Ten billion-level fund performance "returns blood"!

As of July 5, Huaxia Energy Innovation (including A shares and C shares) and the theme of Dongfang New Energy Vehicles have become the first two tens of billions of funds with positive performance.

In addition, other well-known tens of billions of funds also rebounded sharply from the previous retracement, and Christian Democrats said: "Finally, the capital has returned!"

Ten-billion-level fund performance "returns blood"

Since the end of April, A shares have stepped out of the "independent market", and the growth sectors that have been adjusted more before have performed better.In this context, the net value of many funds has rebounded sharply, and the tens of billions of funds with relatively large drawdowns at the beginning of the year have also begun to "return blood" one after another.

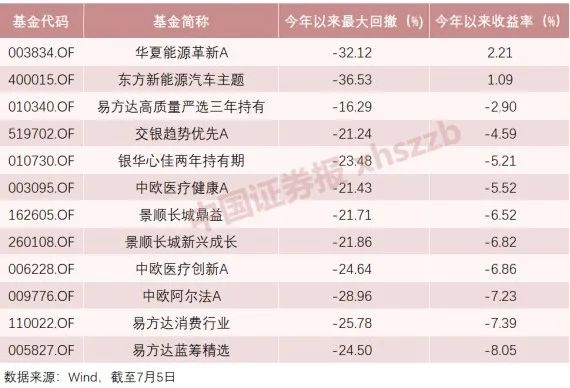

Wind data shows that as of July 5, among the ten billion-level funds of common stock type and partial stock type (excluding funds newly established this year), existing funds have achieved positive returns.

Huaxia Energy Innovation, managed by Zheng Zehong, once had the largest drawdown this year of more than 32%, and it is one of the first ten billion funds with positive performance this year.As of July 5, Huaxia Energy Innovation's A share and C share performance this year reached 2.21% and 1.51% respectively.The first quarterly report of 2022 shows that the fund's heavy holding stocks are mainly in the direction of new energy.

The same performance has returned to the East New Energy Vehicle theme managed by Li Rui.As of July 5, the fund's performance this year has reached 1.09%, turning losses into profits.The fund's heavyweight stocks are also mainly in the direction of new energy, and the largest drawdown this year has reached 36.53%.

Ten-billion-level fund performance this year

Well-known fund performance rebounds

Although the performance of most tens of billions of funds has not returned to positive this year, they have recovered significantly compared to the previous year.

As of July 5, Wind data shows that E Fund managed by Xiao Nan has a high-quality and strict selection for three years, Yinhua Xinjia managed by Li Xiaoxing has a two-year holding period, and Yang Jinjin manages Bank of Communications Trend Priority A and Bank of Communications Trend. Priority C, the loss this year has been reduced to less than 5%.

CEIBS Healthcare A and CEIBS Healthcare C managed by Gülen also rebounded sharply with the recent rebound in the pharmaceutical sector.As of July 5, the performance of CEIBS A share and C share this year were -5.52% and -5.90%, respectively.

In addition, E Fund Blue Chip Selection managed by well-known fund manager Zhang Kun and Invesco Great Wall Emerging Growth managed by Liu Yanchun have both dropped to less than 9% since the beginning of this year.

The fund "returned blood", and the fund comment area also became lively, and some Jimin said with emotion that "finally returned to the fund".

Image source: Fund comment area

You Jimin bought the bottom when it fell, and since mid-April, the yield has reached 14%.Some Christians are regretting "I'm late, can I still enter now?"

Image source: Fund comment area

However, more Christians are entangled in the tangle, "Fund return, whether to run or not run?"

Image source: Fund comment area

Institutions are optimistic about the market as a whole, optimistic about investment opportunities in the consumer industry where difficulties are reversed.

Wells Fargo Fund said that the economic recovery is not over, and the market is not over.Entering July, the market has paid close attention to the economic data that will be disclosed intensively. The first half of July is the period of intensive disclosure of performance forecasts, and the market has gradually entered the stage of “focusing on performance”. Some companies whose performance has improved significantly from the previous month may give birth to new investment opportunities.

Specific to the direction of the industry, the current market mainly focuses on two types of new energy sources with high prosperity and consumer goods with reversal of difficulties.Danyi Investment believes that the new energy industry is booming and both supply and demand are booming, but the stock price and valuation are also high, and the track is crowded and needs to be tracked continuously; After more than a year of adjustment, the current valuation is low. If demand exceeds expectations, Davis will double-click.