Tencent Holdings (00700.HK) announced on the Hong Kong Stock Exchange at noon that the company’s main shareholder, Naspers Group (under the South African Press), will sell shares in the company to raise funds for its repurchase plan, but did not disclose the proportion of the sale.

In April 2021, when it sold 2% of Tencent Holdings at nearly HK$600 per share, Naspers Group once promised that it would not continue to reduce its holdings in Tencent for three years. However, this announcement at noon on June 27 completely broke this written statement. Promise of.

On the afternoon of June 27, Tencent Holdings dived after the market opened. As of press time, it has fallen below the HK$400 mark, with the largest increase of 4.16% in early trading.

Tencent was sold again, and major shareholders broke their promises

"In a press release by Prosus dated April 7, Prosus announced that it will not sell further shares for at least the next three years, and the arrangement is in line with its long-term confidence in the potential of Tencent Holdings' business." On April 8, 2021, Tencent announced Said that, however, after more than a year, the major shareholder broke his promise.

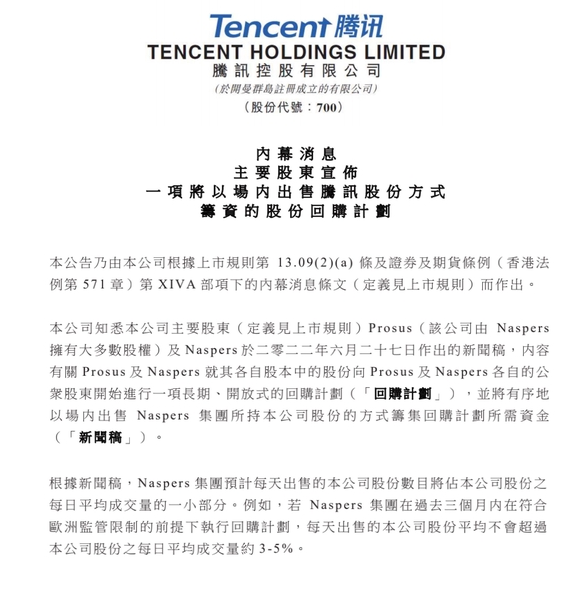

"Knowing that the company's major shareholder Prosus (the company is majority-owned by Naspers) and the press release made by Naspers on June 27, 2022," Tencent announced at noon on June 27, 2022, Naspers Group expects to sell companies every day The number of shares will represent a fraction of the average daily trading volume of the Company's shares."For example, if the Naspers Group had executed a buyback program in the last three months subject to European regulatory restrictions, the average daily sales of the company's shares would not exceed the average daily trading volume of the company's shares by approximately 3-5%."

Prosus is a holding company used to hold the international Internet assets of South African investment company Naspers (the South African newspaper industry).As of now, Prosus holds more than 28% of Tencent Holdings through its subsidiary MIH.

Lin Jiayi, CEO of Xuanjia Finance, told China Business News that the stock price adjustment was not sufficient because Tencent had many domestic public funds "grouping together".Tencent's major shareholders continue to reduce their holdings. On the one hand, the major shareholders themselves need to use funds, such as the announcement stating that they need to repurchase their own shares; on the other hand, there are other uses of funds, such as other investment needs.This reduction of holdings obviously violates the three-year non-reduction commitment announced last year. It may also be that Tencent Holdings’ growth is not expected to return to normal, and the current valuation is relatively high, so the decision to reduce the holdings is made.

In the first quarter of this year, Tencent Holdings repurchased 8,864,400 shares at a total price of HK$3.697 billion (excluding expenses).

Tencent fell below 400 Hong Kong dollars again, and the market has some doubts about whether Ma Huateng's management team can keep investors' confidence.

Chinese concept stocks are cashed out, and Tencent is also selling assets

After the Chinese concept stocks rebounded significantly in the past three months, they were all heavily reduced by major shareholders; while the major shareholders continued to sell off, Tencent Holdings was also selling its assets.

At the end of March 2022, the fair value of Tencent's equity in listed investment companies (excluding subsidiaries) was 606 billion yuan.At the end of the last quarter, the fair value of Tencent's equity in listed investment companies (excluding subsidiaries) was 982.8 billion yuan.In the fourth quarter of 2021, after the spin-off of JD.com to distribute to shareholders as a dividend, Tencent continued to sell assets this year.In the first quarter of this year, disposal and deemed disposal gains were approximately RMB 18.892 billion, including approximately RMB 18.481 billion from disposal of associated company Sea Limited (NYSE: SE).

On June 20, New Oriental Online (01797.HK) closed at HK$16.98 after a 32% drop.Tencent Holdings sold 74.6 million shares of New Oriental Online from June 15 to 16. After the reduction, the shareholding ratio dropped from 9.04% to 1.58%, and the average price of the reduction was less than HK$9.7.

On the morning of April 8, 2021, Tencent Holdings announced that it had been informed by Prosus, a subsidiary of the South African newspaper (which is majority-owned by Naspers and the controlling shareholder of the company), that its wholly-owned subsidiary MIH TC had closed on April 8. Entered into a placing agreement with the placing agent regarding the sale of a total of 192 million shares at a total consideration of HK$114.2 billion, accounting for approximately 2% of the total issued shares, with an average reduction of HK$595.At the time, Prosus said, "It plans to use the proceeds from the sale of these shares to increase the company's financial flexibility to further invest in growth companies, as well as general corporate purposes. Prosus said the epidemic has accelerated the digital transformation of all growth sectors of the group. , including food delivery, payments and fintech, education and e-commerce, and more, Prosus sees an opportunity to continue scaling these business models. In addition, through its venture capital arm, Prosus will continue to support innovative businesses and entrepreneurs.”

On March 22, 2018, Naspers, which has invested in Tencent for 17 years, reduced its holdings in Tencent for the first time. At that time, it reduced its holdings by about 190 million shares, accounting for 2% of Tencent's total share capital. The average price of reductions was HK$402. The price of reducing holdings again actually rose by less than 50%.

And this reduction in June 2022 is likely to be lower than the average reduction in April 2021, and roughly the same price as the first reduction in 2018.ncent again, violating the promise of "not selling for three years"