In May of this year, the annual reports of six major state-owned banks including Industrial and Commercial Bank of China, Agricultural Bank of China and China Construction Bank were disclosed.Judging from the operating performance of the wealth management subsidiaries of the six banks, compared with joint-stock banks, city commercial banks and other banks, large state-owned banks rely on their advantages in wealth management product system, investment types, and risk pressure to achieve relatively strong and stable performance. favored by investors.With the implementation of the "Guiding Opinions on Regulating the Asset Management Business of Financial Institutions" (referred to as the "New Regulations on Asset Management") at the beginning of this year, what are the obstacles faced by banks' wealth management products in the process of breaking new exchanges and starting net worth transformation?How can bank wealth management continue to create income for investors?

The market structure is gradually optimized

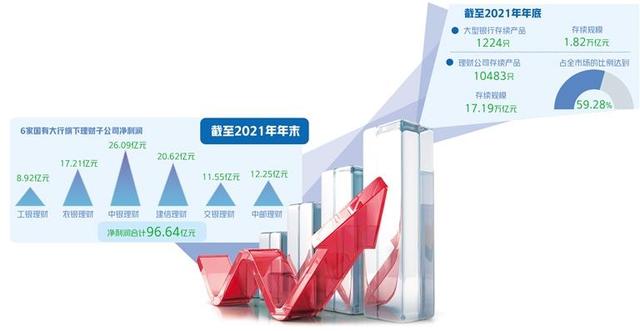

The reporter combed the annual report of the bank and found that as of the end of 2021, the wealth management subsidiaries of 6 major state-owned banks-ICBC Wealth Management, Agricultural Bank of China Wealth Management, Bank of China Wealth Management, CCB Wealth Management, Bank of Communications Wealth Management, and China Post Wealth Management had a total net profit of 9.664 billion yuan , the net profit was 892 million yuan, 1.721 billion yuan, 2.609 billion yuan, 2.062 billion yuan, 1.155 billion yuan, and 1.225 billion yuan.Compared with the operating conditions in 2020, the six wealth management subsidiaries achieved stable profits and obvious growth momentum.

The scale of wealth management products has become a key indicator of competition among wealth management companies.The total scale of assets under management of the six wealth management subsidiaries is close to 10 trillion yuan, and the scale of their wealth management management has increased significantly compared with 2020.Specifically, the balance of ICBC wealth management products was 2,021.804 billion yuan, an increase of 951.731 billion yuan over the end of the previous year; the balance of ABC’s wealth management products was 1,823.211 billion yuan, a big increase compared to the previous year; the entrusted management scale of BOC wealth management exceeded 17,100 100 million yuan, an increase of 23.17% over the end of the previous year; the scale of CCB wealth management products was 2,188.330 billion yuan, a large increase compared to the previous year; the balance of Bank of Communications wealth management products was 1,224.664 billion yuan, an increase of 129.43% over the end of the previous year; China Post Wealth Management The scale of new products under management increased from 256.109 billion yuan at the beginning of the year to 655.306 billion yuan.

From the perspective of the banking wealth management market structure, by the end of 2021, there will be 9 banks' wealth management sub-products with a scale of more than one trillion yuan, including 4 joint-stock banks and 5 large state-owned banks, which continue to play an important role.Among them, the existing scale of CCB Wealth Management and ICBC Wealth Management exceeded 2 trillion yuan respectively, ranking among the top three in the industry.According to the Annual Report on China's Banking Wealth Management Market (2021), by the end of 2021, there were 1,224 existing products of large banks, with an existing scale of 1.82 trillion yuan, a year-on-year decrease of 69.49%; 10,483 existing products of wealth management companies. Only, the surviving scale is 17.19 trillion yuan, a year-on-year increase of 157.72%, accounting for 59.28% of the total market. From the perspective of surviving scale, wealth management companies are an important type of institution. auxiliary layout.Zheng Chenyang, a researcher at the Bank of China Research Institute, said that wealth management companies have become the main force in the wealth management market, and the most important reason for the rapid growth of their product scale is that banks have implemented regulatory requirements.The establishment of wealth management subsidiaries not only makes the business professional and standardized, better isolates the risks on and off the balance sheet, but also greatly improves the competitiveness of products. products, accelerate the transformation and upgrading of wealth management business, and continuously expand the business scale.

