Author: Luo Gemei

The amount of dividends distributed mainly depends on the company's own profitability, and comprehensively considers aspects such as shareholder returns, capital and cash considerations.Overall, the overall dividend ratio of insurance companies is at a good level.

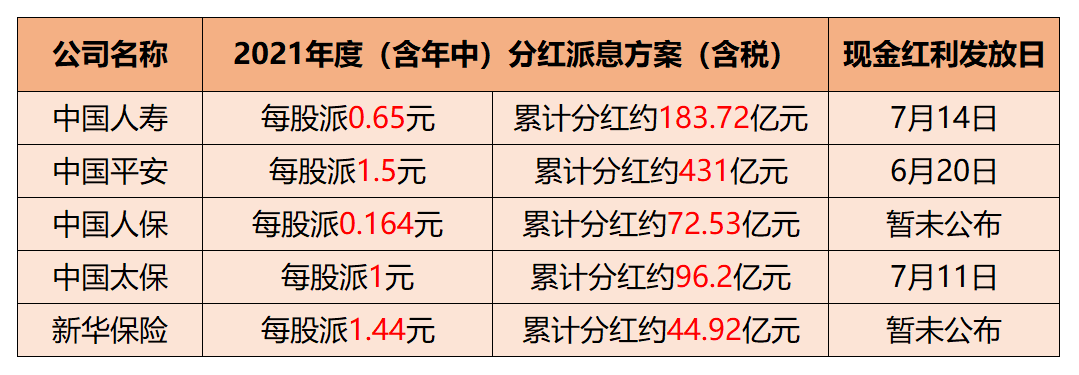

On July 8, China Life Insurance, the “first brother of life insurance”, issued an announcement on the implementation of profit distribution for A-shares in 2021, and plans to distribute “red envelopes” of about 18.372 billion yuan.

Previously, China Pacific Insurance has issued a profit distribution announcement, Ping An has implemented the 2021 dividend distribution plan, and the general meeting of PICC and New China Insurance has also reviewed and approved the 2021 profit distribution plan.

According to statistics from the "International Finance News" reporter, the above-mentioned five A-share listed insurance companies will distribute a total of nearly 83 billion yuan in cash dividends in 2021.In addition, although the profitability of insurance companies in 2021 has generally been lowered, the dividend rate has not decreased, and they have remained above 30%, and Ping An has exceeded 40%.

A total of nearly 83 billion yuan in dividends

China Life announced on July 8 that the 2021 profit distribution is based on the company's total share capital of 282.65 shares before the implementation of the plan, and a cash dividend of 0.65 yuan (tax included) per share will be distributed, with a total cash dividend of about 18.372 billion yuan (tax included), The dividend ratio is 36%.

On June 30, China Pacific Insurance announced that the 2021 profit distribution will be based on the company's total share capital of about 9.62 billion shares before the implementation of the plan, and a cash dividend of 1 yuan (tax included) will be distributed per share, with a total cash dividend of about 9.62 billion yuan.

(Watchmaking: Luo Gemei)

On June 20, Ping An completed the implementation of the 2021 annual dividend distribution.In addition to the interim dividend of 0.88 yuan per share (tax included) that has been distributed, Ping An's full-year 2021 dividend will be 2.38 yuan (tax included) per share in cash, an increase of 8.2% year-on-year, with a total dividend of about 43.1 billion yuan.

According to the profit distribution plan of PICC, it is proposed to distribute a cash dividend of 1.47 yuan (tax included) for every 10 shares. Based on the total share capital of 44.224 billion shares, the total proposed cash dividend is 6.501 billion yuan (tax included).In addition to the 2021 semi-annual dividends distributed (0.17 yuan in cash dividends per 10 shares, a total of 752 million yuan), the full-year dividends in 2021 will be 1.64 yuan in cash dividends per 10 shares, and the total cash dividends will be distributed about 7.253 billion yuan. The cash dividend ratio is 33.5%.

Xinhua Insurance stated that the company plans to distribute a cash dividend of 1.44 yuan per share (tax included) to all shareholders, which is calculated based on the company's 3.12 billion issued shares, a total of about 4.492 billion yuan.In 2021, the company plans to distribute 30.1% of the total cash dividends to the net profit attributable to shareholders of the parent company.

