Financial Associated Press, July 13 (Reporter Yang Hui) Farewell to the era of staking, more and more securities companies have turned to intensive cultivation in the arrangement of branches.It is a proposition for more securities companies to make efforts to transform the functions of the sales department and adjust the number and positioning of branches or sales departments. How to better adapt to the changes of the times and improve service efficiency is also an issue that each securities company needs to think about under the industry change.

Hualin Securities, which has continued to transform into an Internet brokerage, has recently withdrawn 8 business departments, which has once again attracted the attention of the industry. It is less than two months since the cancellation of 8 business departments on May 13, 2022, and the total number of business departments cancelled during the year has reached 16.

After buying the Dolphin APP from ByteDance in February, Hualin Securities has not stopped its steps to cancel the sales department. In 2021, the number of Hualin Securities canceled business departments will also reach 15, and only 1 will be added. In the sales department, the number of cancellations is in the forefront.

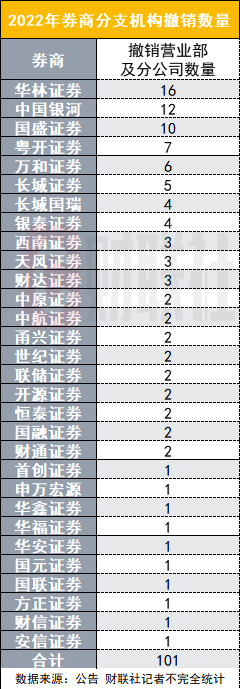

Hualin Securities is not the only one that has abolished its sales department. According to incomplete statistics from a reporter from the Financial Associated Press, many securities companies have abolished their sales departments during the year, and a total of 101 branches have been abolished.The change in the number of business offices has also become one of the most intuitive basis for measuring the development trend of the securities industry and comparing the strategic choices of different securities companies.

Hualin all in the Internet, since 2021, there will be 31 fewer business departments

On July 8, 2022, Hualin Securities issued an announcement deciding to cancel the securities business department of Yongxing Road, Jing'an District, Shanghai, Shenzhen Overseas Chinese Town Securities Business Department, Shenzhen Tairan 4th Road Securities Business Department, Nanchong South China Road Securities Business Department, Yiwu Jiangbin Zhonglu Securities Branch, Zhaoqing Tianning North Road Securities Branch, Qinghai Branch, and Ningxia Branch have 8 branches.

Since then, Hualin Securities has cancelled 16 business departments since 2022. Although the cancellation of business departments and branches is also common in the industry, it is quite rare to cancel business departments with such a big move.This is undoubtedly related to the drastic transformation of Hualin Securities into an Internet brokerage.

As early as May 13, 2022, Hualin Securities issued an announcement stating that in order to meet the needs of the company's Internet strategic transformation and further optimize the layout of business outlets, it has decided to cancel the securities business department of Wuhu Wanjiang Fortune Plaza and Lu'an Wanxi Road Securities Business Department. , Beijing Shuangyu Road Securities Business Department, Liuzhou Wenchang Road Securities Business Department, Shaoyang Shaoshui East Road Securities Business Department, Binzhou Bohai Eighteen Road Securities Business Department, Tai'an Changcheng Road Securities Business Department, Shenzhen Chunfeng Road Securities Business Department 8 branches.

On the interactive platform of listed companies, an investor asked Hualin Securities: "The company cancels 8 business departments, is it actively transforming and accelerating the upgrade? Or is there any difficulty in operation? How much impact will the cancellation have on financial management expenses and operating expenses? Has it been evaluated? ?"

Hualin Securities’ board secretary replied, “The revocation of the branch is to meet the needs of the company’s Internet financial transformation strategy, promote the Internet-based development of wealth management business, form economies of scale and core competitive advantages, reduce operating costs, and improve branch operating efficiency. In the future, the company will rely on the Dolphin Stock App to enhance the online service experience while accelerating the transformation of offline digital branches, further extending the scope of services, and actively building a one-stop customer service ecosystem."

From testing the waters of the "tribal system" reform, poaching heavyweight IT talents, to winning the Dolphin APP, it is the continuous reduction of Hualin Securities' sales department, from 115 in 2020 to 101 in 2021, and then 85 by 2022 so far.

In contrast to the drastic abolition of branches, Hualin Securities will only establish a new branch in Sichuan in June 2021. According to an earlier report by the Financial Association, Hualin Securities has newly deployed a digital branch in order to further carry the user transformation and operation of the Dolphin Stock APP. The company is gradually advancing with two branches in Sichuan and Wuhan as pilots. The powerful Internet investment advisory service system behind the establishment of the digital branch is an important layout of Hualin Securities.

30 brokerages abolished their business departments during the year, with Hualin, Galaxy and Guosheng ranking among the top three

Not only Hualin Securities, the abolition of business departments seems to be the common choice of most securities companies. According to public information statistics, 30 securities companies have carried out relevant actions to abolish business departments or branches during the year, reducing a total of 101 branches.

As mentioned above, Hualin Securities has made the biggest move.China Galaxy and Guosheng Securities ranked second and third with 12 and 10 respectively.

