China Economic Net, Beijing, July 8 (Reporter Li Rong Kangbo) In the first half of this year, overseas stock markets fluctuated sharply, and commodity prices corrected after rising for several consecutive months, resulting in significant differences in the performance of QDII funds.

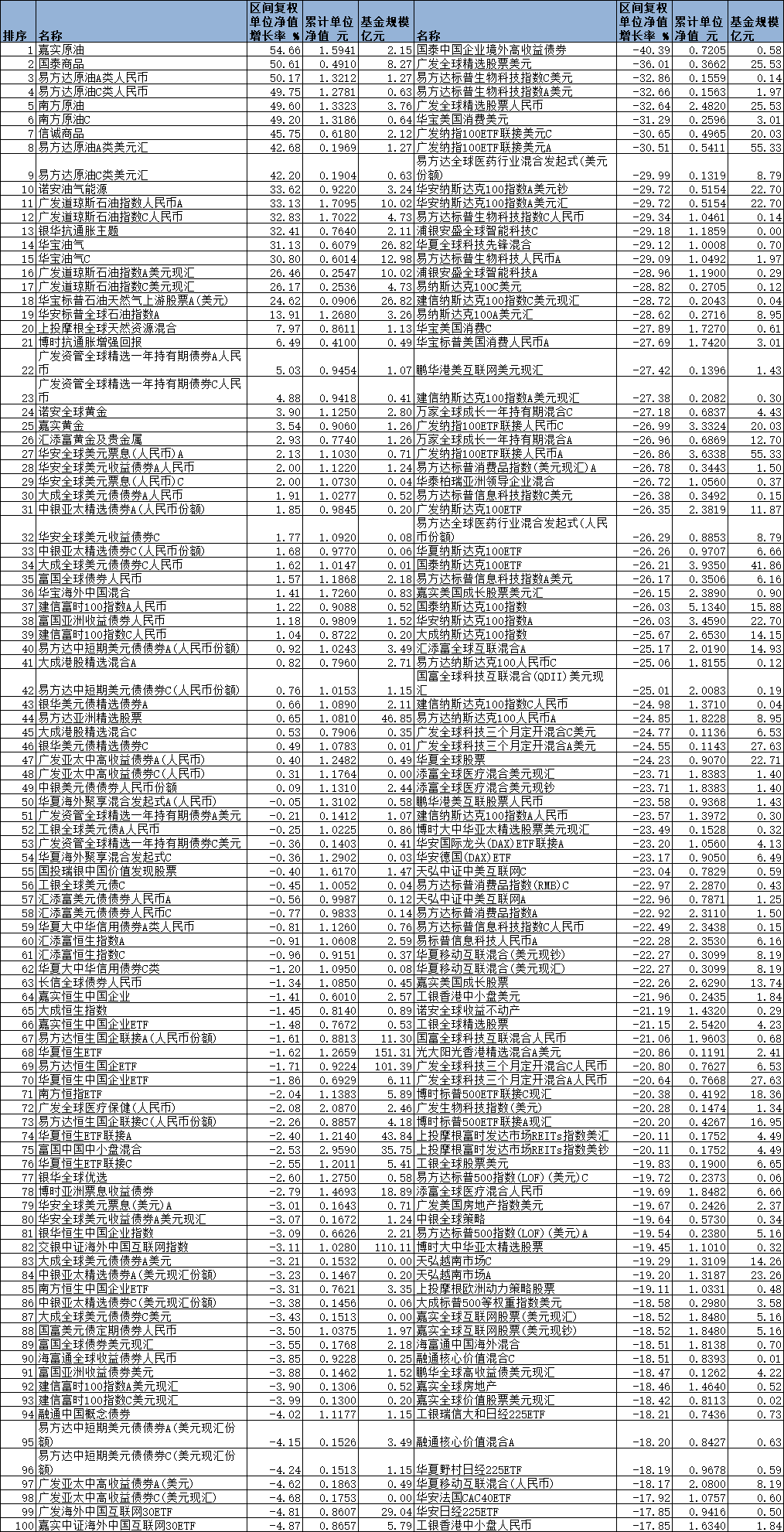

According to data from Flush, after excluding newly established funds and funds with abnormal net worth this year, among the 373 QDII funds with comparable performance in the whole market, only 49 funds recorded positive returns in the first half of the year, accounting for 13%; the remaining 324 funds were all fell, accounting for 87%.

