Every reporter Zhang Shoulin

On June 6, the first trading day after the Dragon Boat Festival, the central parity of the RMB against the US dollar appreciated by 404 points to 6.6691.

During the festival, the onshore market is closed.In the offshore market, with the arrival of June, the RMB against the US dollar rose again, breaking away from 6.7 and entering the 6.6 range.Especially on June 2, the value of offshore RMB hit a recent high.

In the onshore market, the RMB against the US dollar opened at 6.6391 on June 6, a further appreciation of 300 points from the central parity rate.As of 12:00, the onshore renminbi against the US dollar was at 6.6594; the offshore renminbi against the US dollar was at 6.6613, and the value of the currency fell slightly from the opening.

Intraday offshore RMB against the U.S. dollar Image source: Wind

The trend of the onshore renminbi against the U.S. dollar in the day Source: Wind

Jin Tian, a senior researcher at the Institute of Digital Economy of Zhongnan University of Economics and Law, said in an interview with the "Daily Economic News" reporter on WeChat that the liquidity of the domestic capital market has been greatly improved, and foreign investment has continued to increase. At the same time, the market's concerns about the US economy have gradually increased Warming up, the exchange rate of the US dollar against all major currencies has fallen.Under this circumstance, the RMB exchange rate will remain generally stable, especially the exchange rate against the US dollar will continue to show two-way fluctuations, and RMB assets will have a more stable long-term holding and investment value.

The RMB against the US dollar continues to show a two-way fluctuation trend

From the perspective of the real exchange rate, against the background of the continuous soaring inflation in the United States, the prices of US commodities have risen sharply. According to the principle of purchasing power parity, the US dollar is facing depreciation pressure.