During the year, China Galaxy cancelled its sales department frequently.On January 5, 2022, it was announced that the three branches of Shenzhen Baoan Haixiu Road Securities Branch, Huaian Hongzedong Shidao Securities Branch and Huaian Hongzedong Shidao Securities Branch were cancelled.On March 16, it was announced to cancel the Zhanjiang Guanhai North Road Securities Branch, Zhongwei Gulou East Street Securities Branch, Zhanjiang Leizhou Xihu Avenue Securities Branch, Qingdao Harbin Road Securities Branch, Panjin Shifu Street Securities Branch, Lingshi Xiaohe Road Securities Branch, Hefei Yungu Road Securities Branch, and Chenzhou Renmin East Road Securities Branch, etc., announced on July 6 to cancel the Fuzhou Zhongnong Road Securities Branch.

According to the 2021 annual report, China Galaxy has 501 business outlets, making it the securities company with the most branches in China.The annual report mentioned, "The company's business focus has shifted from traffic marketing to customer-centricity. The company's securities brokerage business will further enhance its multi-channel customer acquisition capabilities, develop ecological partners, and actively promote the diversified development of channels."

Guosheng Securities issued an announcement on April 12, 2022, revoking Changsha Middle Shaoshan Road Securities Branch, Yancheng Jiefang South Road Securities Branch, Baoji Administrative Center Securities Branch, Chongqing Daping Zhengjie Securities Branch, Shangqiu Shenhuo Avenue Securities Branch, Hefei Branch There are 10 securities branches in total, including Luzhou Avenue Securities Branch, Hefei Lujiang Juner West Road Securities Branch, Huzhou Second Ring East Road Securities Branch, Jinan Jingshi Road Securities Branch, and Lushan Bailu Avenue Securities Branch.

In addition, Yuekai Securities abolished 7 outlets, Wanhe Securities abolished 6, Great Wall Securities abolished 5, Great Wall Guorui Securities and Yintai Securities abolished 4, and Southwest Securities, Caida Securities, and Tianfeng Securities abolished 3.The actions of small and medium-sized securities companies to optimize their business departments are even more obvious.

According to previous reports from the Financial Associated Press, in 2021, 24 of the 42 listed brokerages have withdrawn at least one business department.Among them, 9 securities companies including Zhongtai Securities, Guotai Junan, Guolian Securities, Soochow Securities, Everbright Securities, Shenwan Hongyuan, Guoyuan Securities, Hualin Securities, and Shanxi Securities have cancelled at least 5 business offices.

In 2022, the situation in 2021 will continue. The main reasons for securities companies to cancel the business department are to further optimize the layout of business outlets, strengthen resource integration, and promote the transformation and upgrading of wealth management business.The fundamental reason is still that the role of the sales department is weakening under the transformation of the business model of the industry.

The "cost-effectiveness" of the sales department is challenged

Comparing the data in 2005 and 2021, the proportion of brokerage business in the revenue structure of securities companies has dropped from 50%-60% to the current 20%-30%, and the contribution of sales departments to the revenue of securities companies is still in a downward trend.The structure of employees recently announced by the Securities Industry Association also shows that the number of brokers has dropped significantly. At present, there are 50,901 brokers in brokerages, a decrease of more than 10,000 people compared with the same period last year, a drop of 17.84%.The number of investment advisors has increased significantly, and wealth management business, as a new growth point, has become a key direction for the transformation of securities companies.

With the development of the industry, the positioning of the brokerage business department has undergone great changes. At that time, the brokerage business department was still opening accounts at the counter, and most investors handled business in the brokerage business department. Shareholders communicate face-to-face. Nowadays, with the rapid development of the Internet, under the catalysis of the epidemic, most businesses other than margin financing and securities lending can be handled online, and the large account room of the sales department has also become a professional investor mainly from private equity funds and other institutions.

With the further transformation of the business model to online, it is inevitable that some branches of the sales department with weak profitability will be cancelled.

The “Lhasa Tiantuan” of Orient Fortune Securities has repeatedly been listed among the top 100 sales offices in the Dragon and Tiger List, which shows that under the Internet model, there are many customers, a large amount of funds, and active transactions. The brokerage business mainly relies on online channels. In terms of security, the reliance on offline outlets has been further reduced, and the asset-light operation model has become a reference direction for many securities companies.

"Cooperating with JD.com to drain traffic and build more business departments into an Internet financial service model is also an important strategic layout for us in the near future." The person in charge of the interviewed securities firm Wangjin said.

Seeking the transformation of Internet operation cooperation has also become the unanimous choice of most securities companies.According to a reporter from the Financial Associated Press, the Shenzhen Bay Sales Department of CICC Wealth and Tencent registered a new company, Jinteng, to cooperate to develop Tencent Wealth Management Pass customers. This cooperation is aimed at transforming wealth management and directly abandoning the stock brokerage business. It is also a new model for the sales department to explore online business cooperation for wealth accounts. It is reported that the operation team started to build last year, and it has expanded from a team of more than a dozen people to an entire network of more than 100 people. The operation team and the scale of assets under management have also steadily increased, and the scale of assets has reached more than 4 billion in just one year.