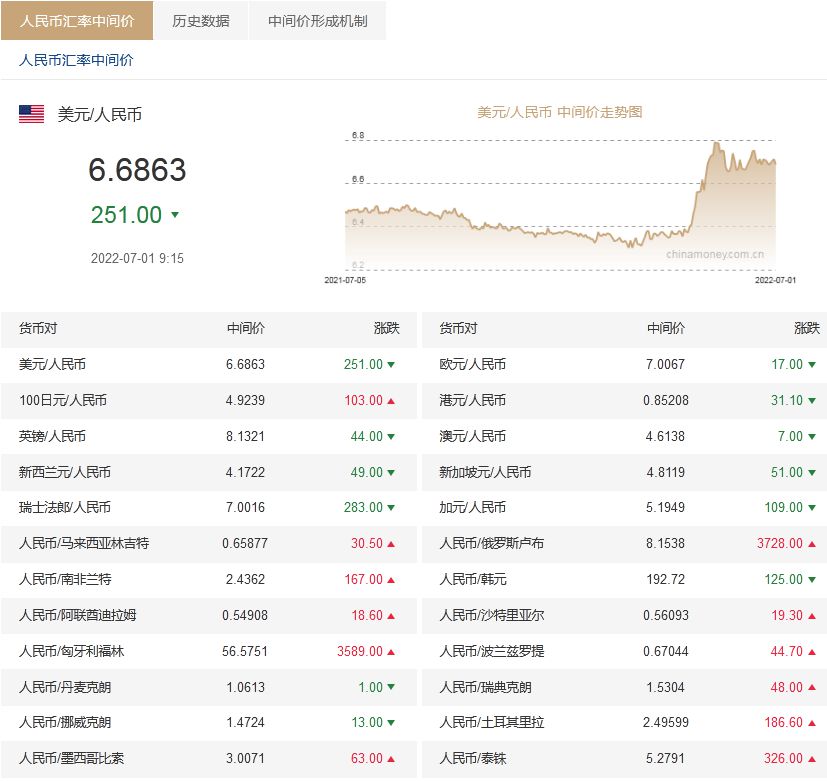

China-Singapore Jingwei, July 1. According to data from the Foreign Exchange Trading Center, on July 1, the central parity rate of the RMB against the US dollar was 6.6863, an increase of 251 basis points.The central parity of the previous trading day was 6.7114, the closing price of the onshore RMB was 6.6943 at 16:30, and it was 6.7001 at 23:30.

Forex Trading Center Website

The second-quarter regular meeting of the Central Bank's Monetary Policy Committee held on June 24 pointed out that since the beginning of this year, the RMB exchange rate is expected to be stable, and the flexibility of two-way floating has been enhanced, which has played the role of a macroeconomic stabilizer.It is necessary to deepen the market-oriented reform of the exchange rate, enhance the flexibility of the RMB exchange rate, guide enterprises and financial institutions to adhere to the concept of "risk neutrality", strengthen expectation management, maintain a balance between internal and external equilibrium, and maintain the basic stability of the RMB exchange rate at a reasonable and balanced level .

China Everbright International Research Report believes that China's economy can recover quickly from this round of epidemics, and the fundamentals are still stable. The exchange rate of the RMB is expected to show a steady appreciation trend in the second half of 2022.Taking into account the positive factors such as abundant foreign exchange reserves, sound financial conditions, and stable financial system, coupled with the orderly progress of the internationalization of the RMB, the RMB exchange rate will remain strong for the rest of 2022, and is expected to trade between 6.5 and 20 per cent against the US dollar. Good support between 6.6.

The research team of Industrial Bank believes that the short-term action of the US dollar index is insufficient, and the increase in foreign investment in RMB stocks has offset the pressure on Hong Kong stocks to pay dividends and buy foreign exchange to a certain extent, and the RMB will remain volatile in the short-term.In the future, when the Federal Reserve strengthens its tightening expectations and reduces tariffs, the profit will be exhausted, and the momentum of the RMB to repair its overvaluation may resume.(Sino-Singapore Jingwei APP)