China Economic Net, Beijing, July 7 (Reporter Li Rongkangbo) In the first half of this year, the A-share market first fell and then rose, showing a "V-shaped" trend as a whole.On the whole, the overall commodity market in the first half of the year showed a strong trend, and the coal industry experienced a wave of independent market conditions. The CSI Coal Index rose by nearly 30% in the first half of the year. The new energy vehicle sector also rebounded rapidly in May and June, driving related funds to "recover blood. ".

However, statistics on the return of hybrid funds in the first half of this year show that they still fell more and rose less. According to iFinD data, the average return of hybrid funds in the first half of this year was -7.11%.After excluding newly established funds and funds with abnormal net worth this year, among the 6,104 hybrid funds with comparable performance in the whole market, only 852 funds rose in net worth, accounting for 13.96%; 5,243 funds fell in net worth, accounting for 85.89%; The net value of 9 other funds closed flat.

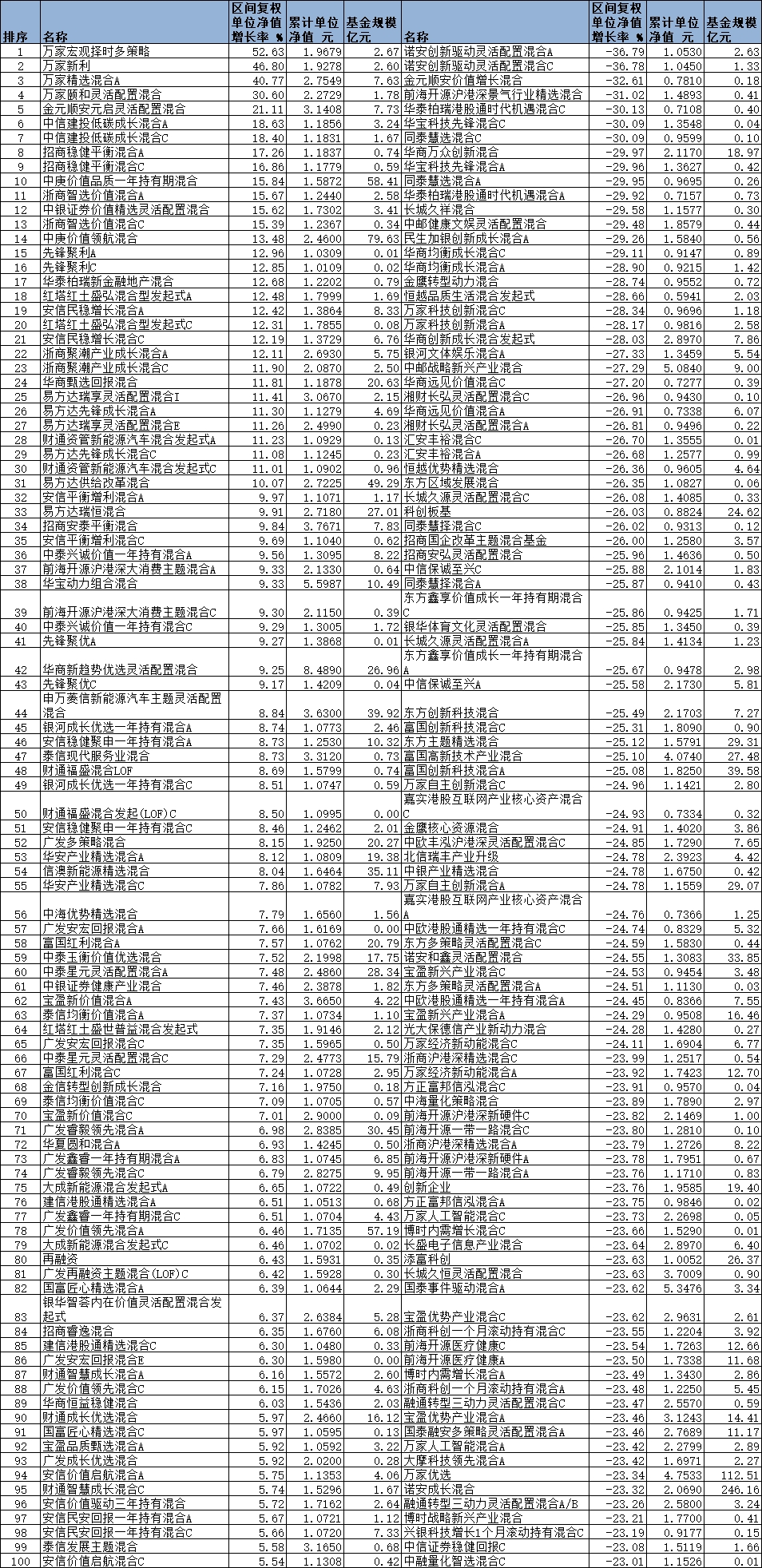

It is worth noting that in the first half of this year, the three funds at the helm of Huang Hai, the fund manager of Wanjia Fund, swept the first, second, and third place in the list of hybrid funds.Among them, the champion fund Wanjia macro macro strategy increased by 52.63%, and it was the only mixed fund that rose by more than 50% in the first half of the year.Wanjia Xinli and Wanjia Selected Mixed A rose 46.80% and 40.77% respectively, ranking second and third respectively.

According to public information, Huang Hai graduated from Shanghai University of Finance and Economics and has served as a fund manager since September 2020. He has served as a researcher at Shenyin & Wanguo Securities Research Institute and investment manager of Hwabao Trust Fund Trust Department.

