The A-share market continued to rise this week, with the Shanghai Composite Index, Shenzhen Component Index, and ChiNext Index up 2.08%, 3.88%, and 5.85%, respectively.

Choice data shows that this week, the cumulative net inflow of northbound funds was 25.344 billion yuan, of which the net inflow of Shanghai Stock Connect was 127.50 yuan, and the net inflow of Shenzhen Stock Connect was 12.595 billion yuan.This week, Northbound funds increased their positions in 936 stocks and lightened their positions in 662 stocks. Among them, Wuliangye added the largest amount, and "Cement Mao" Conch Cement was the largest.

Increased shareholding in 45 stocks by over 10 million shares

This week, northbound funds have had net inflows for 4 consecutive trading days, with a cumulative net inflow of over 25 billion yuan.Choice data shows that the net inflow of northbound funds was 7.049 billion yuan on May 30, 13.865 billion yuan on May 31, 1.247 billion yuan on June 1, and 3.183 billion yuan on June 2.

From the perspective of northbound capital holdings, Choice data shows that as of June 2, the market value of northbound capital holdings was 2.27 trillion yuan, an increase of 95.8 billion yuan this week.This week, Northbound Capital increased its positions in 936 stocks, and its holdings in 45 stocks increased by more than 10 million shares. The largest increase in its holdings in Nanshan Aluminum was 81.1862 million shares. In addition, its holdings in Satellite Chemical and Guanghui Energy increased respectively. 77.499 million shares and 67.623 million shares.

It is worth noting that the reason for the large increase in Northbound Capital’s shareholding in Satellite Chemical is that Satellite Chemical’s equity registration date of 3.49 yuan for every 10 shares transferred to 3.99 shares is June 2. In fact, Northbound Capital has not significantly increased its holdings in Satellite. Chemical.

Judging from the market performance, among the top ten stocks that increased their holdings by northbound funds this week, except for Guanghui Energy, Agricultural Bank, and Guodian Electric Power, which fell by 8.50%, 0.99%, and 0.57%, all other stocks rose, and Focus Media rose the most. , up 10.40% this week.

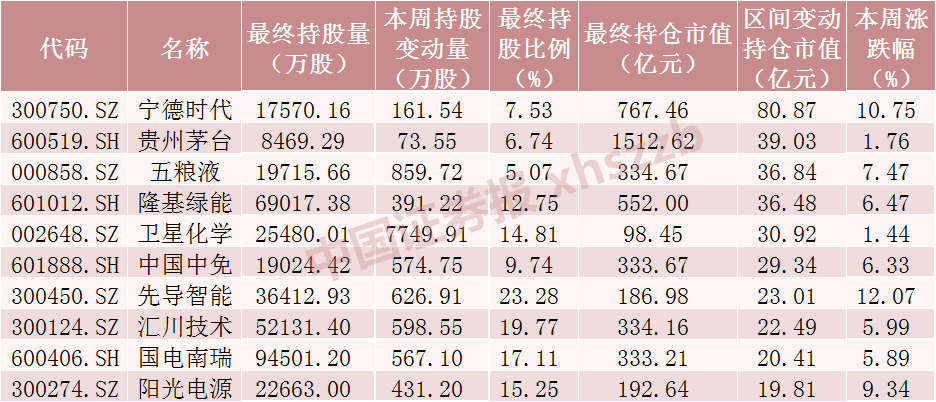

Northbound capital holdings increased the top ten stocks this week

Source: Choice

Choice data shows that this week, the market value of Northbound funds' holdings in 44 stocks increased by more than 500 million yuan, and the market value of Ningde Times, Kweichow Moutai, and Wuliangye's holdings topped the list, which were 8.087 billion yuan, 3.903 billion yuan, and 3.684 billion yuan respectively.

The top ten stocks with the largest increase in market value of northbound capital holdings this week were all added to their positions by northbound capital. Among them, Wuliangye, Putailai, China CDFG, Pioneer Intelligence, Inovance Technology, and Guodian NARI have increased their holdings by more than 500. million shares.

From the perspective of market performance, the above 10 stocks all rose, and Pioneer Intelligence rose the most, up 12.07% this week.

Top 10 stocks with increase in market value of northbound capital positions this week

Source: Choice

Jiacang Wuliangye exceeds 1.4 billion yuan

Based on the average transaction price and the number of shares to be added, Wuliangye is the stock with the largest increase in northbound capital this week.This week, Northbound funds increased their holdings of Wuliangye by 8,597,200 shares, with an increase of 1.435 billion yuan.From the detailed data, this week, northbound funds added Wuliangye for 4 consecutive trading days, of which more than 5 million shares were added on May 30.

