As a result of the conflict between Russia and Ukraine, Russian oil has been sanctioned by some countries with import restrictions, while a record amount of oil is being shipped to India and China.

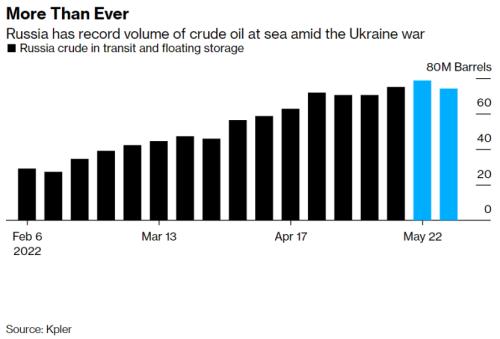

According to commodities market data analysis firm Kpler, 74 million to 79 million barrels of oil from OPEC+ producers were in transit and in float in the past week, more than double the 27 million barrels in February before the Russian-Ukrainian conflict erupted. .Asia overtook Europe as the largest buyer of Russiancrudefor the first time last month , and the gap will continue to widen in May, according to the company.

The sharp rise in Russian oil shipments by sea underscores the turmoil in the global energy trade caused by the outbreak of the Russian-Ukrainian war, with U.S., U.K. and many European Union companies refusing to import Russian goods, forcing Russia to find buyers in Asia.China and India have bought millions of barrels of oil from Russia at steep discounts.

Jane Xie, senior oil analyst at Kpler, said:

“Asian buyers are buying more for economic motives than for political stances. However, there has been an increase in U.S. focus on Indian purchases of Russian oil, so there may be some downside risks to this trade flow, even if not at the moment. are likely to be significantly affected."

Flows of Russian oil to two of Asia's biggest buyers, India and China, surged to record levels in April, largely driven by increased purchases by India, she said.While shipments may be down this month, they will only be marginally lower than last month's all-time high.

If the European Union can agree on energy sanctions on Russia by the end of this year, Russia's seaborne trade with Asia will increase, and seaborne crude oil shipments will increase, industry consultant FGE said in a report this week. 45 million barrels to 60 million barrels.

Shipping crude oil from Russia to Asia will take longer than shipping to Europe, typically about two months each way to China.

About 57 million barrels of Urals and 7.3 million barrels of Russian Far East ESPO crude were at sea as of May 26, compared with just 19 million barrels of Urals and 5.7 million barrels of Russian Far East ESPO crude at the end of February, according to Kpler.