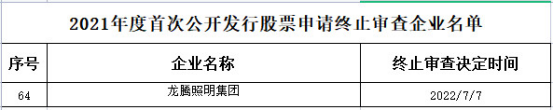

China Economic Net, Beijing, July 11th, according to the official website of the China Securities Regulatory Commission, the China Securities Regulatory Commission will publicize the IPO review workflow of the Issuance Supervision Department and the status of the companies applying for it.Longteng Lighting Group is listed on the list of companies that apply for the termination of the review of initial public offerings in 2021, and the decision to terminate the review is July 7, 2022.

The licensed projects of Longteng Lighting Group Co., Ltd. (hereinafter referred to as "Longteng Lighting") include: various engineering construction activities; construction engineering design; general contracting of housing construction and municipal infrastructure projects; building intelligent system design; building intelligent engineering construction ; Power facility installation, repair, and test; import and export of goods; technology import and export; import and export agency; road cargo transportation (excluding dangerous goods).

As of the date of signing the prospectus, Longze Investment directly held 56.88 million shares of the company, accounting for 48.486% of the company's total share capital before the issuance, and was the company's controlling shareholder.The actual controllers of the company are Long Huibin, Xu Fuping and Long Teng. Long Huibin and Xu Fuping are husband and wife, and Long Teng is the son of Long Huibin and Xu Fuping.Long Huibin directly holds 27.039% of the company's shares, Xu Fuping directly holds 10.655% of the company's shares, and Longteng directly holds 4.927% of the company's shares; Long Huibin and Xu Fuping hold 75% and 25% of the controlling shareholder Longze Investment respectively. People indirectly control the voting rights of 48.486% of the company's shares through Longze Investment; in addition, Long Huibin serves as the executive partner of Longrui Investment and Longxiang Investment, and Long Huibin indirectly controls 6.189% of the company through Longrui Investment and Longxiang Investment respectively. , 2.336% of the voting rights of the shares; Long Huibin, Xu Fuping and Long Teng together directly and indirectly control the voting rights of 99.631% of the company's shares.

Longteng Lighting originally planned to be listed on the main board of the Shenzhen Stock Exchange, and the number of shares to be publicly issued should not exceed 40 million shares, accounting for no less than 25% of the total share capital after the issuance. the situation of the shares.Longteng Lighting originally planned to raise 600 million yuan, which was planned to be used for the new project of Longteng Smart Industrial Park, supplementary engineering project working capital, and marketing network construction project.

The sponsor of this issuance is Guotai Junan Securities Co., Ltd., and the sponsor representatives are Zhang Yi and Yu Weijun.

(Editor in charge: Xu Zili)