At present, 29 wealth management companies have been approved for establishment, including 25 wealth management subsidiaries of commercial banks and 4 joint venture wealth management companies controlled by foreign parties, of which 25 have been approved to open.According to the type of controlling shareholder, the number of wealth management subsidiaries initiated and opened by large banks, joint-stock banks, city commercial banks and rural financial institutions was 6, 8, 7 and 1 respectively.It is worth noting that the three joint venture wealth management companies that have opened so far are all controlled by foreign institutions, which means that my country's wealth management market not only has strong attractiveness, but also the pace of opening to the outside world is also accelerating.

In general, my country's bank wealth management market has good prospects for development, and most banks are more enthusiastic about the large wealth management business.Zheng Chenyang said that driven by various factors such as interest rate liberalization and financial disintermediation, the traditional expansion path of banks is unsustainable. Asset-light and capital-light operations are the direction of development, and wealth management business is the key development target of banks.Wealth management subsidiaries entered the market quickly, relying on the parent bank's channel, customer base, technology, and brand advantages to grow development strength, continuously strengthen its dominant position in the wealth management market, and expand channels for bank wealth management to expand asset scale.

Continue to improve regulatory efficiency

Recently, the China Banking and Insurance Regulatory Commission issued 4 fines for the wealth management business of some wealth management subsidiaries and their parent banks, with a total penalty amount of nearly 15 million yuan.Experts said that this is the first time since the first bank wealth management subsidiary was approved to open in 2019, and the regulatory authorities have issued a fine to a wealth management subsidiary and a commercial bank’s wealth management custody business. The administrative penalty also means that the follow-up wealth management supervision system will become more and more strict. .

It is reported that two of the fined wealth management subsidiaries are also leading institutions in the industry, namely Bank of China Wealth Management and Everbright Wealth Management.Dong Ximiao, chief researcher of China Merchants Union Finance, believes that the China Banking and Insurance Regulatory Commission will punish BOC Wealth Management and Everbright Wealth Management, which shows that after the establishment of the financial management company and the financial management business rules and regulations, the regulatory authorities will focus on promoting the standardized and orderly operation of wealth management subsidiaries to ensure relevant systems and measures. Implemented and implemented to promote the healthy development of wealth management business and wealth management market.

In recent years, the regulatory authorities have continuously established a regulatory framework and implemented relevant supporting measures one after another.Since the joint release of the "New Regulations on Asset Management" by multiple departments in 2018, the reform of the asset management industry has been opened, followed by the "Administrative Measures for Wealth Management Subsidiaries of Commercial Banks", "Interim Measures for the Management of Sales of Wealth Management Products of Wealth Management Companies" and "Wealth Management of Wealth Management Companies" Documents such as the Product Liquidity Risk Management Measures have been implemented successively, and then the recently released Internal Control Management Measures of Wealth Management Companies (Draft for Comments).A series of regulatory norms have clarified the general principles, classified management, product custody and other specific requirements of wealth management business, and have improved the regulatory consistency of various asset management industries.

Liu Yuzhen, director of the Financial Development Research Center of Peking University, said that the wealth management company industry as a whole is in the "nascent stage". They are all new asset management institutions that have just been established in the past few years. Their organizational structure and business characteristics are quite different from those of traditional commercial banks and non-bank financial institutions. big.At present, the regulatory authorities have promulgated relevant regulatory measures. On the one hand, it is conducive to promoting wealth management companies to establish and improve unified and standardized internal control standards and promote the standardized development of wealth management companies; on the other hand, it can also prevent financial risks that may arise in the process of rapid development.As far as the internal operation of a wealth management company is concerned, each business management department of a wealth management company should establish a clear and independent organizational structure for the division of responsibilities.This independent and mutually oversight structure helps to identify potential business risks in a timely manner and helps reduce moral hazard and conflicts of interest.

