbon neutrality, traditional Chinese medicine, and biotechnology, public offering products will also become increasingly diversified.Sun Guiping, a senior fund analyst at the Shanghai Securities Fund Evaluation and Research Center, said that in the future, the recovery of the capital market will drive the recovery of the fund issuance market, and the issuance of new funds is expected to accelerate. The total management scale of public funds is expected to reach 30 trillion yuan by the end of this year.

(Editor in charge: Guan Jing)