The total turnover of the ten stocks on the Dragon Tiger List exceeded 1.1 trillion yuan, and the stock with the largest turnover was more than 250 billion yuan. Such a huge transaction took only five months. It's finished.

For such a huge transaction, the trading objects are not the leading stocks with a market value of hundreds of billions of yuan, and the traders are not investment institutions, but completed by hot money. The trading objects are the top ten dragons and tigers with the most active hot money transactions this year. stock.

After every market crash, hot money is always very active, and the latest decline is no exception. Since the end of December last year, hundreds of stocks have been speculated by hot money. The first financial analysis found that as of the close of June 22, among the top 30 stocks with share price increases this year, well-known hot money has repeatedly appeared.

New stocks and subject stocks are the objects that hot money likes to hype the most. Among these hot money, the four business offices of Orient Fortune Securities in Lhasa are naturally indispensable (Orient Fortune Securities Lhasa East Ring Road No. 1 Securities Business Department, Orient Fortune Securities Lhasa East Ring Road Second Securities Business Department, Orient Fortune Securities Lhasa Tuanjie Road First Securities Sales Department, Orient Fortune Securities Lhasa Tuanjie Road Second Securities Sales Department). However, this is also related to the fact that Orient Fortune Securities centrally locates Internet account opening in these four business departments. According to the transaction data of the Dragon Tiger List, as a gathering place for retail investors, the total turnover of these four business departments during the year reached 226.524 billion yuan, accounting for 40.17% of the turnover of the top 100 business departments.

Which ten stocks are most favored by hot money

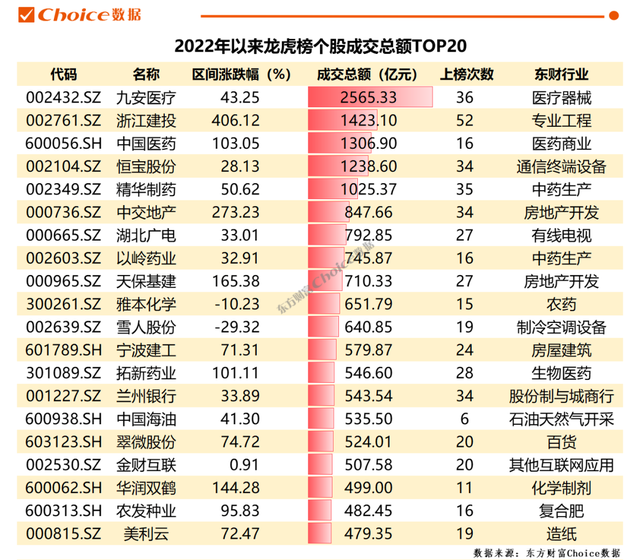

Taking the trading volume of the Dragon Tiger List as the standard, Jiu'an Medical is undoubtedly the favorite stock of hot money this year.

According to the transaction statistics of Oriental Fortune, as of May 30 this year, the total transaction volume of Jiu’an Medical was as high as 256.533 billion yuan, ranking first in this year’s transaction scale. Zhejiang Jiantou, followed by Zhejiang Construction Investment, ranked second in terms of turnover on the Dragon and Tiger list, with a turnover of 142.31 billion yuan during the year. It has been on the Dragon and Tiger list 52 times in total this year.

In addition, the total turnover of China Medicine, Hengbao Co., Ltd., and Essence Pharmaceuticals also reached 130.69 billion yuan, 123.86 billion yuan, and 102.53 billion yuan during the year.

In addition to the above-mentioned five stocks, five stocks including CCCC Real Estate, Hubei Radio and Television, Yiling Pharmaceutical, Tianbao Infrastructure, and Yaben Chemical also entered the top ten in terms of turnover on the Dragon Tiger List, with a turnover of 65 billion to 84.7 billion yuan during the year. between.

Almost without exception, these stocks with huge turnover and fierce growth have hot money behind them. Taking Jiu'an Medical as an example, during the period of the stock's change, many business offices of Oriental Fortune Lhasa appeared in the top five positions for buying and selling the stock many times.

