"Investor Network" Ding Wanying

edit soup towel

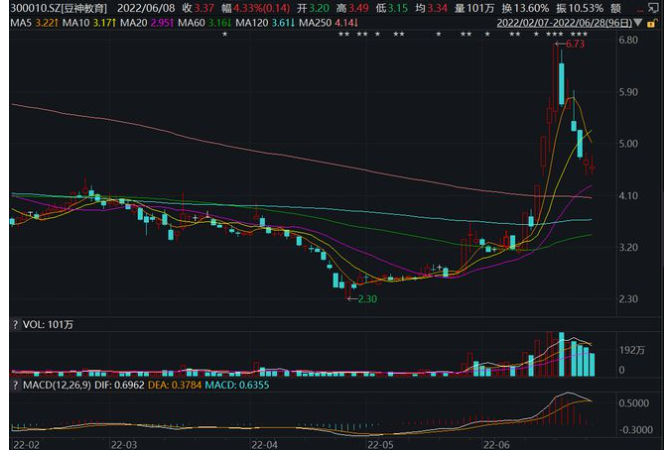

Since June, New Oriental's "Oriental Selection" has become popular on the Internet, driving the popularity of the education sector in the A-share market.Affected by this, Doushen Education Technology (Beijing) Co., Ltd. (hereinafter referred to as "Doushen Education", 300010.SZ) also experienced 4 daily limit prices in 6 trading days, which attracted the attention of the market and regulatory authorities.

From May 27 to June 20, Doushen Education’s share price rose as much as 142%.However, after the company supplemented relevant risk warnings, the stock price fell back quickly, dropping 32% from June 21 to 28. As of June 28, the closing price was 4.6 yuan per share.

It is worth noting that Doushen Education’s previous plan to sell assets to resolve the debt crisis recently declared bankruptcy.On June 26, it issued an announcement saying that Hainan Lianzhong Yitong Network Technology Co., Ltd. (hereinafter referred to as "Hainan Lianzhong") proposed to terminate the transaction, and Doushen Education planned to sell its grandson company Beijing Lisichen New Technology Co., Ltd. for 876 million yuan. The issue of 100% equity of the company (hereinafter referred to as "Lisichen New Technology") was therefore stranded.

The letter of concern asks whether it is "hot spot"

In the past month, Doushen Education's share price has been on a roller coaster ride, which is not unrelated to the release and termination of its major asset sale draft, and the fire of New Oriental's "Oriental Selection" to drive education stocks.

The "Oriental Selection" created by New Oriental went out of the circle with unprecedented popularity in June this year, and at the same time caused fluctuations in the education sector of the A-share market.

On June 13th, Doushen Education gained a daily limit, and then the company replied to investors on June 15th, saying: "Live broadcast e-commerce sales is one of the company's main businesses." "About 100 teachers have shared literature and history on the live broadcast platform. Knowledge, disseminate Chinese culture, and provide users with a variety of courses and products to help improve the literary literacy of users and their families.”

Screenshot of Doushen Education Interactive Q&A

Data source: Wind

Then Dou Shen Education connected with 3 daily limit.On June 17, Doushen Education received a letter of concern from the Shenzhen Stock Exchange, requesting a detailed explanation of the current development of the company's live broadcast business and whether the company and related parties have hot spots.

Data source: Beanshen Education Announcement

At noon on June 20, Doushen Education replied to the letter of concern that the sales of live broadcast reached 149 million yuan, and it is expected that the proportion of this business in the company's revenue will increase in 2022.The next day, Doushen Education issued a letter of concern and correction notice, and said: "The company's live broadcast e-commerce sales business is still in the exploratory stage, the performance of this business may fluctuate greatly, and there are major uncertainties in the development of this business. sex."

The correction announcement shows that after the company responded to the letter on June 20, 2022, and after self-examination, some statements in the reply letter were not clear and accurate, and some words were expressed in a publicity tone, so the corrected statement was reissued. Reply.Specifically, the corrected reply deleted the contents detailing the live broadcast business, the number of fans on the platform, and the sales of this business as of the end of the reply date in 2022 of 149 million yuan.

So here comes the question. On June 15th, Doushen Education responded to investors on the interactive platform that "live broadcast e-commerce sales are one of the company's main businesses", and on the 20th, it listed sales and its revenue ratio for 2022. Wait, why did the statement change on June 21?What led to the apparent shift in the company's statement about it?"Investor Network" contacted Doushen Education for communication, but did not receive a reply.

Some investors reminded the company that live streaming and bringing goods to build MCN requires a lot of cash flow, that is, "burning money". However, the recent capital situation of Doushen Education is hardly optimistic.

Investor questions

Data source: Wind

Selling plans to terminate cash flow problems to be solved

According to public information, Doushen Education was formerly known as Lisichen Technology Co., Ltd. (hereinafter referred to as "Lisichen"), which started out as a security technology business.In 2009, it was listed on the Shenzhen Stock Exchange and became one of the first companies listed on the Growth Enterprise Market.Since 2013, Li Sichen has transformed into the field of education, and has carried out several mergers and acquisitions. It has successively acquired education companies such as Kangbang Technology, an education information technology company, and Chinese Future, a large language education institution. Become a K12 education company with language business as its main business in the A-share market.

The main composition of Doushen Education

Data source: Wind

Affected by the "Double Deduction" policy, Doushen Education made a total of more than 300 million yuan for impairment of goodwill for its previous investment and its own K12 subject training business. Under the circumstances, the company fell into the predicament of tight capital chain.

At the end of April this year, Doushen Education signed an "Equity Transfer Agreement" with Hainan Lianzhong, planning to transfer 100% of Lisichen New Technology for 876 million yuan.According to the plan at the time, 728 million yuan will be used to repay part of the listed company's liabilities in the Bank of China, and 60 million yuan will be used to repay loans to Shanghai Pudong Development Bank.

Doushen Education issued an official announcement on May 27, including multiple announcements including "Financial Advisor", "Asset Evaluation", "Legal Opinion", etc.