In the second half of this year, the bank wealth management market has ushered in the post-"New Asset Management Regulations" era, and the development space and potential are still huge.Dong Ximiao said that in the next stage, the regulatory authorities should strengthen and improve the supervision of wealth management business, and wealth management companies should enhance their professional and characteristic development capabilities.Small and medium-sized banks should accelerate the development of the agency sales of wealth management products, and make concerted efforts from all parties to jointly promote the wealth management market to serve the real economy efficiently and flexibly, and better meet the needs of investors to balance risks and returns.In addition, “wealth management companies should run risk management throughout the entire business operation process and improve the long-term mechanism for risk prevention and control. Through professional asset investment management, different measures should be taken for low-liquidity assets, restricted liquidity assets and high-liquidity assets. to ensure that the liquidity of assets matches the operation mode and the redemption needs of investors.” Zheng Chenyang said.

Accelerate the transformation of net worth

With the continuous pressure reduction of capital-guaranteed wealth management products of wealth management companies and the continuous issuance of new products, the transformation process of product net worth has significantly accelerated.In April, the banking wealth management registration and custody center released data on the banking wealth management market in the first quarter of this year. In the first quarter, there were 7,717 new products in the banking wealth management market, with a fund-raising scale of 25.14 trillion yuan; 5.58 million new investors, accumulatively invested 205.8 billion yuan in revenue.As of the end of March, the existing scale of wealth management products was 28.37 trillion yuan, and the net value ratio reached 94.15%, an increase of 21.12 percentage points over the same period last year.

It is worth noting that although the transition period of the "New Asset Management Regulations" has ended, bank wealth management has not yet achieved 100% net worth transformation, especially the valuation and pricing of wealth management products, product structure adjustment, and investment research system construction are the needs of the asset management industry. Right more difficult.For example, from the perspective of the construction of the investment research system, the investment management, product research and development, and marketing service capabilities of most bank wealth management subsidiaries are relatively lacking. The investment and research capabilities of equity assets are relatively weak, which restricts the process of net worth transformation and the level of market-oriented competition.

At present, banks that have not yet completed the transformation of net worth should actively grasp the direction of transformation and accelerate the progress of transformation.Zheng Chenyang said that banks that have established wealth management subsidiaries should give full play to their professional advantages, conduct in-depth research on customers' investment preferences and risk tolerance, match customers with diversified asset allocation plans, enrich product systems, and form complementary self-operated and agency sales. Banks that have the ability but have not established wealth management subsidiaries should seize the opportunity of transformation, conduct market research and input-output analysis, prepare to set up subsidiaries in advance according to their own business needs and conditions, and accelerate their entry to buy time for transformation; Small and medium-sized banks that cannot set up wealth management subsidiaries should digest existing products as soon as possible, turn to the agency sales market, and even withdraw from the wealth management market according to actual conditions to cultivate advantageous businesses.Banks that have completed their net worth transformation are still a long way off from full net worth. They must keep up with the pace of regulation and work hard on net worth valuation, product structure adjustment, customer acceptance and satisfaction.

Since the beginning of this year, the net value of wealth management products issued by some commercial banks and wealth management companies has fluctuated more, and a few products have even been "broken", causing investors to worry.Dong Ximiao said that the so-called "broken net" does not mean a loss of financial products.At present, the term of wealth management products is relatively long, and the “broken net” wealth management products are still in the closed period.Before the product expires, the change in net value is only for reference and does not indicate actual loss.As the market improves, it is still quite possible for some wealth management products to achieve positive returns after maturity.The relatively stable style of bank wealth management products has not changed, and it is still an important choice for the public to invest in wealth management.

In the era of bank wealth management net worth, how to balance the risks and benefits of wealth management investment and meet the needs of different investors has put forward higher requirements for the marketization degree and personnel allocation of bank wealth management.Huo Yijing, a researcher at Puyi Standard, said that financial institutions of banks should actively adjust their management models, improve their investment and research capabilities and risk management capabilities, especially the training and allocation of professional investment and research talents.At the same time, it can further expand the layout of "fixed income +" products, share equity market dividends under the relatively stable advantages, and provide investors with more diversified choices while expanding investment categories.

With the rapid development of the bank's wealth management market and the entry of a large number of investors, whether investors can break the original "rigid payment" expectations for wealth management products is a major challenge for banks' wealth management investment.Dong Ximiao believes that, in general, some investors in the banking wealth management market are relatively inexperienced in wealth management and investment.Financial regulators and financial institutions should take various measures to continuously educate and protect investors.At the same time, investors themselves should strengthen their studies, continuously improve their financial literacy, and enhance their awareness and ability to prevent risks.