Author: Juan Yong

Zhengzhou Coal and Electricity, which had been losing money for the past three years, suffered two more safety accidents during the year, adding uncertainty to its performance.

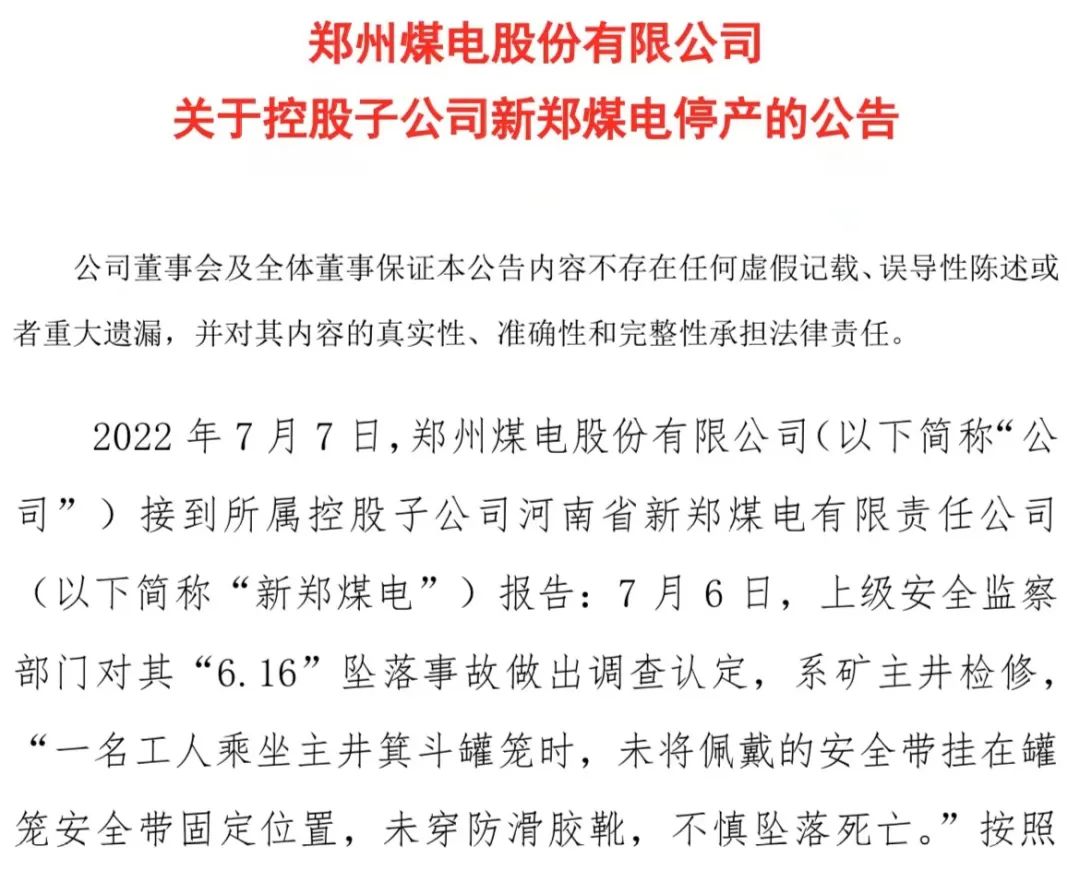

On the evening of July 7, Zhengzhou Coal and Electricity announced that it received a report from its holding subsidiary Xinzheng Coal and Electricity: On July 6, the higher-level safety supervision department conducted an investigation into its "6.16" fall accident and determined that it was the maintenance of the mine's main shaft. "When a worker was riding on the main well skip cage, he did not hang the seat belt he was wearing on the seat belt of the cage, and he did not wear anti-skid rubber boots, and he accidentally fell to his death."

