The reporter recently learned from a number of leading private equity institutions that since May, many leading private equity companies have continued the high-frequency research on listed companies this year in online or offline ways, showing more growth in the coverage of individual stocks. The attention of individual stocks and small and medium-sized market capitalization companies. In addition to popular tracks such as new energy, large consumption, and pharmaceutical biology, sectors and directions such as state-owned enterprise reform, military industry, and the Science and Technology Innovation Board have generally received more attention.

Continue high-frequency research

Since the recovery of the A-share market in May, many top private equity firms have accelerated their research due to the demand for "rebounding", especially for the tens of billions of private equity funds whose yields have not turned positive this year. Monitoring data from a third-party institution shows that as of June 7, since the stock market rebounded in May, a number of domestic private equity firms have completed more than 40 surveys of A-share companies since the stock market rebounded in May. Among them, Danshui Spring has participated in 51 surveys of listed companies, Gao Yi Asset has participated in 49 times, and Panjing Investment has completed 45 times.

"Since May, our company's listed company research work has been affected by the epidemic in some regions. Except for local listed companies in the region that do not affect on-site communication and industrial chain inspections, others have become online. However, the overall research of listed companies The rhythm and frequency have not declined." The head of a medium-sized private equity firm headquartered in the Yangtze River Delta region with good performance in the past two years told reporters. According to the private equity person, the agency’s research on A-share companies from May to now has, on the one hand, been more inclined to the balance of the industry, and on the other hand, it has specially considered and objectively deducted the impact of the epidemic on the emotions of industry researchers and fund managers. The key conclusions of the communication issues should be revised optimistically and cautiously, and try to remain objective.

Su Xuejing, general manager of Qingli Investment, said that since the market stabilized at the end of April, the agency has mainly covered new energy, semiconductors, military industry and the direction of stable economic growth in the research of listed companies and individual stocks. On the whole, a large research breadth has been maintained.

Guo Feng, chairman and fund manager of Shanghai Shifeng Assets, said that due to the impact of the epidemic, since the second quarter, he has mainly participated in the survey of listed companies online, and has a wide range of industry coverage. Recently, in addition to continuing to pay attention to popular track stocks such as new energy, semiconductors, pharmaceutical biology, and consumption, it has also investigated industries such as coal, fine chemicals, building materials, and the Internet, as well as multiple subdivisions under the domestic logic.

Several new main lines surfaced

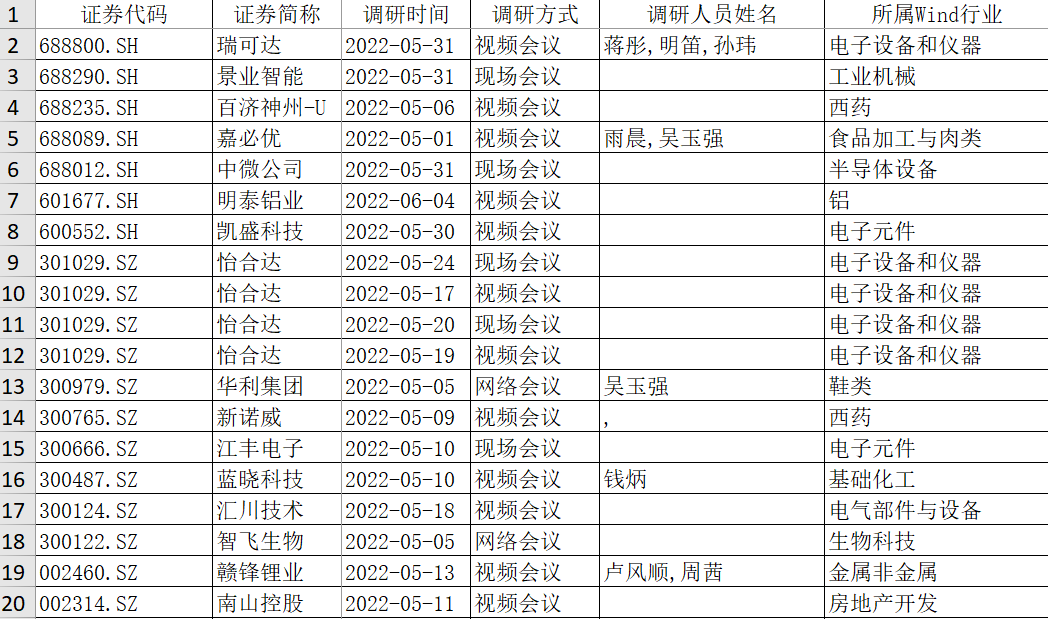

The data shows that since May, well-known private equity institutions such as Gaoyi Assets, Jinglin Assets, Danshuiquan and other well-known tens of billions of private equity institutions have covered a large number of science and technology innovation boards and ChiNext markets in the public survey of A-share companies. Sexual emerging industry companies. Taking Jinglin Assets as an example, as of June 9, among the 29 surveys conducted by the agency on A-share companies since May, there were 15 surveys for companies on the Science and Technology Innovation Board and ChiNext, and 8 for the original SME board. company.

Some stocks from Jinglin Assets Research since May

In this regard, Guo Feng said that the recent top private equity companies have paid more attention to individual stocks on the Growth Enterprise Market and the Science and Technology Innovation Board. "At this stage, growth stocks with strong technological attributes are often more likely to iterate on new demands in some industries. In addition, the supply is relatively short and the stock price adjustment is sufficient in the early stage, which may generate many structural opportunities. Official Lei, deputy general manager and chief researcher of Star Stone Investment, said: "Due to the relatively large decline in the growth sector in the early stage, the opportunities for subdivisions within the sector are increasing, and the long-term winning rate of related investments will be significantly improved."

In addition, some leading institutions are currently paying more attention to some new main lines in their investment horizons. The aforementioned person in charge of the ten-billion-level private equity in Shanghai emphasized that after nearly a month of overall rebound repair, without considering the index market, the difficulty of digging out strong stocks has increased significantly compared with previous estimates. From this point of view, the structural opportunities for A shares in the future may be concentrated in new directions that did not receive much market attention in the early stage.

Su Xuejing said that recently, Qingli Assets has carried out key research and layout on the direction of state-owned enterprise reform, which is in line with the country's medium and long-term direction. Judging from the situation in 2021, the agency found that many state-owned enterprises have rejuvenated with new vitality after the reform of scientific research institutes and equity incentives. Considering the long-term low valuation of state-owned enterprises in the A-share market, many state-owned enterprises can benefit from the reform. The recognition of A-share companies in the capital market may continue to increase.

From the perspective of "traversing the economic cycle", many private equity institutions have expressed that they will pay more attention to investment opportunities that are "not closely related to the macro economy". Zhu Liang, executive partner and investment director of Danyi Investment, said that considering factors such as fundamentals, the agency will especially prefer software, semiconductor, and smart car supply chain companies that are relatively less related to the macro economy.