Data source: Wind

On July 11, the three CSI TCM ETFs from the three fund companies Penghua, Yinhua and Huatai-Pineapple officially began to subscribe, and new products were added to the ETF segment.This type of ETF tracks the CSI Traditional Chinese Medicine Index, and mainly selects securities of listed companies involved in the production and sales of traditional Chinese medicines as samples to reflect the overall performance of listed companies with the concept of traditional Chinese medicine.In recent years, the issuance of ETF funds has been accelerating, and ETFs in many sub-sectors, including carbon neutrality and traditional Chinese medicine, have expanded rapidly, and new varieties have been launched one after another.

In addition to traditional Chinese medicine ETFs, another sub-track in the pharmaceutical field, vaccines, will also usher in corresponding ETF products.The National Securities Vaccine and Biotechnology ETF from Huatai-Pineapple, Cathay Pacific, and Wells Fargo has recently received approval and has become the first vaccine-themed ETF in the market.In addition, Bosera, China Merchants, and Harvest also submitted the application materials for the CSI Vaccine and Biotechnology ETF.As of now, six vaccine index funds are in the pending approval process, and the industry expects the above-mentioned funds to be issued in batches in the near future.

In recent years, ETF investment themes have continued to innovate, and many fields, including medicine and carbon neutrality, have become the main direction of ETF product innovation.

On July 4, the first batch of eight carbon-neutral ETFs went on sale.Judging from the subscription situation on the first day, the carbon neutral ETF of E Fund Fund has subscribed more than 1 billion yuan, and the carbon neutral ETF of GF, Nanfang and other fund companies also attracted nearly 1 billion yuan.Previously, on April 21, eight fund companies including E Fund, GF, Wells Fargo, Nanfang, China Merchants, China Universal, ICBC Credit Suisse, and Dacheng reported carbon neutral ETFs; on June 28, eight ETFs were approved; on July 4 The first batch of carbon-neutral ETFs was launched on 11 March 2019.As the first batch of carbon neutral ETFs in China, this type of product adopts the full replication method to track and replicate the carbon neutral index of the CSI Shanghai Environmental Exchange.

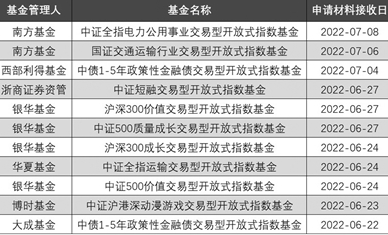

At the same time, other sub-track ETFs also showed a trend of "blooming everywhere" and continued to "increase" in the issuance market.According to Wind data, as of July 11, 127 ETF product application materials have been received during the year, covering infrastructure, electricity, biological breeding and other sub-sectors.Specifically, since July, a total of three ETF products have been declared, namely, China Southern Asset Management's power utility ETF, transportation industry ETF, and China Bond 1- to 5-year policy financial bond ETF under Western Profit Fund.In addition, on May 9, the application materials for biological breeding-themed ETFs declared by eight fund companies including Nanfang, GF, Huaxia, and Tianhong were collectively received.

According to industry insiders, there is still a lot of room for development of ETF and index fund products in my country based on the proportion of foreign passive index funds.However, because ETFs have a distinct first-mover advantage, they are already dominated by giants on the track with sufficient demand. For fund companies that currently have no obvious scale advantage, the future layout of subdivided products may become a breakthrough point for more fund companies. .