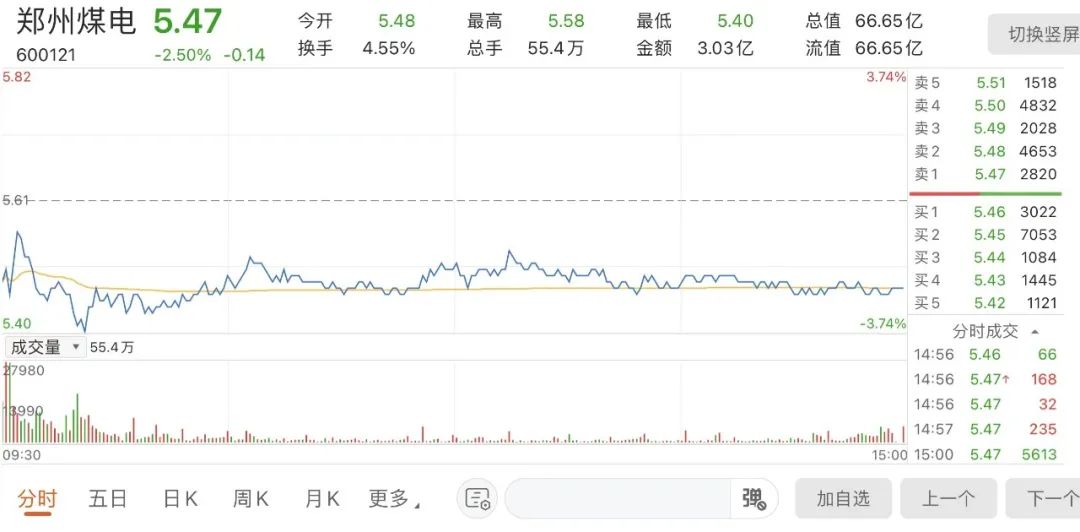

On July 8, Zhengzhou Coal and Electricity closed down 2.5% at 5.47 yuan per share, with a total market value of 6.665 billion yuan.

Accidents occur frequently

According to the "Henan Province Safety Production Risk Management and Control and Hidden Hazard Control Measures", Xinzheng Coal and Electric Power needs to carry out safety risk identification, assessment and control of the main lifting system once, and improve the maintenance and maintenance safety measures of mechanical and electrical equipment (facility).Prior to this, Xinzheng Coal and Electric Power had to stop all operations except ventilation, drainage and gas inspection.

Xinzheng Coal Power is of great importance to Zhengzhou Coal Power, with its annual approved production capacity of 3 million tons, 2.44 million tons of coal production in 2021, and operating income of 1.286 billion yuan, accounting for 40% of the listed company's total revenue in 2021.

Zhengzhou Coal and Electricity said that since the specific time for Xinzheng Coal and Electricity to resume production has not yet been determined, the impact of the suspension on the company's performance cannot be predicted for the time being.A person from the Zhengzhou Coal and Electricity Board Secretary Office told the reporter of the International Finance News, "The company is actively rectifying the mines to meet the production resumption standards as soon as possible and reduce the production shutdown time."

In fact, this is the second time a safety accident has occurred in Zhengzhou Coal Power this year.According to the company's announcement on February 24, a signal worker in the loading chamber at the bottom of the main coal mine fell into the weighing bucket, resulting in death.After the accident, the company immediately launched an emergency plan, reported to the relevant departments in accordance with relevant regulations and procedures, and stopped production for rectification.The annual approved production capacity of Gaocheng Coal Mine is 1.2 million tons. In 2021, due to regional policy shutdowns and rainstorm disasters, it will produce 690,000 tons of coal, with an operating income of 388 million yuan, accounting for 12.05% of the company's total annual revenue.

Zhengzhou Coal and Electricity subsequently disclosed that on April 9, it received the approval of the Henan Provincial Department of Industry and Information Technology on the acceptance of the resumption of work and production at the Gaocheng Coal Mine. According to preliminary statistics, as of April 9, the Jicheng Coal Mine has been shut down for 46 days due to the accident, and the cost of downtime is about 37 million yuan.

As early as July 2021, due to the torrential rain disaster, the Chaohua Coal Mine under Zhengzhou Coal and Electric Power Co., Ltd. did not resume production until December of that year due to serious water influx around the upstream flood discharge.At that time, Zhengzhou Coal and Electricity stated that according to preliminary statistics, as of November 30, 2021, Chaohua Coal Mine had 82.26 million yuan for emergency resumption of production due to floods, 70.36 million yuan for shutdown losses, and 9.75 million yuan for impairment of fixed assets.

Performance is worrying

Zhengzhou Coal and Electricity Co., Ltd. was established in 1997. It is a joint stock limited company exclusively initiated by Zhengzhou Coal Group. On January 7, 1998, the company was listed on the Shanghai Stock Exchange. It is the first domestic A-share listed company of a key state-owned coal enterprise. It is the first listed former central enterprise in Henan Province.

Zhengzhou Coal and Electricity is mainly engaged in coal production and sales, and also engages in trade business such as procurement and sales of coal-related materials and equipment.According to its official website, the company has 6 pairs of production mines, with an annual coal production capacity of nearly 10 million tons. The main products are medium ash, low sulfur, high calorific value, good grindability lean coal, lean lean coal and anthracite, which are of high quality. Industrial thermal coal.

Although sitting on a large amount of high-quality thermal coal, Zhengzhou Coal and Electricity's performance is worrying to the outside world.

Due to two consecutive losses, on April 19, 2017, Zhengzhou Coal and Power was issued a delisting risk warning, and the stock abbreviation was changed to *ST Zhengmei.In 2017, the company turned losses into profits and got out of the delisting crisis.However, the success of protecting the shell has not dispelled the haze of Zhengzhou coal power. In 2018, the company's net profit plummeted by more than 70%. Then, in 2019 and 2020, it lost 920 million yuan and 944 million yuan respectively.

