Financial Associated Press, July 13 (Editor Ma Lan) PepsiCo, the U.S. food and beverage giant, announced its second-quarter 2022 financial report on Tuesday, and its performance was better than Wall Street had previously expected.Although the company still maintains that market demand has not shown signs of weakening, data show that the company's sales growth in the second quarter did not keep up with revenue growth, suggesting weak market demand.

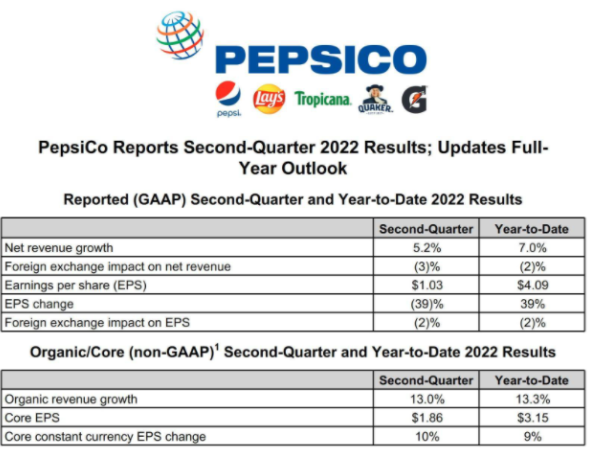

In the second quarter, PepsiCo’s adjusted earnings per share were $1.86, better than expected by $1.74; operating income was $20.23 billion, up 5.2% year-on-year, beating expectations by $19.51 billion.

In addition, PepsiCo reported a second-quarter net profit of $1.43 billion, down from $2.36 billion a year earlier.Meanwhile, PepsiCo expects core revenue to grow 10% in fiscal 2022, compared with an 8% forecast previously given.

Costs will still rise

In the financial report, the sales volume of PepsiCo’s food business in Europe fell by 7%, beverages fell by 8%, and total revenue fell by 8%, mainly due to the sharp decline in the Russian market.However, the food business reported growth in other regions.

In the report, PepsiCo pointed out that an important reason for the increase in operating income was that the average selling price rose by 12% in the second quarter, but cost pressures continued to squeeze profit margins.

Hugh Johnston, chief financial officer of PepsiCo, said that inflation will continue for some time, and next year will see more raw material price increases, but has not seen demand slow down due to price increases, and believes that the price of PepsiCo products has room for further increases. .

But it is worth noting that it can be found in the financial report that the growth of Pepsi's product sales has not kept up with the growth of revenue. This signal may indicate weak market demand after product prices have risen.

Among the product categories, Quaker Food North America, which performed normally behind the pads, was the only North American segment to report sales growth in the second quarter, with its main products, rice, pasta, oatmeal and biscuits, increasing revenue by 18% and volumes up. 2%.

In contrast, the Lay's series reported a 2% decline in sales, which may reflect a shift in North American consumer preferences.

Substitute for price increase

Faced with cost pressures, PepsiCo will accelerate cost management programs and use solutions such as designing smaller packages, said PepsiCo CEO Ramon Laguarta.

Johnston added that it is also possible to reduce the number of chips in a bag rather than increase the price.

In the first quarter of this year, PepsiCo has raised prices across the board for its beverages.Taking the Chinese market as an example, the price of 500ml of original Pepsi, Mirinda and Qixi has increased from 3 yuan to 3.5 yuan; the prices of Gatorade, Guobinfen and Pure Water Sparkling water have also increased respectively.

Arun Sundaram, an analyst at CFRA Research, said that although the price increases of food packaging companies are close to the upper limit, because Pepsi and Coca-Cola are in a duopoly competition and have huge pricing power, the price ceiling of both parties can be higher than ordinary companies.

However, frequent price increases are not the strategy that Pepsi wants, and the reduction of single products is the next main route.

Johnston also mentioned that PepsiCo is looking at cutting costs through lower-cost packaging and more careful hiring.