According to the reporter's statistics, including the two-year holding of Shenwanlingxin Jiale, between June 30 and July 6, as many as 4 funds announced their failure to raise funds, including two partial equity mixed funds and partial debt mixed funds. and one stock FOF.

Despite the recent recovery of the A-share market and active trading, there are still fund companies that have failed in the fund issuance market.At the same time, there are also new funds that have become popular as soon as they are unveiled, easily hitting the cap of 10 billion yuan and adopting a proportional allocation.

Failed to raise

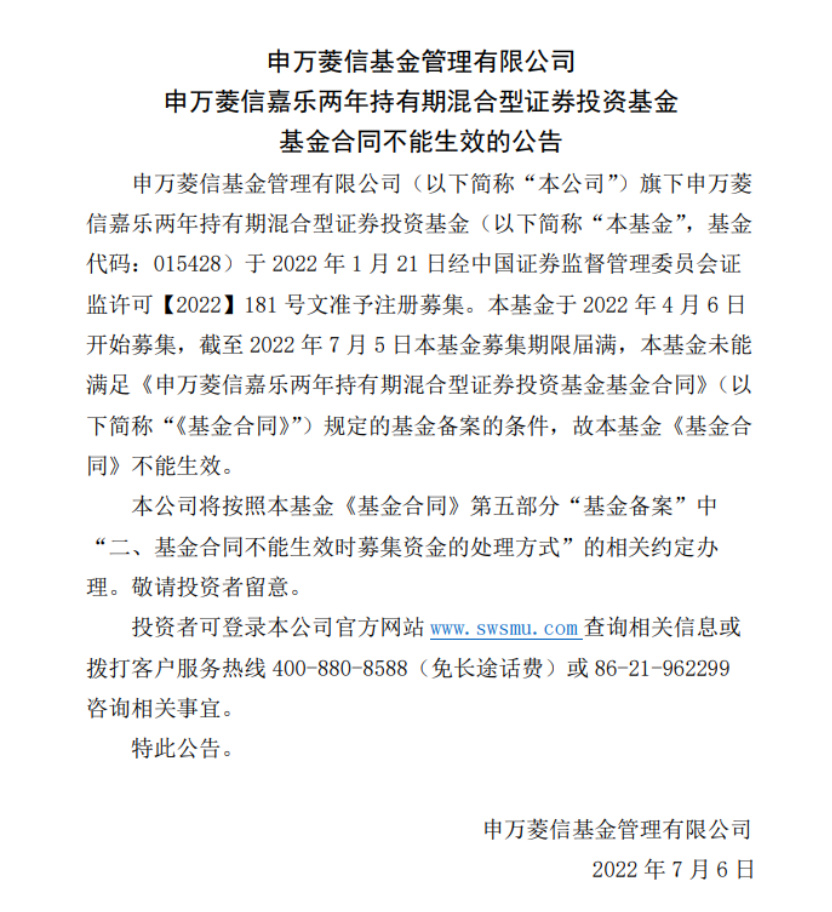

On July 6, 2022, Shenwan Lingxin Fund issued the "Announcement that the Shenwan Lingxin Jiale Two-Year Holding Period Hybrid Securities Investment Fund Fund Contract Will Not Be Effective".

The announcement stated that the fund started raising on April 6, and as of July 5, the raising period expired, failing to meet the "Shenwanling Xinjiale Two-Year Holding Period Hybrid Securities Investment Fund Fund Contract" (hereinafter referred to as the "Fund Contract") Therefore, the Fund Contract cannot take effect.

This is the 17th fund that has failed so far this year.

According to public information, the proportion of Shenwanlingxinjiale’s two-year holding period’s mixed investment portfolio is that the fund’s stock and depositary receipt investments account for 60%-95% of the fund’s assets; 50%.

Fu Juan, the proposed fund manager of Shenwanling Xinjiale with a mixed two-year holding period, is a doctoral student.Since 2006, he has been engaged in financial related work, and has worked in Shanghai Shenyin Wanguo Securities Research Institute and ABC Aggregate Fund.Joined Shenwan Lingxin Fund in July 2020, currently the head of the equity investment department and the head of the research department, Shenwan Lingxin New Economy Mixed Securities Investment Fund, Shenwan Lingxin Lexiang Mixed Securities Investment Fund, Shenwan Lingxin Ledao Three-year holding period Mixed securities investment fund, Shenwan Lingxin Intelligent Auto Stock Securities Investment Fund, Shenwan Lingxin Letong Mixed Securities Investment Fund, Shenwan Lingxin Shuangli Mixed Securities Investment Fund Manager, and concurrently investment manager.

At present, Juan Fu manages a total of 7 funds (combined calculation of various shares), the current total fund assets are 8.605 billion yuan, and the best fund return during her tenure is 170.01%.

Coincidentally, on July 2, China Universal Active Investment Index Preferred One-Year Regular Open Equity Fund (FOF-LOF) fund issued an announcement that the contract could not take effect. This is the first FOF product that failed to raise this year.

According to the reporter's statistics, including the two-year holding of Shenwanlingxin Jiale, between June 30 and July 6, as many as 4 funds announced their failure to raise funds, including two partial equity mixed funds and partial debt mixed funds. and one stock FOF.

In sharp contrast to the failure of some fund issuances, there are new funds that have recently become "explosions" in the issuance market.

On July 5, the three-year holding fund of E Fund Quality Kinetic Energy adopted a proportional allotment because it reached the upper limit of 10 billion yuan, with a ratio of 81.42%.

Regarding the "two-layered" situation in the fund issuance market, the reporter learned from the industry that the phenomenon of "two-eighth differentiation" in the fund issuance market has intensified, and the survival of the fittest and the increasingly fierce product issuance market has become the norm.

A person from the product department of a large fund company in South China said that the brand and channel influence of leading companies in the industry have shown a positive feedback loop, while some waist or tail companies will lead to more and more obvious competition and pressure as the overall cost of the industry rises.

According to data, since the beginning of this year, the number of funds with an issuance scale of less than 300 million yuan has reached 374, accounting for nearly 50% of the total number of funds issued.

Protect the "shell"

The fund issuance market is uneven, and some institutions focus on "saving" old products.

Recently, Lion Fund announced that from July 2, due to work adjustment, Cai Songsong will serve as the fund manager of Lion's optimized allocation, and Wu Bojun, the former fund manager, will no longer be the fund manager of Lion's optimized allocation, but will still serve as Lion's fund manager. Fund manager of Aggressive Return Fund and Novan Lixin Fund.

According to the fund's 2022 quarterly report, Lion's optimized allocation of fund shares at the end of the first quarter totaled 1,438,200 shares, and the fund's net asset value was only 2,011,100 yuan, a veritable "mini fund".

For the fund to be taken over by Cai Songsong, a well-known fund manager, in the view of the industry, it is to "save" the fund to become large-scale.

The reporter checked and found that there are many fund managers in the industry who took over "mini funds" and "saved" successful cases.

For example, Cui Chenlong, the fund manager of Qianhai Open Source Fund, was appointed as the manager of Qianhai Open Source Utilities Fund on July 20, 2020. The fund was only 13 million yuan at the end of the second quarter of that year, and it grew to 484 million yuan by the end of 2020. , By the end of 2021, the size of the fund will reach 25.816 billion yuan.

A source from a medium-sized fund company in Beijing told reporters that this is a method of "reducing costs and increasing efficiency". Compared with the cost of applying for new funds, communication channels and production materials, "protecting the shell" and using star funds It is more cost-effective for managers to do large scale.