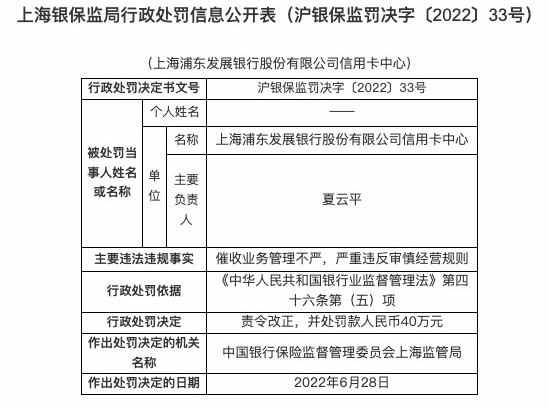

CDC Finance, June 30, according to the China Banking and Insurance Regulatory Commission, the Administrative Penalty Information Disclosure Form (Hu Yin Bao Jian Pu Jue Zi [2022] No. 33) published by the Shanghai Banking and Insurance Regulatory Bureau of the China Banking and Insurance Regulatory Commission shows that Shanghai Pudong Development Bank shares. Due to the lax management of the collection business and serious violation of the prudent management rules, the Shanghai Banking and Insurance Regulatory Bureau ordered it to make corrections in accordance with Article 46(5) of the Banking Supervision and Administration Law of the People's Republic of China. A fine of RMB 400,000 will be imposed, and the penalty date will be June 28, 2022.

According to the financial report, Shanghai Pudong Development Bank will achieve operating income of 190.982 billion yuan in 2021, a year-on-year decrease of 5.402 billion yuan or 2.75%; net profit attributable to shareholders of the parent company is 53.003 billion yuan, a year-on-year decrease of 5.322 billion yuan, a decrease of 9.12%.It is worth noting that this is the first time that Shanghai Pudong Development Bank has seen both revenue and net profit attributable to the parent in at least the past ten years.

As of the end of 2021, the total assets of Shanghai Pudong Development Bank Group were 8,136.757 billion yuan, an increase of 186.539 billion yuan or 2.35% over the end of the previous year; of which, the total domestic and foreign currency loans (including discounted bills) were 4,786.040 billion yuan, an increase of 252.067 billion yuan over the end of the previous year. An increase of 5.56%.The Group's total liabilities amounted to RMB7,458,539 million, an increase of RMB154,138 million or 2.11% over the end of the previous year; of which, the total deposits in local and foreign currencies were RMB4,403,056 million, an increase of RMB326,572 million or 8.01% over the end of the previous year.

In terms of revenue, Shanghai Pudong Development Bank will achieve operating income of 190.982 billion yuan in 2021, a year-on-year decrease of 5.402 billion yuan or 2.75%.Realized net interest income of RMB 135.958 billion, a decrease of RMB 2.623 billion or 1.89% year-on-year.The net non-interest income was 55.024 billion yuan, a decrease of 4.81% over the previous year; among which, the net fee and commission income was 29.134 billion yuan, a decrease of 14.18%, and other non-interest income was 25.890 billion yuan, an increase of 8.52%.

In terms of asset quality, at the end of 2021, the balance of non-performing loans of SPDB was 76.829 billion yuan, a decrease of 1.632 billion yuan from the end of the previous year; the non-performing loan ratio was 1.61%, a decrease of 0.12 percentage points from the end of the previous year; the provision coverage ratio was 143.96%, a decrease from the end of the previous year. 8.81 percentage points; loan provision ratio (appropriation-to-loan ratio) was 2.31%.