The overseas market is one of the few bright spots in Haidilao’s business in recent years. If it can be successfully split and listed, it is hoped that it will bring certain capital supplements.

Haidilao (06862.HK), the “Hotpot One Brother”, plans to separate and list its overseas catering business separately.

On the evening of July 11, Haidilao announced that the company is considering splitting the shares of Super Hi International Holding Ltd. (hereinafter referred to as "Super Hi") by way of physical distribution and listing separately on the main board of the Hong Kong Stock Exchange. possibility of listing.Super Hi and its subsidiaries are principally engaged in the catering business outside the PRC (the “Overseas Business”).

Haidilao stated that the board of directors believes that the proposed spin-off is in the overall interests of the company and its shareholders, as the proposed spin-off will enable Super Hi’s business and the rest of the Group’s businesses to achieve better development in their respective geographic areas, and Generate future value-added benefits on an independent listing platform.

“As of the date of this announcement, Super Hi has not yet filed an application for listing of Super Hi shares with the Hong Kong Stock Exchange, and the proposed spin-off has not materialized. If the proposed spin-off can proceed, the Company will, in due course or in accordance with the Rules Governing the Listing of Securities on the Stock Exchange issued a further announcement to inform its shareholders and potential investors of the latest progress of the proposed spin-off," Haidilao said.

In response to the spin-off and listing of overseas businesses, Times Finance contacted and interviewed Haidilao. The other party only stated that there is currently no other content that can be announced to the public, and everything is subject to the announcement.

Affected by the epidemic, Haidilao's performance continued to be sluggish.The 2021 financial report shows that in the past year, Haidilao’s revenue was 41.11 billion yuan, a year-on-year increase of 43.7%, and a loss of 4.16 billion yuan, which turned from profit to loss year-on-year.This is also the first annual loss since Haidilao went public.

The loss of Haidilao's performance is related to its blind expansion in the second half of 2020.According to the financial report data, in the first half of 2020, Haidilao stores increased by 167. In the second half of the year, this number was 363. The number of new stores at the end of the period increased by 117% compared with the first half of the year.In the first half of 2021, Haidilao has added 299 new stores.

This has also led to the tight capital chain of Haidilao, and its performance has turned red.Under the pressure of the situation, in the second half of 2021, Haidilao admitted that it had misjudged the situation before and that the expansion plan against the trend was not successful. It decided to adjust the expansion strategy, close some restaurants and plan to appropriately reduce future capital investment.In November of the same year, Haidilao launched the "Woodpecker Plan", which closed about 300 underperforming stores based on business conditions.According to the financial report data, in the whole year of 2021, Haidilao opened 421 new stores and closed 276 stores.

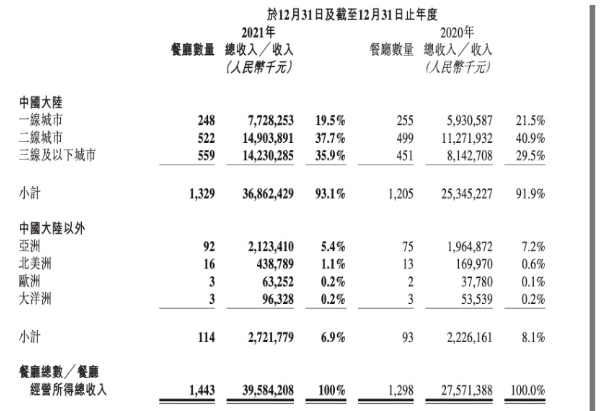

Source of market revenue of Haidilao in various regions in 2021: 2021 financial report

In the case of a loss in performance, choosing to spin off the overseas catering business and listing it will inevitably lead the outside world to speculate whether there is a shortage of funds in Haidilao.The overseas market is one of the few bright spots in Haidilao’s business in recent years. If it can be successfully spun off and listed, it is hoped that it will bring some capital supplements.

According to the financial report data, as of the end of 2021, Haidilao has a total of 114 stores outside the mainland, with a total revenue of 2.722 billion yuan, contributing 6.9% of Haidilao's revenue.In 2020, Haidilao has 93 stores outside the mainland, with revenue of 2.226 billion yuan.

Times Finance learned from the Haidilao official website that at present, Haidilao has 5, 1 and 13 stores in Hong Kong, Macau and Taiwan respectively, for a total of 19 stores.Based on this calculation, the number of Haidilao stores outside China (Asia, North America, Europe, Oceania) is about 95.

Shen Meng, chief strategist of Guangke Consulting, told Times Finance that under different epidemic prevention policies around the world, the differences in the operating environment of the catering market are becoming more and more obvious, while the proportion of Haidilao’s business in overseas regions has gradually increased, and it has the ability to independently spin off. ability."

On July 11, Haidilao closed at HK$16.98 per share, with a total market value of 94.647 billion yuan. Compared with the peak period of 454.475 billion Hong Kong dollars, it has evaporated more than 350 billion Hong Kong dollars.(Wang Yan)