Until 2021, coal price increases will basically run through the whole year.In mid-January of that year, the coal price once reached 1,150 yuan/ton. Affected by the periodic decline in demand, it dropped to about 571 yuan/ton at the end of February. In May, it turned up again to 950 yuan/ton, which lasted until mid-October. The highest coal price is 2600 yuan/ton.Since then, under the dual effects of supply guarantees and policies, coal prices have fallen off a cliff.Under the high and fluctuating coal price, the economic situation of the coal industry was generally stable and improving throughout the year, and the industry's revenue and profits continued to achieve double growth. The total profit of coal enterprises above designated size was 702.31 billion yuan, a year-on-year increase of 221.7%.

However, even if the market environment improved, it still failed to save Zhengzhou Coal and Electricity's declining performance.In 2021, the company's revenue will be 3.212 billion yuan, a year-on-year increase of 15%, with a net profit loss of 215 million yuan.The company explained that during the reporting period, since June, due to the continuous impact of regional policy shutdowns and heavy rainstorms and floods, its 6 pairs of production mines have been suspended to varying degrees, resulting in a reduction of about 1.5 million tons of raw coal output compared to the plan for the whole year. , a corresponding reduction in revenue of about 973 million yuan, a reduction in current profit of about 386 million yuan, and the loss of rainstorm disasters, resulting in a loss in 2021.

Benefiting from the rise in commodity coal prices, in the first quarter of 2022, Zhengzhou Coal and Power’s performance recovered, with a revenue of 1.092 billion yuan, a year-on-year increase of 31.41%, and a net profit of 50.3555 million yuan, turning losses into profits year-on-year.However, affected by the suspension of production due to a coal mine accident, during the reporting period, the company's coal production and sales fell by 18.6% and 6.04% year-on-year respectively.

Nanhua Futures pointed out on July 8 that the fundamentals of thermal coal have turned around recently, the supply is at a high level, and the overall supply and demand are booming.The main disadvantage of thermal coal is the high inventory of ports and the high inventory of downstream power plants, so the recent decline in port prices is relatively large.The current market sentiment is relatively strong, mainly due to policy uncertainty.From a fundamental point of view, the peak of coal consumption will soon follow, so the space below will not be very large.In addition, from the supply side, coal production is also at a high level.On the whole, the supply and demand of thermal coal will be booming, and the price is expected to stabilize under the policy control.

Introduce state-owned shareholders

The cloud of losses has not yet dissipated, and Zhengzhou Coal and Electricity has introduced two shareholders with considerable background.

On June 10, Zhengzhou Coal and Electricity announced that the non-public agreement transfer of the company's shares by the controlling shareholder Zhengmei Group was approved. Zhengzhou Coal Group plans to transfer 70 million shares of the company to Zhongyu Xin, accounting for 5.75% of the total share capital. The transfer price 4.22 yuan per share, a total of 295 million yuan.

According to the company's disclosure on February 17, Zhengmei Group's non-public agreement to transfer its 5.19% shares of the listed company to China Pingmei Shenma Group has completed the transfer registration procedures.The unit price of the transfer is 4.87 yuan per share, and the total transaction price is 308 million yuan.

After the two transfers are completed, the shareholding ratio of Zhengzhou Coal Group will be reduced from 62.84% to 51.91%, and it is still the controlling shareholder of Zhengzhou Coal and Electricity. It became the second and third largest shareholder.

Zhengmei Group's counterparties have a lot of background.Zhongyu Xinzeng is the first provincial-level credit enhancement institution in Henan Province. It was established on February 8 this year with a registered capital of 4 billion yuan. It is 100% owned by Henan Yuzi Urban-Rural Integration Construction and Development Co., Ltd., and the actual controller is Henan Provincial Department of Finance; China Pingmei Shenma Group is a state-owned super-large enterprise group focusing on energy and chemical industry. It has three listed companies: Pingmei Co., Ltd., Shenma Industry, and Xinda New Materials. It is the most comprehensive coking industry in China. Coal, thermal coal production base and the largest nylon chemical production base in Asia.

It is worth mentioning that the actual controllers of Zhengzhou Coal and Power and China Pingmei Shenma Group are both Henan SASAC.Zhengzhou Coal and Electricity said that China Pingmei Shenma Group recognized the long-term development prospects of Zhengzhou Coal and Electricity and made strategic investment in Zhengzhou Coal and Electricity. Through this transaction, China Pingmei Shenma Group will help Zhengzhou Coal and Electricity optimize its shareholding structure and corporate governance. Support Zhengzhou coal power to improve quality and efficiency, and promote the integration and coordinated development of state-owned resources.