Original title This company sold 21 suites in Shenzhen Bay, with an average price of about 40,000 yuan per square meter, and a cash-out of over 400 million!

What should I do if the main business cannot sustain?In the core of the Bay Area like Shenzhen, selling a house is a good "life-saving straw".

Recently, ST United Construction issued an announcement that the company signed the Real Estate Transfer Contract with Beijing Chichuang, and sold a total of 21 sets of self-owned properties from the 17th to 19th floors of the Shenzhen Bay Science and Technology Park office building at a price of 418 million yuan, with a total construction area of 10,287.53 yuan. Square meters, the average price is about 40,600 yuan / square meter.

This is not the first time that ST United Construction has sold a house. In June last year, the company sold 4 houses in Huizhou. It was also part of the fundraising project when the company went public in 2011, with a return of nearly 200 million yuan.After the sale, the company had no place to produce, and leased the property back for 4 years, "to ensure the normal production and operation of the company's LED display business."

Disposal of property assets for two consecutive years

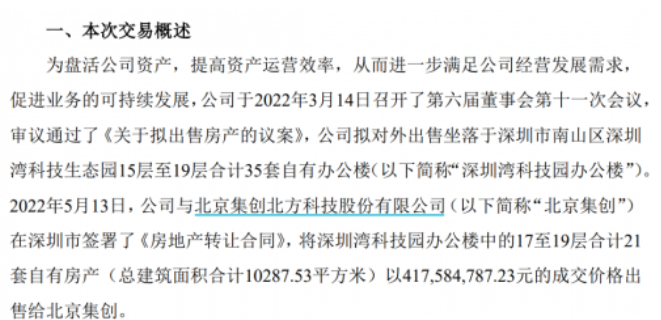

According to the announcement of ST United Construction, in order to "revitalize the company's assets and improve the efficiency of asset operation", the company's board of directors reviewed and approved the "Proposal on the Proposed Sale of Properties" on March 14, 2022. The company plans to sell externally located in Shenzhen, Nanshan District, Shenzhen. There are a total of 35 sets of self-owned office buildings from the 15th to 19th floors of the Bay Technology Ecological Park.

On May 13, 2022, the company and Beijing Chichuang North Technology Co., Ltd. (hereinafter referred to as "Beijing Chichuang") signed the "Real Estate Transfer Contract" in Shenzhen. A total of 21 sets of self-owned properties (with a total construction area of 10,287.53 square meters) were sold to Beijing Chichuang at a transaction price of 418 million yuan.

The real estate in this transaction was purchased by the company in cash in September 2016. The purchase price is about 418 million yuan. The land is an industrial land with a 50-year use right, and the remaining use period is 45 years.According to the appraised price, the value of these 21 suites is 442 million yuan, but the transaction was sold at a book value of 418 million yuan without a premium. The company said it was the result of negotiation between the two parties.

This is not the first time that the troubled ST LianJiang has sold a house. In June last year, the company announced that it sold four properties in Huizhou, which was also part of the fundraising project when it went public in 2011.The specific property asset package is: No. 5 Tong'an Road, Dayawan West District, Huizhou, Guangdong (Plant 2), (Plant 3), (Plant 4), (Dormitory No. 1), a total of 4 properties, with a total land area of 35,000 square meters, The total construction area of the house is 78612.61 square meters.

The above-mentioned Huizhou real estate involves the investment project "LED application product industrialization project" raised from the initial public offering of stocks in 2011. The investment in this project includes land costs, infrastructure investment, production equipment purchase and initial working capital.The project used the raised funds to invest a total of 156 million yuan.It is not unnecessary for the company to sell these factory dormitories now, but it is more helpless. After the company sells it, it signs an "Industrial Plant Lease Contract" with the buyer's home industry, and the company will sell the Huizhou real estate for lease back. 4 years to "ensure the normal production and operation of the company's LED display business".

The net worth is only over 100 million

Beware of triggering financial delisting

It is worth noting that from 2018 to 2020, the total operating income of ST Lianjian Construction has dropped sharply, which are 4.053 billion yuan, 3.014 billion yuan and 1.135 billion yuan respectively; the net profit attributable to the parent also suffered losses, which were -2.888 billion yuan, -1.381 billion yuan and -361 million yuan.

The huge losses in the past three years are basically due to the high premium mergers and acquisitions in the early stage and the huge goodwill impairment provision in the later stage.In order to expand the marketing service industry, since 2013, ST Lianjian has carried out a series of investment mergers and acquisitions.From 2014 to 2017, Lianjian Optoelectronics acquired 13 companies, costing a total of 5.429 billion yuan and forming a high goodwill of 4.637 billion yuan.Since 2017, the companies acquired in the early stage have continued to explode, and ST Lianjian has continuously suffered huge losses.

In addition, Sichuan Timeshare Advertising Media Co., Ltd. (hereinafter referred to as "Timeshare Media"), a wholly-owned subsidiary of ST United Construction, was also involved in a financial fraud case.On December 19, 2018, ST Lianjian (then called: Lianjian Optoelectronics) received the "Decision on Administrative Punishment" issued by Shenzhen Securities Regulatory Bureau. From 2014 to 2016, Timeshare Media used fictitious advertising business income, inter-period Confirming the advertising business income and other methods, the total inflated operating income was 61.787 million yuan, and the inflated profit was 60.4725 million yuan.This resulted in false records in the 2014 annual report, 2015 semi-annual report, 2015 annual report, 2016 semi-annual report, 2016 annual report and 2017 semi-annual report.

Since ST Lianjian was found to have made false statements by the China Securities Regulatory Commission, a large number of investors initiated lawsuits for compensation.Affected by this, the 2020 financial report of ST Lianjian was issued by Daxin Certified Public Accountants with an unqualified audit report with a paragraph of "significant uncertainty related to continuing operations".

In the face of difficulties, ST Lianjian began to sell a large number of assets: when it acquired 100% shares of Litang Marketing in 2015, the price was as high as 496 million yuan, but on January 8, 2021, the price was only 15.3 million yuan; in 2016, the price was 364 million yuan. The acquisition of Dehuahan Culture was sold at an incredible price of 1 yuan in August 2020; the acquisition of Timeshare Media in 2014 cost 860 million yuan, and the sale price in June 2020 was only 100,000 yuan.

At present, after continuous selling and selling, as of the end of the first quarter of 2022, the company's net assets have only remained at 147 million yuan, which can easily trigger the financial delisting regulations of the Shenzhen Stock Exchange.There are two main rules for financial delisting on the GEM. One is that the lower of the net profit before or after the annual report deduction is negative and the revenue is less than 100 million yuan, and will be delisted by *ST (already *ST) ), if it touches this indicator for two consecutive years, it will be terminated from listing; second, if the audited net assets in the first year are negative, a risk warning *ST will be set, and if this indicator is touched for two consecutive years, it will be terminated from listing.

At present, the operating income of ST Lianjian is difficult to be less than 100 million yuan, and the possibility of triggering the first item is small, but if it continues to lose money this year, the net assets will easily turn negative. In the first quarter of this year, ST Lianjian reported a loss of 11.87 million yuan.

The share price of ST Lianjian has continued to fall in recent years. The current share price has dropped by as much as 92% from the high point in 2015, and the latest market value is only about 2 billion yuan.