According to the cash dividend list of A-share listed companies released by the China Association of Listed Companies (hereinafter referred to as "China Association") in June, Ping An, China Life Insurance, China Pacific Insurance, and PICC are among the "Top 50 List of Listed Companies with Rich Returns". Ranked 6th, 12th, 25th, and 33rd respectively, the list is based on the total cash dividends in the past year and the past three years as the main indicator.

The China Shanghai Association pointed out that cash dividends, as an important form of realizing investment returns, are an important manifestation of respecting and protecting the rights and interests of investors.A sustainable, stable, scientific and reasonable dividend distribution mechanism is of great significance to the value recognition and quality improvement of listed companies, as well as the stable and healthy development of the capital market.

Dividend rate is over 30%

The reporter found that in the case of the general downward adjustment of the profitability of insurance companies in 2021, the dividend rate of each company remains at a high level of more than 30%, but the adjustment of the dividend rate varies greatly.

Taking Ping An of China as an example, in 2021, the company will realize operating profit attributable to shareholders of the parent company of 147.961 billion yuan, a year-on-year increase of 6.1%; net profit attributable to shareholders of the parent company is 101.618 billion yuan, a year-on-year decrease of 29.0%.However, the total amount of dividends increased by 7.6% compared with last year, and the proportion of net profit attributable to the parent also increased significantly by 13.7 percentage points to 42.4%. This is the 10th consecutive year that Ping An has increased cash dividends.

The independent directors of Ping An of China believe that the company's full-year cash dividend level in 2021 is slightly higher than the company's shareholder return plan, but it maintains the continuity and stability of the profit distribution policy, and fully protects all investors, including small and medium investors. the legitimate rights and interests of shareholders.

Looking at China Pacific Insurance, the company will achieve a net profit of 26.834 billion yuan in 2021, a year-on-year increase of 9.2%; operating profit is 35.346 billion yuan, a year-on-year increase of 13.5%.In 2021, CPIC’s net profit attributable to the parent company will be 26.834 billion yuan, and the total cash dividends will account for 35.9% of the net profit attributable to the parent company, down from 50.9% in 2021.

In this regard, the management of CPIC put forward two considerations: First, in the context of the launch of the second phase of "C-ROSS", the 2021 dividend should be adjusted appropriately from a prudent perspective.Second, the Group is actively promoting a large amount of investment in health, technological innovation and other fields, as well as the strategic layout of the Yangtze River Delta, Guangdong-Hong Kong-Macao Greater Bay Area, Beijing-Tianjin-Hebei and other key areas of China's economic growth.

A non-bank analyst from a foreign-funded institution told the International Finance News that the amount of dividends distributed mainly depends on the company's own profitability, and comprehensively considers returns to shareholders, consideration of capital and cash, and other aspects.Overall, the overall dividend ratio of insurance companies is at a good level.In particular, China Pacific Insurance has always maintained a high level of 30% to 50%. Even if there is a decline in 2021, it will still rank third, which is not low.

Insurance stocks remain at low valuations

In fact, due to factors such as industry transformation and the epidemic, the overall performance of insurance stocks has been sluggish in the past two years.Since the beginning of this year, only the share prices of China Life Insurance and PICC have risen slightly, while New China Insurance, China Pacific Insurance, and Ping An have all declined to varying degrees.Among them, the insurance sector has seen several rounds of supplementary gains since June, but it is still at a low level.

(Screenshot from iFinD of Straight Flush)

In this context, listed insurance companies have played a "combination punch" of share repurchase and increased holdings of executives to convey confidence to the market and investors.

As of June 30, 2022, Ping An of China has repurchased 103 million A shares through centralized bidding transactions, accounting for 0.56122% of the company's total share capital, and the total amount of funds paid is RMB 5 billion (excluding transaction fee).This year, CPIC A+H shares have been increased by 287,900 shares by senior executives.

Tianfeng Securities pointed out that in terms of life insurance, with the improvement of the epidemic situation and the stabilization of the margin of the agent, the repair of the liability side of life insurance may continue; the improvement of the equity market and the gradual mitigation of real estate risks can also bring about an improvement in investment income.Insurance stocks as a whole are currently at historically low valuations.

East Asia Qianhai Securities Research Institute said that on the liability side of the insurance industry, new business is expected to pick up, benefiting from the gradual increase in demand for wealth management and the stabilization of the team.On the asset side, the downward expectation of interest rates has weakened, showing a trend of valuation repair.

(Editor in charge: Han Yijia)