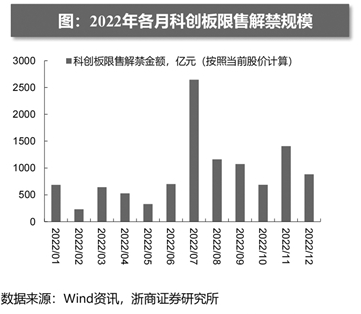

Scale of restrictions on sales and lifting of restrictions on the Science and Technology Innovation Board in each month of 2022

Data source: Wind, Zheshang Securities Research Institute

As the third anniversary of the opening of the Sci-Tech Innovation Board approaches, the market will also usher in the peak of lifting the ban.Data show that in the second half of this year, the total scale of the lifting of the ban on the Science and Technology Innovation Board exceeded 750 billion yuan, of which the scale of lifting the ban in July exceeded 250 billion yuan, accounting for about a quarter of the scale of the lifting of the ban on the Science and Technology Innovation Board for the whole year.Institutions and industry experts said that in the long run, the lifting of the ban is actually more conducive to the development of the sector, and the increase in the number of tradable shares is expected to further enhance the trading activity of the Science and Technology Innovation Board, provide better market trading conditions for institutional investors to enter the market, and further open up growth. With space for the Science and Technology Innovation Board.

The peak of the lifting of the ban is approaching

On July 22, the Science and Technology Innovation Board will celebrate the third anniversary of the opening of the market, and a large-scale centralized lifting of the ban will follow.Wind data shows that according to the closing price on July 12, the scale of the lifting of the ban on the Science and Technology Innovation Board in the second half of this year was 754.449 billion yuan. In July, a total of 92 companies on the Science and Technology Innovation Board released a total of 10.695 billion restricted shares, with a total market value of more than 250 billion yuan. , accounting for about a quarter of the total lifting of the ban on the Science and Technology Innovation Board in the whole year.If the IPO general shares, IPO institutions allotment shares, and private placement institutions allotment shares that are released on the first day of listing are excluded, a total of 10.417 billion restricted shares were lifted from 77 companies in July, with a total market value of over 240 billion yuan, the largest number in the past three years. The peak monthly scale of lifting the ban.

According to the Zheshang Securities Research Report, July this year will be the peak of the lifting of the ban for companies listed on the Science and Technology Innovation Board in three years (that is, controlling shareholders and actual controllers are not allowed to transfer IPO shares within three years from the date of listing).In 2022, the total scale of the restricted sales and lifting of the Sci-tech Innovation Board will be 1,085.7 billion yuan, and the "Dafei" lifting of the ban will exceed 470 billion yuan, accounting for 43.6%.At the same time, in 2022, the “Xiaofei” (that is, other shareholders are not allowed to transfer IPO shares within one year from the date of listing) on the Science and Technology Innovation Board will lift the ban of more than 380 billion yuan, of which the largest lifting scale was in August this year, reaching 65.3 billion yuan.

In terms of type, the IPO of the original shareholders' restricted shares and the IPO of the strategic placement shares accounted for 99% of the lifting of the ban on the Science and Technology Innovation Board in July; from the perspective of distribution industries, the Industrial Securities Research Report shows that electronics, mechanical equipment, power equipment, defense The scale of the lifting of the ban in the military industry and medical and biological industries is at the top, reaching 103.87 billion yuan, 70.28 billion yuan, 28.56 billion yuan, 27.92 billion yuan and 22.52 billion yuan respectively; the market value of the machinery equipment, defense industry, non-ferrous metals, electronics and power equipment industries accounted for free circulation The proportion of market capitalization is relatively high, at 41%, 40.5%, 21.9%, 21% and 8.5% respectively.In terms of individual stocks, as of the close on the 12th, the top companies lifted the ban in July were China Micro (32.993 billion yuan), Montage Technology (31.661 billion yuan), CRSC (29.126 billion yuan), Hangke Technology (19.939 billion yuan) 100 million yuan), Western Superconductor (12.349 billion yuan) and Nanwei Medicine (10.013 billion yuan), the scale of lifting the ban exceeded 10 billion yuan.

Market impact expected to be limited

Zhang Junxiao, an analyst at Guosheng Securities, said that compared with the previous two years, the lifting of the ban on the Science and Technology Innovation Board should focus on three differences: First, the scale of lifting the ban in a single month is a new high, but the increase is more due to the non-Science and Technology 50, and the pressure It is not as good as the first round; second, the lifting window is more continuous, and the second half of the year is facing high pressure. The first two rounds of lifting are mainly concentrated in July and August. The ratio remains at around 5%. Compared with the previous period, this round of lifting of the ban may continue to restrain emotions. Third, this round is mainly due to the lifting of the ban by major shareholders, and there are more concerns about concentrated reduction of holdings.

When it comes to the impact of the large-scale lifting of the ban, institutional people generally believe that the impact is limited and there is no need to worry too much.Yang Delong, chief economist of Qianhai Open Source Fund, believes that this wave of centralized lifting of the ban will have a certain impact on the short-term trend of the Science and Technology Innovation Board, but the actual impact still depends on the subsequent actual actions of major shareholders. In addition, some investors are worried cause fluctuations in market sentiment.However, in the medium and long term, investment on the Sci-tech Innovation Board still depends on the fundamentals of the company, and the allocation of good companies that are in line with the national strategic development direction and have core competitiveness.Wang Yang of Zheshang Securities believes that the market is worried about the lifting of the ban on the Science and Technology Innovation Board, but the impact is limited. The reason is that the stock price tends to rise after the lifting of the ban on “Da Fei”. Although the lifting of the ban on “Xiao Fei” has an impact, it has been adjusted in advance from January to April. , and about more than 260 companies did not have the pressure to lift the ban on "Xiaofei" this year, and the proportion of "Xiaofei" lifted in July was relatively low.

Zhang Qiyao, an analyst at Industrial Securities, said that in the medium and long term, with the lifting of the ban on a large number of restricted stocks, the increase in the number of tradable shares is expected to further enhance the trading activity of the Science and Technology Innovation Board and enhance the willingness of institutional investors to increase allocations.In the future, more chips will enter the circulation, which will provide better market trading conditions for institutional investors to enter the market, and further open up the space for additional allocation of the STAR Market.

CICC said that based on historical experience, the peak period of lifting the ban is often accompanied by an increase in the scale of subsequent reductions. From the perspective of capital, it may have a certain short-term impact on asset prices, but the medium and long-term impact is relatively limited.Most of the companies listed on the Sci-tech Innovation Board reflect the trend of China's industrial upgrading and industrial independence. Combined with the continuous improvement of the state's support for technological innovation and industrial upgrading, the "Science and Technology Innovation" attribute of the Sci-tech Innovation Board is in full condition.