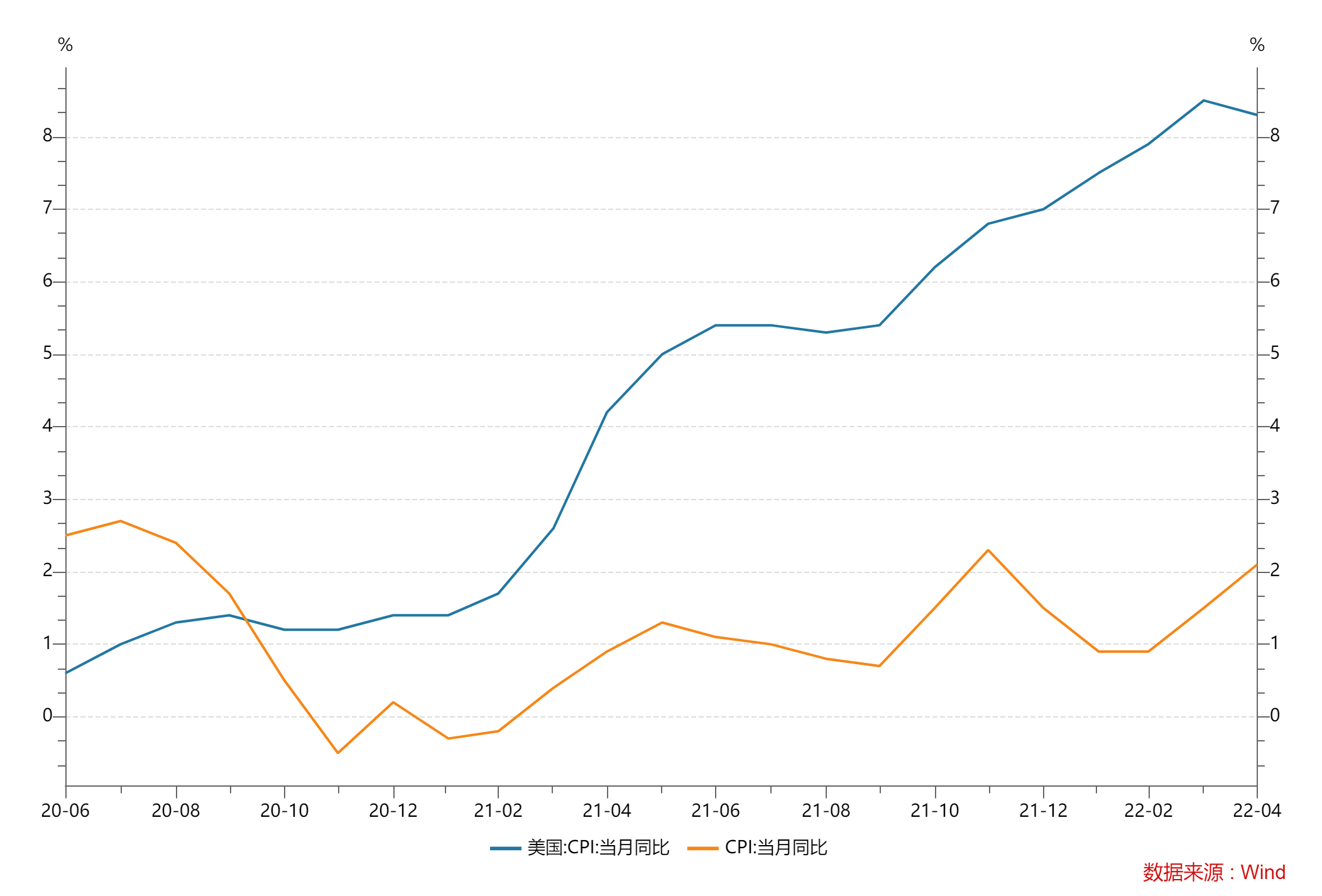

In April, the US CPI increased by 8.3% year-on-year, and the US economy is currently plagued by high inflation.China's April CPI was 2.1% year-on-year.There is a huge disparity in inflation between China and the United States.

China and US CPI trends Image source: Wind

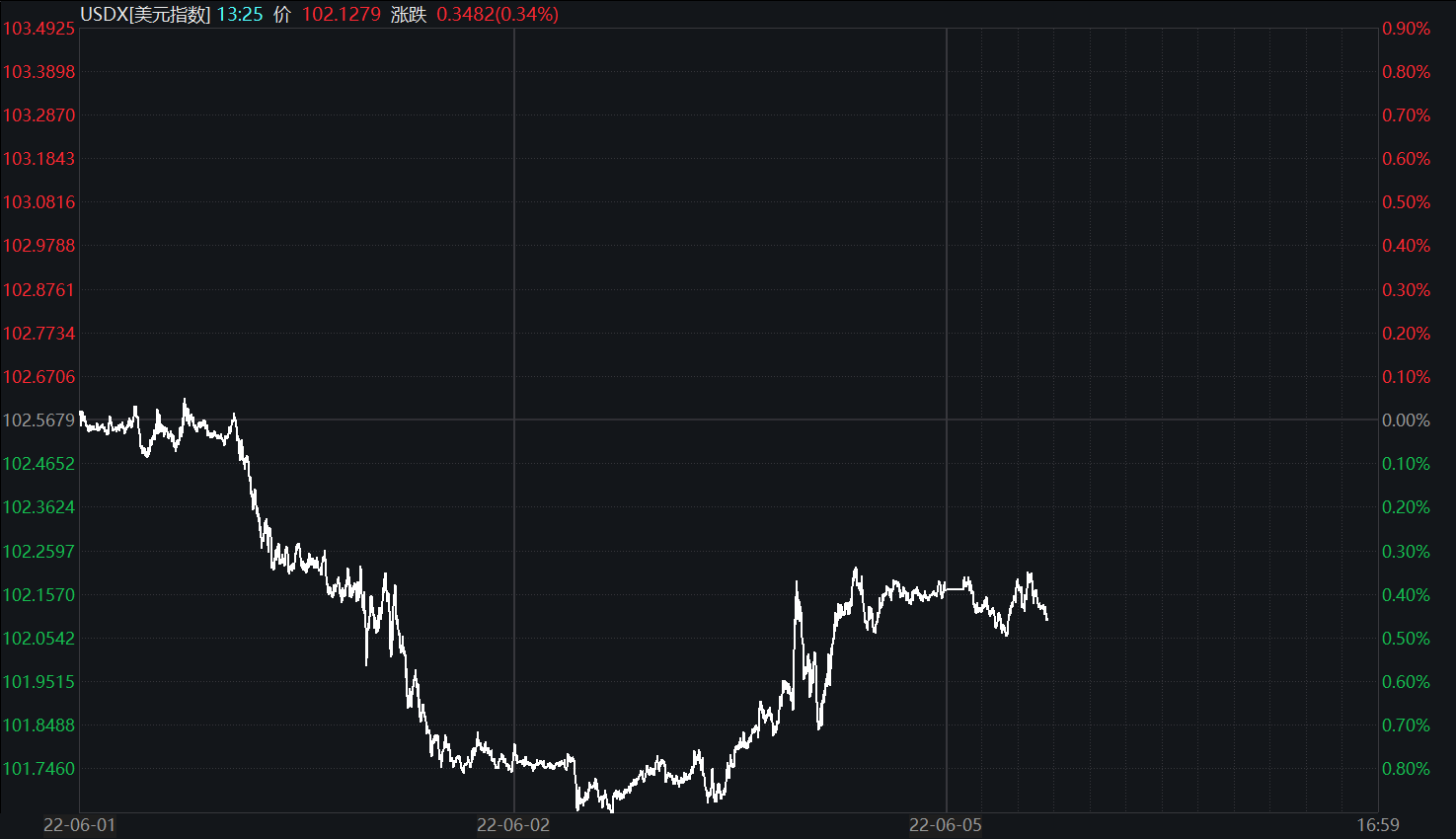

Paying attention to the US dollar index found that since June, the US dollar index has been relatively weak, hovering at 102, and once reported 101.6794.

