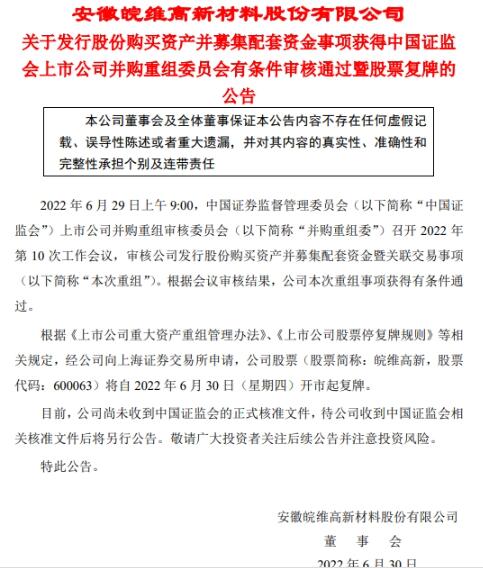

China Economic Net, Beijing, June 30. Yesterday evening, Wanwei High-tech (600063.SH) announced that on June 29, 2022, the China Securities Regulatory Commission's Listed Company Mergers and Acquisitions Review Committee will review the company's issuance of shares to purchase assets and raise supporting funds. and related-party transactions.According to the review results of the meeting, the company's reorganization was approved conditionally.

On June 21, 2022, Wanwei High-tech released the report on the issue of shares to purchase assets and raise supporting funds and related transactions (draft) (revised draft).The transaction report shows that the transaction includes two parts: issuing shares to purchase assets and raising supporting funds.The listed company in this transaction intends to purchase 100% of the equity of Wanwei Wansheng held by the counterparty in total by issuing shares, and at the same time plans to issue shares to a specific object, Wanwei Group, to raise supporting funds.

Wanwei High-tech intends to purchase Wanwei Group, Anyuan Ventures, Wang Bichang, Lu Hanming, Shen Yajuan, Tong Chuntao, Lin Renlou, Yao Xianping, Zhang Hongfen, Fang Hang, Xie Dongming, Hu Liangkuai, Xie Xianhu and Yi Xinhua holds 100% equity of Wanwei Wansheng in total.After the transaction is completed, Wanwei Wansheng will become a wholly-owned subsidiary of the listed company.

According to the “Assessment Report” issued by Zhonglian Guoxin Pingbao Zi (2022) No. 108, Zhonglian Guoxin Assessment adopted the asset-based method and the income method to evaluate Wanwei Wansheng, and adopted the income method. The evaluation result of the law shall be regarded as the evaluation conclusion of all shareholders' equity of Wanwei Wansheng.Taking December 31, 2021 as the appraisal base date, the appraisal value of all shareholders' equity (net asset value) of Wanwei Wansheng is 794 million yuan, and the audited book value of the net assets of Wanwei Wansheng on the appraisal base date is 190.7742 million yuan , the value added was 603.2258 million yuan, and the value-added rate was 316.20%.

After friendly negotiation between the parties to the transaction, the transaction price of 100% equity of Wanwei Wansheng, which is the subject of the transaction, is 795 million yuan, all of which will be paid by issuing shares.

In this transaction, the stock issue pricing base date for the listed company’s issuance of shares to purchase assets is the announcement date of the resolution of the sixth session of the company’s eighth board of directors, and the stock issue price for issuing shares to purchase assets is 4.32 yuan per share, which is not lower than 120 days before the pricing base date. 90% of the average trading price of the stock during the trading day.

The total number of shares issued by the Company to the counterparty was 184,027,777 shares.The number of issued shares corresponding to the purchase of assets through the issuance of shares accounted for 8.54% of the total share capital after the issuance.During the period from the pricing base date to the issuance date, if the listed company has other ex-rights and ex-dividend matters, the issuance quantity will also be dealt with accordingly according to the issuance price.

In addition, Wanwei High-tech intends to issue shares to Wanwei Group to raise supporting funds by means of pricing. The issue price of the listed company's issuance of shares to specific objects to raise supporting funds is not lower than the announcement of the first board resolution of the listed company to review the transaction. 80% of the average stock trading price of listed companies in 20 trading days, or 4.52 yuan per share.

The amount to be raised this time does not exceed 198.75 million yuan. According to the calculation of the issuance price of the supporting funds for this raising of 4.52 yuan per share, the number of issued shares does not exceed 43,971,238 shares.The total amount of supporting funds raised shall not exceed 100% of the transaction price of the assets purchased by issuing shares in this transaction, and the number of issued shares shall not exceed 30% of the total share capital of the listed company before this transaction. All of them are used to supplement the working capital of the listed company, and the proportion used to supplement the working capital shall not exceed 25% of the transaction price.

The final number of shares to be issued will be determined by the company's board of directors in accordance with the authorization of the general meeting of shareholders and the underwriting agency within the scope of the plan finally approved by the China Securities Regulatory Commission.This raising of supporting funds is premised on the implementation of the issuance of shares to purchase assets, but this issuance of shares to purchase assets is not premised on the implementation of the financing of supporting funds. implementation of the behavior.

This transaction does not constitute a major asset reorganization, does not constitute a reorganization and listing, and constitutes a connected transaction.The counterparties of the company’s purchase of assets by issuing shares this time include Wanwei Group and Anyuan Venture Capital, of which Wanwei Group is the company’s controlling shareholder. Within 12 months before the signing of this report, Anyuan Venture Capital was a shareholding of the company. According to the "Listing Rules" and "Guidelines for the Self-regulation of Listed Companies No. 5 - Transactions and Connected Transactions", this transaction constitutes a connected transaction.

According to the performance commitments signed by Wanwei Group, Anyuan Ventures, Wang Bichang, Lu Hanming, Shen Yajuan, Tong Chuntao, Lin Renlou, Yao Xianping, Zhang Hongfen, Fang Hang, Xie Dongming, Hu Liangkuai, Xie Xianhu, Yi Xinhua and listed companies In the "Performance Compensation Agreement", the profit commitment period of the performance promiser to Wanwei Wansheng is 2022, 2023 and 2024, and the net profit of Wanwei Wansheng in the above-mentioned periods shall not be less than RMB 46.1654 million and RMB 81.5196 million respectively. yuan and 94.4509 million yuan.

Wanwei High-tech said that after the acquisition of Wanwei Wansheng, the overall scale of related transactions decreased, and at the same time, it also realized the vertical extension of PVB resin raw materials to the downstream product line, and became the country's leading industry chain covering PVA-PVB resin-PVB interlayer film. The business synergy effect is significant, which will help to further expand the product series and increase the market share.Therefore, this transaction will help the listed company to become stronger and bigger, improve its anti-risk ability and sustainable profitability, and continue to create value for shareholders.

As an independent financial advisor, Caitong Securities stated in the independent financial advisor report that after Wanwei High-tech acquired 100% equity of Wanwei Wansheng through this transaction, it will realize the vertical extension of PVB resin raw materials to the downstream product line, and further expand the product series. The company's asset scale and profitability will increase, and the company's ability to continue operating will be enhanced.There is no situation that may cause the company's main assets to be cash or no specific operating business.The sponsors of this financial advisory are Wang Qibiao and Xu Zhengxing.

(Editor in charge: Han Yijia)