Judging from the fund's quarterly report previously disclosed, Huanghai has been holding heavy positions in the real estate sector for a long time, and since the third quarter of last year, it has aggressively increased its positions in coal stocks.As of the end of the first quarter of this year, the top ten stocks in Wanjia's macro-time-multiple strategy are mainly composed of coal, real estate and other sectors. The top five stocks with heavy holdings are Shaanxi Coal Industry, Poly Development, Huaibei Mining, Shanxi Coal International, and Lu'an Environmental Protection. can.Wanjia Xinli and Wanjia Selected Mixed A funds have similar configurations.

Huang Hai remains cautiously optimistic about the market in the second half of the year, believes that there are structural opportunities, and is more optimistic about the performance of the value sector.In Huanghai's view, cyclical industries, especially upstream resource products, have relatively high allocation value.It said that the focus is on energy and non-ferrous metals. The long-term valuation of these sectors is not high, and there is potential for dividends.

In addition, in the first half of the year, the 4th place in the list of hybrid funds was also a product of Wanjia Fund. Wanjia Yihe, managed by Zhang Heng, rose by 30.60% with flexible allocation.Similar to the Yellow Sea, Zhang Heng also focused on coal and other energy sources in the first quarter of this year.

A reporter from China Economic Net noticed that "small and beautiful" has become a prominent feature of blue-chip funds in the first half of the year.Among the 31 hybrid funds that rose more than 10% in the first half of this year, small-scale funds accounted for more.At present, only the size of its funds as of the end of the first quarter can be calculated. According to statistics, about two-thirds of the funds have a size of less than 500 million yuan, and about one-third of the funds are less than 100 million yuan.

However, there are a few exceptions.The one-year holding period of Zhonggeng Value Quality and Zhonggeng Value Pilot Mix managed by Qiu Dongrong, a star fund manager of Zhonggeng Fund, rose by 15.84% and 13.48% respectively in the first half of the year.As of the end of the first quarter, the management scale of these two funds was 5.841 billion yuan and 7.963 billion yuan respectively.The return of the selection of Chinese businessmen managed by Zhou Haidong, a subsidiary of Huashang Fund, increased by 11.81% in the first half of the year. As of the end of the first quarter, its management scale was 2.063 billion yuan.The supply reform of E Fund, managed by Yang Zongchang, a subsidiary of E Fund Fund, increased by 10.07% in the first half of the year. As of the end of the first quarter, its management scale was 4.929 billion yuan.

Among the nearly 86% of the hybrid funds whose net worth fell in the first half of the year, 2,132 funds fell by more than 10%, accounting for 35%; 216 funds fell by more than 20%, accounting for 3.5%; 7 funds fell by 30% Above, the biggest drop was 36.79%.

Inquiring into the first quarter reports of 7 hybrid funds that fell by more than 30% in the first half of the year, it can be found that these funds have different shareholdings in the first quarter of this year. Other configurations are relatively scattered.

For example, in the first quarter of this year, the top stocks of Huatai-Pineapple Hong Kong Stock Connect Era Opportunity Mixed C were mainly concentrated in the real estate and brokerage sectors. As of the end of the first quarter, the top ten stocks with heavy holdings were CIFI Holdings Group, Jinke Service, and Longfor Group. , Country Garden, CITIC Securities, CICC, Binjiang Group, China Overseas Development, China Securities, GF Securities.The fund fell 30.13% in the first half.

The shareholding of Tongtai Huixuan’s mixed sponsorship C is relatively scattered. As of the end of the first quarter, its top ten stocks with heavy holdings were Porton, Shenhuo, Medicilon, Yankuang Energy, Aonong Bio, Wen’s, Junting Hotel, Zijin Mining, Yuntianhua, Shandong Gold.The fund said in its first quarterly report that it will continue to maintain a balanced allocation, mainly from three perspectives, one is high prosperity and high growth sectors, provided that the valuation adjustment is relatively in place, such as some CXO and medical service targets; For those that have been transferred, such as farming, hotel tourism, etc., the industry is still in a relatively left position, and the layout is ahead of time to wait for the industry to reverse; the third is low valuation and inflation logic, such as metals, coal, fertilizers, agricultural products, etc.

Looking forward to the second half of the year, Industrial Fund Qian Ruinan is cautiously optimistic about the A-share market in general, saying that in the second half of the year, it will actively seize opportunities rather than blindly defend.He bluntly said that the impact of subsequent market performance factors is expected to gradually increase, so finding industries and companies with good performance trends and grasping relatively reasonable valuations are still the main tasks.

At the industry configuration level, Qian Ruinan said that in general, a relatively decentralized strategy will be adopted, and efforts will be made to find excellent targets in more fields."Specifically, while maintaining a certain allocation ratio in popular track industries such as new energy, I will also pay attention to the military industry with strong demand certainty, the media and computer with a low valuation quantile level and gradually improving fundamentals , and the pharmaceutical industry, the anti-inflation resource sector also needs attention.”

Regarding whether the future is more optimistic about high-quality growth or value return, Lu Bin, investment director and fund manager of HSBC Jintrust Fund, said that at the beginning of this year, his view was to be optimistic about value return and high-quality growth. Variety."The main line of the market in the second half of the year may be high-quality growth, supplemented by value return. In the second half of the year, the important thing is not which style to choose, but the main investment direction of value and growth direction." In terms of high-quality growth, in addition to smart electric vehicles, Lu Bin also pays attention to investment opportunities in growing industries such as medicine, semiconductor, and TMT.

The top 100 hybrid funds in the first half of 2022