The trend of the US dollar index since June Image source: Wind

The minutes of the meeting disclosed by the Federal Reserve recently showed that in the face of persistently high inflation, most officials of the Federal Reserve believe that there may be a 50 basis point rate hike in the next several regular meetings.

Jin Tian, a senior researcher at the Digital Economy Research Institute of Zhongnan University of Economics and Law, said in an interview with the "Daily Economic News" reporter on WeChat recently that since the middle and late May, the RMB exchange rate has shown a trend of rebounding.From the perspective of external factors, with the increasing uncertainty of the US monetary policy and the sudden plunge in the capital market, the US dollar index has retraced from the highest point of 105 to around 102.3, and the selling pressure of the RMB in the foreign exchange market has been gradually eased.

In a recent interview, Jin Tian also said that the current trend of the Fed raising interest rates and shrinking the balance sheet is relatively clear, and whether the dollar index can continue to rise will depend more on the economic performance and monetary policies of other major economies including China. Exchange rate fluctuations are amplified or become the norm.

From the perspective of internal factors, Jintian said in a recent interview that a number of policies have accelerated and stabilized growth recently. In particular, the impact of the epidemic in Shanghai has been significantly eased, and the protection of the industrial chain and supply chain has received more attention. Overly pessimistic expectations of China's economic fundamentals have been initially revised.

On June 6, Jintian said in an interview with the "Daily Economic News" reporter on WeChat that with the resumption of production and work in Shanghai and Beijing, 33 economic stabilization measures in six major areas of the State Council have been implemented rapidly, and the economic data in May and the third quarter is expected to be Stabilized and rebounded, the resilience of China's economy has been proved once again; the liquidity of the domestic capital market has also been greatly improved, and the inflow of foreign capital has continued to increase.At the same time, the market's concerns about the US economy have gradually increased, and the exchange rate of the US dollar against all major currencies has fallen.Under this circumstance, the RMB exchange rate will remain generally stable, especially the exchange rate against the US dollar will continue to show two-way fluctuations, and RMB assets will have a more stable long-term holding and investment value.

Policy efforts to further promote the opening up of the bond market

From a policy perspective, on June 2, the People's Bank of China and the State Administration of Foreign Exchange held a press conference. Pan Gongsheng, Deputy Governor of the People's Bank of China and Director of the State Administration of Foreign Exchange, said that the People's Bank of China and the State Administration of Foreign Exchange have conscientiously implemented the decisions and arrangements of the CPC Central Committee and the State Council. When implementing monetary and credit policies, we should pay attention to several principles: first, while stabilizing economic growth, it is conducive to the long-term sustainable development of the economy; second, while stabilizing economic growth, maintaining employment stability, price stability and balance of international payments; The third is to guide financial institutions to adhere to market-oriented and prudent operation while stabilizing economic growth, and effectively prevent financial risks.

In addition, Pan Gongsheng said that with the relief of the epidemic and the effects of various policies to stabilize growth, the advantages of domestic production and supply continue to exist, and trade in goods is expected to maintain a reasonable surplus.At the same time, with the opening of my country's financial market to the outside world, the return on investment in RMB assets is stable, which will continue to attract foreign investors to invest in China.

Pan Gongsheng said that in the next step, the People's Bank of China and the State Administration of Foreign Exchange will take the lead and make appropriate efforts to continue to increase the implementation of the prudent monetary policy, create a good monetary and financial environment, and make concerted efforts with relevant departments to promote the implementation of the package of policies as soon as possible and give full play to the The policy effect of stabilizing the economy and helping enterprises to bail out is to keep the economy operating within a reasonable range.

On May 27, the People's Bank of China, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange issued Joint Announcement [2022] No. 4 (On Further Facilitating Foreign Institutional Investors Investing in China's Bond Market) (hereinafter referred to as the "Announcement"), coordinating and synchronizing the promotion of inter-bank and the exchange bond market opened to the outside world.

The "Announcement" clarifies that foreign institutional investors who are allowed to enter the inter-bank bond market can invest in the exchange bond market directly or through interconnection.

In response to a reporter's question, the relevant person in charge of the People's Bank of China said that the People's Bank of China and the State Administration of Foreign Exchange will, in accordance with the requirements of the "Announcement", promptly release the regulations on the management of funds for foreign institutional investors to invest in China's bond market.The fund management regulations will unify the cross-border management policies of foreign institutional investors' funds, integrate existing foreign exchange management requirements, and clarify business registration, fund exchange, cross-border receipts and payments, foreign exchange hedging, etc., to further facilitate foreign institutional investors to invest in Chinese bonds. market.

It is reported that the "Announcement" is an important step to further promote the institutional opening of China's bond market, which is conducive to improving the diversified investor team, improving the liquidity and stability of the bond market, expanding capital account inflows, and better promoting international income Balanced support is conducive to the overall utilization of domestic and international markets and resources, better serving the real economy, accelerating the cultivation of custodian banks with global competitiveness, and improving the financial system's ability to cope with complex international situations.

(Editor in charge: Ma Xin)