After-hours data on January 18th, the four business offices of Orient Fortune Securities in Lhasa all entered the top five positions for buying. The amount was 474 million yuan, and the net purchase was 130 million yuan. Previously, on December 30, 2021, these four business departments also entered the top five seats for buying.

The situation in Chinese medicine is similar. In the 23 trading days in March this year, the stock recorded 12 daily limit. On March 31, the hype about Chinese medicine reached a climax. Shortly after opening higher in early trading that day, its stock price closed the daily limit for large orders, but opened the daily limit in midday trading, and fell to a minimum of 36.30 yuan in late trading, with an amplitude of 19.78%.

After-hours Longhu list data shows that the list of Chinese pharmaceutical buyers is occupied by the sales department of the Oriental Fortune Department. On the list of sellers, in addition to the CITIC Securities Xi'an Zhuque Street Securities Sales Department, where the famous hot money "Fang Xinxia" is located, sold 84.9017 million yuan, the others are also the Oriental Fortune Department Sales Department.

When hot money concentrates on buying a certain stock, its stock trend tends to rise sharply, and even the stock doubles after several daily limit ups.

This is evident in stocks such as Jiu'an Medical. Since the beginning of this year, Jiu'an Medical has increased by 43.25%. From November 19, 2021 to January 19 this year, its increase was as high as 608.84%, becoming the stock with the largest increase in the past year; Zhejiang Jiantou also increased by 406.12% during the year, the largest increase this year.

And when the hot money sells a stock, its stock trend falls rapidly. Entering China Medicine, after rising by 230.25% in a single month in March, it began to fall sharply in April. In the 15 trading days from April 1 to April 25, the stock fell by 44.31%.

In addition, there are many well-known hot money behind the top 30 companies in the A-share market this year. Choice data shows that as of June 22 , among the top 30 companies with A-share gains since 2022 , institutions ( including public funds, social security funds, securities companies, foreign capital, banks, etc.) held only 33.37% of tradable shares on average. .

A private equity fund manager said that hot money buying stocks with fewer institutional positions will reduce the risk of being smashed and buried in the middle of the mountain; and stocks with low institutional positions are generally small, and hot money is easier to hype.

Among them, Chengchang Technology (001270.SZ), Shanghai Yizhong-U (688091.SH), Zhongtong Bus (000957.SZ), ST Shida (600734.SH), Jiangsu Huachen (603097.SH), Yuneng Among 14 companies including Technology (688348.SH), Haiqi Group (603069.SH), and Hongbai New Materials (605366.SH), as of the end of the first quarter, no institution even held a position in its tradable shares.

As of June 22, Chengchang Technology, whose stock price has risen by as much as 331.37% in 2022, has 18 different brokerage business departments and 17 sellers in the Longhu list. The seat of the brokerage business department.

Hot money speculates on new stocks and theme stocks

As of the close on June 23, as a new stock that only landed on the main board of the Shenzhen Stock Exchange on June 6, Chengchang Technology has achieved 13 daily limits in 14 trading days.

Wind data shows that from the date of listing to June 19, Chengchang Technology’s daily turnover rate was less than 3%, but after harvesting ten consecutive boards, on June 20, Chengchang Technology’s turnover rate reached 3%. 27.81%, and it rose to 44.03% on June 21.

In terms of trading volume, from June 6 to June 19, Chengchang Technology’s daily trading volume was less than 1 million shares, but it rose to 7.7751 million shares on June 20, and soared to 12.4722 million shares on June 21. share. On June 22, Chengchang Technology once again became the stock with the largest net inflow of funds in the Dragon Tiger list, with a net purchase of over 340 million yuan. The data shows that the stock rose 5% on the day, the stock price rose 27% in the past three trading days, and the intraday turnover rate was 64.58%.

In addition to hyping up new stocks, hot money is still following the theme hype, and Zhongtong Bus (000957.SZ) is one of them.