In the past June, the international oil price has fallen from a high level, and crude oil funds have become the leading decliners among QDII funds in June, and many funds of this type have fallen by more than 15% in a single month.However, extending the time line, from the perspective of the first half of this year, the yield of crude oil QDII funds is still considerable.

According to statistics from a reporter from China Economic Net, the top 3 QDII fund gainers in the first half of the year all rose by more than 50%.Among them, Harvest Crude Oil won the championship with an increase of 54.66%, Cathay Pacific Commodities and E Fund Crude Oil Class A RMB ranked second and third, up 50.61% and 50.17% respectively.

In the first half of the year, there were 6 QDII funds with an increase of between 40% and 50%, namely, E Fund Crude Oil Class C RMB, Southern Crude Oil, Southern Crude Oil C, Prudential Commodities, E Fund Crude Oil Class A USD Exchange, E Fund Crude Oil Class C USD Exchange , the increase was 49.75%, 49.60%, 49.20%, 45.75%, 42.68%, 42.20%.

Although the current crude oil QDII is strong on the screen, many industry insiders do not recommend investors to buy crude oil QDII funds at the current time.According to financial commentator Guo Shiliang, the crude oil fund is currently at a historically high level, and it is not recommended to chase higher for the time being.It believes that crude oil prices are inherently inseparable from cyclical influences, and after this round of rising cycles, they may face a long adjustment cycle.

Zhou Jing, manager of Huabao Oil and Gas Fund, said that at present, there are more worries about the supply of crude oil in the market, and short-term oil prices may remain high and volatile.Zhou Jing reminded that the short-term volatility of oil prices has increased, and crude oil itself is a highly flexible variety. It is recommended that investors do a good job in risk control, use idle funds for investment, and do a good job of multi-asset allocation.

In addition to crude oil funds, some bond-based QDII and gold-themed QDII also recorded positive returns, but the increase was relatively small.For example, GF Asset Management Global Select One-Year Holding Term Bond A RMB and GF Asset Management Global Select One-Year Holding Term Bond C RMB rose 5.03% and 4.88% respectively.Nuogan Global Gold, Harvest Gold, China Universal Gold and Precious Metals rose 3.90%, 3.54% and 2.93% respectively.Huaan Global USD Income Bond A RMB, Dacheng Global USD Bond A RMB, BOC Asia Pacific Select Bond A (RMB share), Huaan Global USD Income Bond C, BOC Asia Pacific Select Bond C (RMB share), Dacheng Global USD Bond The C yuan and the Wells Fargo global bond yuan also rose slightly.

On the other hand, among the QDII funds whose net worth fell in the first half of the year, a total of 200 fell by more than 10% (10% included), accounting for 53.6%; 75 fell by more than 20%, accounting for 20%; 8 fell by more than 30% , the highest drop of 40.39%.

Looking at the QDII funds with the highest decline, the highest decliner was an overseas high-yield bond fund. Some QDII funds that invested in large US stock technology companies such as Microsoft, Apple, Google, and Amazon also fell significantly, while some invested in biomedicine. The QDII funds of companies such as Rongchang Bio, Tianjing Bio, Nanwei Medical, Connoya, etc. are also at the top of the list of decliners.

In addition, some index-based QDII funds or ETFs tracking the Nasdaq 100 Index, the S&P Biotech Select Sector Index, the S&P 500 Information Technology Index, the Frankfurt DAX Index, etc. also generally had poor returns in the first half of this year.

Top 100 QDII funds in the first half of 2022