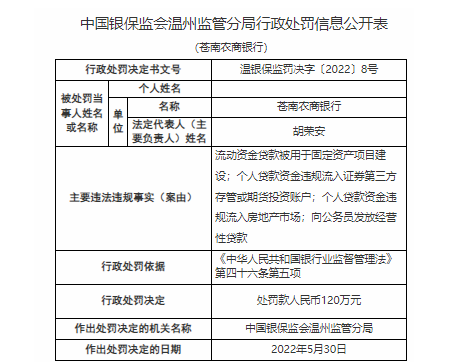

Caijing.comFinancial News On June 8, the administrative penalty information of the China Banking and Insurance Regulatory Commission showed that Cangnan Rural Commercial Bank had the following violations: working capital loans were used for the construction of fixed asset projects; personal loan funds illegally flowed into securities third-party custody or futures Investment accounts; personal loan funds flowed into the real estate market in violation of regulations; issued business loans to civil servants, and was fined RMB 1.2 million by the Wenzhou Supervision Branch of the China Banking and Insurance Regulatory Commission.