In December 2020, the Shanghai and Shenzhen Stock Exchanges issued new delisting regulations, comprehensively improving delisting standards, simplifying delisting procedures, and strictly regulating delisting.The new delisting regulations have been in operation for more than a year, and the market ecology of "survival of the fittest, both in and out" has become increasingly perfect.

What are the circumstances that trigger the forced delisting of listed companies?Under the new delisting regulations, how can investors effectively safeguard their legal rights?Stock delisting is normalized, how can ordinary investors make good investments?

Four types of forced delisting

Delisting generally refers to the situation in which a listed company voluntarily or passively terminates its listing due to failing to meet the listing standards of the stock exchange, that is, the stock of the listed company is terminated from listing and trading on the stock exchange, and the listed company becomes an unlisted company.Improving the delisting mechanism of listed companies is an important institutional arrangement for comprehensively deepening the reform of the capital market, and an important measure to strengthen the survival of the fittest in listed companies, improve the quality of listed companies, and protect investors.

The new securities law, which came into effect in March 2020, has amended the legal provisions regarding delisting.As the self-regulatory agencies of the securities market, the Shanghai Stock Exchange and the Shenzhen Stock Exchange have published relevant rules that are the direct basis for the delisting of listed companies.In December 2020, the Shanghai and Shenzhen Stock Exchanges issued newly revised rules for delisting, including the Shanghai Stock Exchange Listing Rules, the Shenzhen Stock Exchange Listing Rules, and the Shanghai Stock Exchange's Science and Technology Innovation Board Listing Rules. Rules, etc. (hereinafter referred to as the "New Delisting Regulations").In January 2022, the Shanghai and Shenzhen Stock Exchanges issued newly revised listing-related rules, including the Shanghai Stock Exchange Listing Rules (2022 Revision) and the Shenzhen Stock Exchange Stock Listing Rules (2022 Revision).

As far as the type of the current delisting system is concerned, it can be divided into compulsory delisting and voluntary delisting.There are four main types of situations that can trigger the forced delisting of listed companies:

For the Science and Technology Innovation Board and ChiNext that have implemented the registration system, the specifications for their delisting systems are reflected in the "Shanghai Stock Exchange's Science and Technology Innovation Board Stock Listing Rules" issued by the Shanghai Stock Exchange in April 2019 and the Shenzhen Stock Exchange in June 2020. The "Shenzhen Stock Exchange Growth Enterprise Market Listing Rules", both of which have set up a special chapter to provide detailed provisions on the delisting system, including the core content of the delisting system, including the type of delisting, hearing and review, and the delisting arrangement period.

Pay attention to investor rights in delisting

Wind data shows that as of the end of April 2022, a total of about 150 A-share listed companies have completed delisting.

After further analysis, the reasons for delisting can be summarized into two categories: poor management and violations of laws and regulations.Listed companies cover all walks of life, with different ownership structures, business models, life cycles, and growth stages.But why is a delisted company "fallen" step by step, from normal operation to poor management, from compliance with laws and regulations to violation of laws and regulations, and finally entering delisting, there are certain rules to follow, and it is worth pondering and thinking. Research.