Choice data showed that Liangye rose 7.47% on Friday.As of the close on June 2, Northbound Capital held 197 million shares of Wuliangye, and the stock price of Wuliangye was 169.75 yuan per share, with a total market value of 658.9 billion yuan.

Detailed data of Wuliangye shares held by Northbound funds

Source: Choice

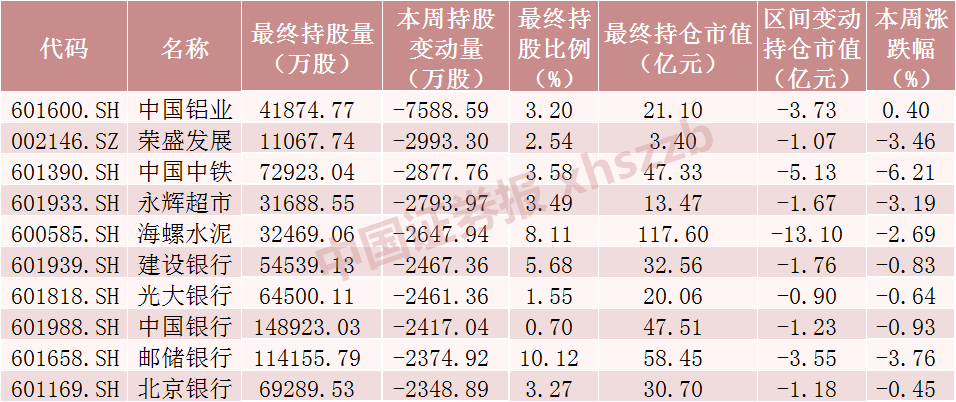

34 stocks were reduced by more than 10 million shares this week

Choice data shows that this week, northbound funds reduced their positions in a total of 662 stocks, of which more than 10 million shares were reduced in 34 stocks.Aluminum Corporation of China has the largest number of shares reduced, at 75.8859 million shares; Rongsheng Development and China Railway have reduced their positions by 29.933 million shares and 28.7776 million shares respectively.

From the perspective of market performance, among the top ten stocks in the number of stocks to lighten their positions by northbound funds this week, except for China Aluminum, which rose by 0.40%, all other stocks fell, and China Railway fell the most, down 6.21%.

Top 10 stocks to lighten up by northbound funds this week

Source: Choice

Judging from the changes in the market value of holdings, Choice data shows that this week, the market value of Northbound Capital's holdings in 6 stocks has decreased by more than 500 million yuan, and the market value of Conch Cement, Yili shares, and Poly Development has been reduced by 1.31 billion yuan. , 1.119 billion yuan, 752 million yuan.

Among the top ten stocks with a decrease in market value this week, except for Yili, which was increased by 7.666 million shares from Northbound funds, all other stocks were reduced. Among them, Conch Cement, Poly Development, China Railway, Gree Electric, Aluminum Corporation of China, China Post The Reserve Bank has been lightened up by more than 10 million shares.

From the perspective of market performance, among the above 10 stocks, except for Midea Group and Aluminum Corporation of China, which rose by 2.09% and 0.40% respectively, all other stocks fell, and China Railway fell the most.

Top 10 stocks with a decrease in market value of northbound capital positions this week

Source: Choice

Lighten up Conch Cement over 900 million yuan

Based on the average transaction price and the number of shares to lighten up positions, Conch Cement is the stock with the highest amount of lightened positions in northbound funds this week.This week, Northbound funds lightened up 26.4794 million shares of Conch Cement, and the amount of lightening up reached 973 million yuan.From the detailed data, this week, northbound funds lightened up Conch Cement for 4 consecutive trading days, of which over 11 million shares were lightened on June 2.

Choice data show Conch Cement fell 2.69% this week.As of June 2, Northbound Capital held 326 million shares of Conch Cement, the share price of Conch Cement was 36.22 yuan per share, and the total market value was 182.9 billion yuan.

Detailed data of Conch Cement held by Northbound capital

Source: Choice

Note: The shareholding ratio data in the table is the value published on the official website of the Hong Kong Stock Exchange. The specific calculation rules are: Shanghai Stock Connect is the proportion of A shares in circulation, and Shenzhen Stock Connect is the proportion of all A shares.