China Economic Net, Beijing, June 28th, Jitai Co., Ltd. (002909.SZ) today's share price daily limit, as of closing at 18.84 yuan, an increase of 9.98%, an amplitude of 3.97%, a turnover of 629 million yuan, a turnover rate of 9.40%, and a total market value of 70.23 billion.

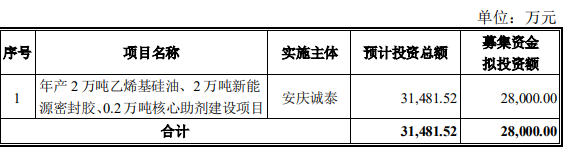

Last night, Jitai Co., Ltd. announced the plan for the non-public issuance of A shares in 2022.Jitai Co., Ltd. plans to raise a total of no more than 280 million yuan (including this amount) in this non-public offering of shares. After deducting the issuance costs, the raised funds are planned to be used for "annual production of 20,000 tons of vinyl silicone oil and 20,000 tons of new energy sealants." , 02,000 tons of core additives construction project".

Among them, vinyl silicone oil and new energy sealant are mature products of the company's electronic glue.Vinyl silicone oil is used as the basic raw material for thermal conductive gel and electronic potting glue and other products. In addition to satisfying the production of electronic glue products of fundraising projects, it is also used for external sales.New energy sealants include electronic silicone rubber, thermal conductive gel and electronic potting glue, which are mainly used in new energy fields such as new energy vehicles, photovoltaics, and power batteries, as well as other emerging market fields such as LED drive power, 5G communication, and electronic and electrical.In addition, core additives, as an important component to ensure the quality and performance of construction silicone sealants, are mainly used in the production of the company's own construction silicone sealants.

The company has established a wholly-owned subsidiary, Anhui Jitai, and Anhui Jitai has established a wholly-owned subsidiary, Anqing Chengtai.The main body of this non-public offering and investment project is Anqing Chengtai. The specific implementation method is that the company uses the raised funds to increase capital in Anhui Jitai, and then Anqing Chengtai increases capital from Anhui Jitai.

Before the raised funds of this non-public offering are in place, the company will make an initial investment with self-raised funds according to the needs of the project, and after the raised funds are in place, the initial investment will be replaced in accordance with the requirements and procedures of relevant laws and regulations.

The number of shares in the non-public issuance of Jitai shares is finally determined by dividing the total amount of funds raised in this non-public issuance by the issuance price. At the same time, the number of shares issued this time does not exceed 7% of the total share capital of the company before the issuance, that is, it does not exceed 26,092,671 shares ( Including this amount), and the total amount of funds to be raised does not exceed 280,000,000 yuan (inclusive).Within the above-mentioned scope, the board of directors of the company shall, according to the authorization of the general meeting of shareholders, negotiate with the sponsor (lead underwriter) after the issuance is approved by the China Securities Regulatory Commission.

The pricing base date of this non-public offering is the first day of the offering period.The issue price shall not be lower than 80% of the company's average stock trading price in the 20 trading days prior to the pricing benchmark date (average stock trading price in the 20 trading days prior to the pricing benchmark = total stock trading volume in the 20 trading days prior to the pricing benchmark / 20 transactions prior to the pricing benchmark). daily stock trading volume).If the company's shares have ex-rights or ex-dividend events such as dividend distribution, bonus shares, and capital reserves converted to share capital from the base date of the issuance to the issuance date, the issuance base price will be adjusted accordingly.The final issue price will be negotiated by the company's board of directors and the sponsor (lead underwriter) in accordance with the conditions of investors' subscription quotations in accordance with the provisions of laws and regulations, after the company obtains the approval document of the China Securities Regulatory Commission for this issue. Sure.

The target of this non-public offering of shares is no more than 35 specific targets, including legal persons, natural persons or other legal investment organizations that comply with laws and regulations.Securities investment fund management companies, securities companies, qualified foreign institutional investors, and RMB qualified foreign institutional investors who subscribe for two or more products under their management shall be regarded as one issuer; There are funds to subscribe.After the company obtains the approval from the China Securities Regulatory Commission, the final target of issuance will be approved by the company's board of directors and the sponsor (lead underwriter) within the scope authorized by the general meeting of shareholders in accordance with the provisions of relevant laws, administrative regulations, departmental rules or normative documents. Subscription quotations are determined according to the principle of price priority.

The lock-up period for the non-public offering of shares is 6 months, and they cannot be transferred within 6 months from the date of the end of the offering.After the end of the lock-up period, it will be implemented in accordance with the current relevant regulations of the China Securities Regulatory Commission and the Shenzhen Stock Exchange.

The resolution on this non-public offering of shares is valid for 12 months from the date when the company's general meeting of shareholders considers and approves the resolution on this non-public offering of shares.

As of the announcement date of the plan, the target of the issuance has not yet been determined, so it is impossible to determine whether the target of the issuance is related to the company.The relationship between the issuer and the company will be disclosed in the "Issuance Report" and other documents announced after the completion of the issue.

As of the announcement date of the plan, Antai Chemical holds 40.06% of the company's shares and is the company's controlling shareholder.Zou Zhenfu directly holds 2.24% of the company's shares, and holds 40.06% and 0.47% of the company's shares through its holdings of Antai Chemical and Guangtai Laser respectively, controlling 42.77% of the company's shares in total.Zou Zhenfu is the actual controller of the company.

According to the calculation of the upper limit of the number of this non-public offering, after the completion of this non-public offering, the shares held by Antai Chemical will account for no less than 37.44% of the company's total share capital, and it is still the company's controlling shareholder.Zou Zhenfu controls no less than 39.97% of the company's shares and is still the actual controller of the company.Therefore, this non-public offering will not result in a change in control of the company.

This non-public offering does not constitute a major asset restructuring.After the completion of this issuance, the proportion of the company's public shares will not be less than 25%, and there is no situation where the equity distribution does not meet the listing conditions.

The issuance plan was reviewed and approved at the twelfth meeting of the third board of directors of the company on June 27, 2022.The issuance plan still needs to be approved by the company's general meeting of shareholders.The issuance plan still needs to be approved by the China Securities Regulatory Commission.

Jitai shares said that after the funds raised from this issuance are in place, the company's total assets and net assets will increase accordingly, the financial strength will be enhanced, and the company's asset-liability ratio will be reduced.This issuance will help the company to improve its solvency and further improve the company's financial structure.After the funds raised from this issuance are in place, the company's total share capital will increase. Since it takes a certain period of time to realize the income of the projects invested with the raised funds, the company's earnings per share may be diluted in the short term, and the return on net assets may decline.However, with the completion and production of the fundraising projects, the company's performance will gradually improve.In the medium and long term, this issuance will help the company to increase production capacity, extend the industrial chain, improve the company's operating performance, and further enhance the company's profitability.