Zhongtong Bus, which has the concept of "nucleic acid detection vehicle" overhead, has accumulated more than 20% deviation in the closing price of the stock for three consecutive trading days. After the resumption of trading on June 10, it was only 8 trading days. Suspension.

In an interview with China Business News, Wang Xiaohua, an analyst at Orient Securities, said that there are two main reasons for the current round of Zhongtong Bus's surge. The first reason is the sufficient liquidity in the market. Since bottoming out at the end of April, the market's single-day trading volume has Often maintained at more than one trillion yuan. Another support point is that the company has successively hit the hot spots of "nucleic acid detection vehicles" and "new energy vehicles", which has opened up the market's imagination and triggered a continuous upside of subject stocks.

Prior to May 5, in response to questions from investors on the Shenzhen Stock Exchange's interactive platform, Zhongtong Bus responded that it has sold nucleic acid testing vehicles in batches to help prevent and control the epidemic. On the evening of June 17, Zhongtong Bus also stated in an investor relations event that it has completed the research and development of a solar-powered extended-range intelligent driving bus, which has the functions of solar power generation and automatic driving, and can realize the connection of solar energy to power batteries. "

Wang Xiaohua told China Business News that the equity market often magnifies the technological breakthroughs of some companies, and then mistakenly believes that this will lead to major fundamental changes.

"The announcement has already indicated that some new products, such as solar vehicles, will not have a significant impact on the profits of the core main business in the short term. If we return to the main business, we will need to estimate the value based on the output-return ratio of passenger cars. The current state of losses is actually putting pressure on the stock price." Wang Xiaohua said.

The stock price has risen wildly from the fundamentals, and the driving force behind it is still hot money. During the 13 consecutive daily limit periods starting from May 13, Zhongtong Bus has frequently appeared on the Dragon and Tiger list, and many hot money such as Galaxy Securities Shaoxing Securities Sales Department, Huaxin Securities Jiangsu Branch, Ping An Securities Hangzhou Hangda Road Sales Department, etc. Frequently haunted seats make frequent appearances on the list.

According to Tonglian data, in the three-day transaction data of Zhongtong Bus released on June 21, the well-known hot money seats "Lhasa Corps" (Orient Fortune Securities Lhasa Tuanjie Road No. 1 Business Department, Orient Fortune Securities Lhasa East Ring Road No. 1 and No. 2 Sales Department, etc.), Ningbo Sangtian Road, etc. are all on the list.

Four Orient Wealth Securities business departments took over 40% of the transactions

Choice data shows that as of the close on June 23, the total turnover of strong hot money since 2022 has reached 683.718 billion yuan, 67.854 billion yuan higher than the same period last year.

Among the seats of the brokerage business department where the hot money is concentrated, the second business department of the East Fortune Lhasa East Ring Road acts as the "leading big brother". Since the beginning of this year, the sales department has been on the Dragon Tiger List 2,956 times, ranking first among all hot money seats.

In addition, Oriental Fortune Lhasa Tuanjie Road No. 2 Business Department, East Ring Road No. 1 Business Department, and Tuanjie Road No. 1 Business Department ranked No. 2, No. 3 and No. 4 among all hot money companies with 2,608, 2,605 and 2,133 listings respectively. name.

The capital and customer structure of the above-mentioned business departments of Oriental Fortune Lhasa are currently unknown to the outside world. However, according to industry insiders, different from other brokerages, the company concentrates non-institutional clients in several business offices to open accounts, so some business offices have a large transaction volume.

There is also a clear head effect in the brokerage business department. Data show that since the beginning of this year, the turnover of the top 100 brokerage business departments has reached 563.852 billion yuan, accounting for 49.49% of the total turnover of 4,927 business departments. The total turnover of the above-mentioned four Orient Fortune Securities business departments reached 226.524 billion yuan during the year, accounting for 40.17% of the turnover of the top 100 business departments.

In addition, the total transaction value of CICC Shanghai Branch and Huatai Securities Business Headquarters also reached 43.391 billion yuan and 37.189 billion yuan respectively, ranking fifth and sixth in the hot money list .