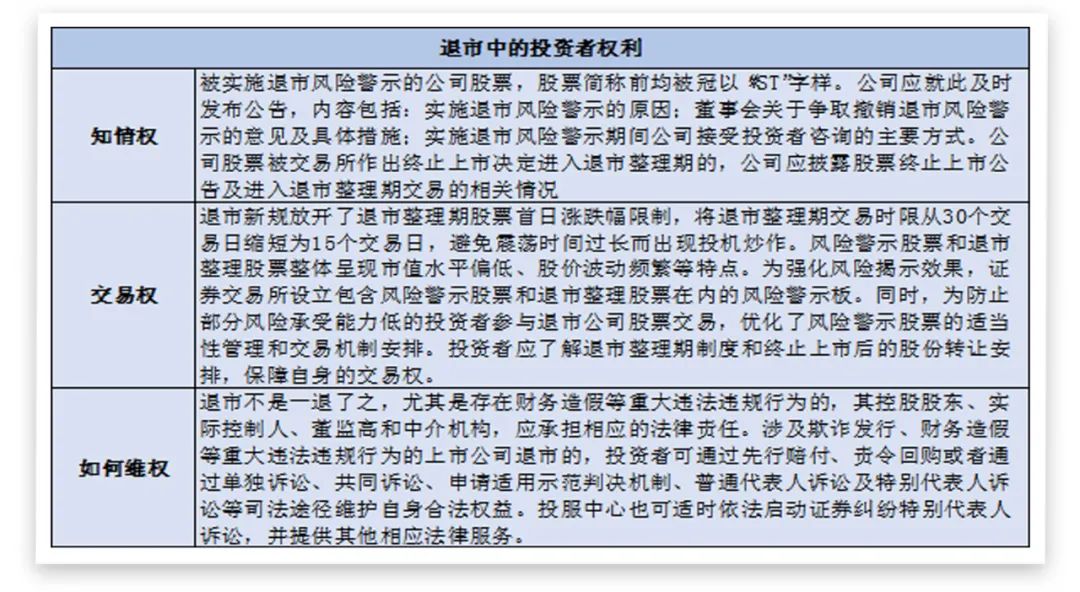

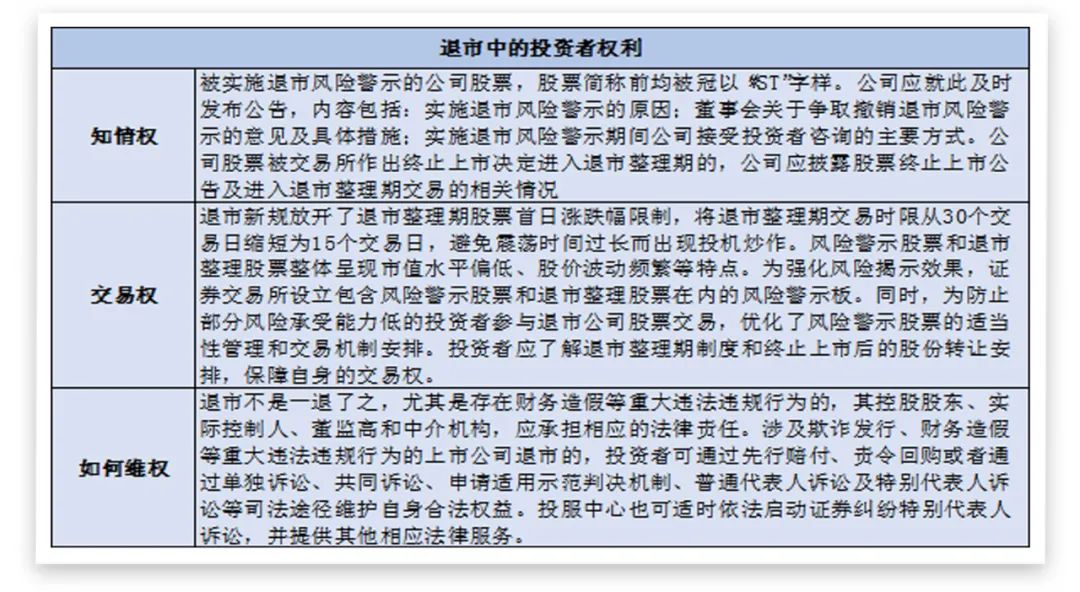

As an important participant group in my country's capital market, small and medium investors are at a disadvantage in terms of information, capital, and expertise, and their rights and interests are easily infringed during the delisting process.As an investor, it is necessary to understand the relevant arrangements for the protection of investors' rights and interests under the new delisting regulations, and to exercise their rights when they are informed, so as to effectively safeguard their legal rights.

For small and medium investors, they should maintain a rational attitude, take "buyer conceit" as the basic investment concept, pay full attention to announcements such as "delisting risk warning" issued by the company, and cannot hype *ST and delisted companies with a gambling mentality.

What about ordinary investors?

Under the background of normalized delisting of stocks, many investors began to worry about how to make good investments because of their limited time and energy and lack of understanding of listed companies?In fact, investment funds are a good choice.

Generally speaking, funds are less risky than stocks.Fund managers typically rebalance their positions before stocks are delisted and invest in other stocks instead.Although it is usually difficult for ordinary investors to choose a listed company, if the same task is handed over to a professional team, the result will often be very different.

Buying a fund is actually choosing a fund manager and the team behind it. I believe that an excellent investment and research team with strong certainty can cope with changes in most markets, avoid unnecessary risks, and devote all their energy to screening stocks and building portfolios. , and bring stable and sustainable investment returns to the holders in the medium and long term.

Another great advantage of choosing a fund investment is that you can use a small amount of money to buy a basket of stocks, that is, a portfolio of stocks, so as to moderately diversify risk.The Portfolio Theory of Nobel Laureate in Economics Markowitz has scientifically verified the effectiveness of risk diversification in protecting investment returns.Simply put, the more you buy different types of stocks, the lower your investment risk.Public funds have strict restrictions on positions: a fund cannot hold more than 10% of the fund's assets in the same stock.Diversified allocation can greatly reduce the risk brought by a single stock.

Funds usually attach great importance to the concept of asset allocation. Some funds also carry out diversified allocation of A shares, Hong Kong stocks, overseas equity, bonds, etc., and carry out distributed allocation in different regions and types of markets to maintain the diversity and low correlation of portfolio assets.

In addition, once the stocks held by the fund are really facing delisting, even if there is liquidity risk to the fund, the fund's various liquidity management tools can also play a role.

However, buying a fund does not mean sitting back and relax. Investors also need to cultivate correct concepts, develop rational investment habits, and establish long-term investment and value investment concepts. They should avoid buying funds in large amounts at one time, and use relatively fixed cycles. Fund investment is carried out by purchasing in batches and the amount, so as to dilute the timing and smooth out fluctuations.

(Editor in charge: Li Rong)