"Investor Network" Zhang Wei

At present, my country has become the largest country in the world in terms of automobile sales for more than ten consecutive years.According to the statistics of the International Automobile Manufacturers Association (OICA), China's automobile sales will reach 26.27 million units in 2021, a year-on-year increase of 3.79%, continuing to rank first in the world.

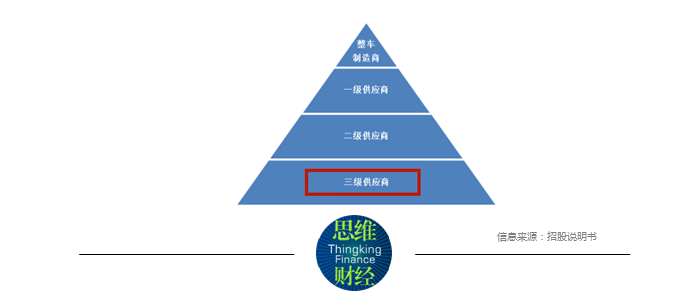

The boom in vehicle sales has driven the development of the domestic auto parts industry.However, under the inherent "pyramid" supplier system of the auto parts industry, most domestic auto parts manufacturers are still in the position of third-tier suppliers.

Figure 1: Domestic auto parts supplier system

In this case, there are also some domestic auto parts companies hoping to expand their business scale through listing, so as to improve their right to speak with their superior suppliers.

It is difficult to increase profits in 2021

On May 19, Zhejiang Shenghuabo Electric Co., Ltd. (hereinafter referred to as "Shenghuabo"), an auto parts manufacturer, disclosed its prospectus for listing on the main board of the Shanghai Stock Exchange, and plans to raise 402 million yuan for capacity expansion and intelligent transformation.

According to its official website, Shenghuabo's main business is the research and development, production and sales of wiper assemblies, seat motors and other auto parts.The company's customers include vehicle manufacturers such as SAIC, Great Wall Motor, and Geely Automobile, as well as parts and components suppliers such as Faurecia and Lear.Since Shenghuabo was established in December 2004, its main business has not undergone major changes.

In terms of revenue, from 2019 to 2021 (hereinafter referred to as the "reporting period"), the main business income of Shenghuabo was 1.747 billion yuan, 1.877 billion yuan and 2.439 billion yuan respectively; the net profit attributable to the parent was 175 million yuan respectively. , 192 million yuan and 210 million yuan.During the reporting period, the revenue of wiper assemblies and seat motors accounted for more than 90%, and the revenue of other components accounted for less than 10%.

Chart 2: Shenghuabo's main business revenue and proportion

Data shows that Shenghuabo's main revenue in 2021 will increase by 30% year-on-year, but the net profit attributable to the parent will only increase by 10% year-on-year.

Regarding the reason why it is difficult to increase revenue in 2021, Shenghuabo told Investor.com, "It is mainly due to the decline in the gross profit margin of the company's main business in 2021 compared with 2020."

Financial data shows that the gross profit margin of Shenghuabo's main business during the reporting period was 29%, 26% and 22% respectively.During the same period, the company's comprehensive gross profit margin dropped from 30% to 24%, which is consistent with the average comprehensive gross profit margin of comparable listed companies in the industry such as Top Group (601689.SH) and Songzhi Shares (002454.SZ).

Shenghuabo also said that among the company's two main products, the gross profit margin of the wiper assembly has been declining year by year, because the vehicle manufacturer has an "annual reduction" requirement for the purchase price of products of the same specification, and the product can only be used within a certain period of time. Sales at reduced prices; and since the second half of 2020, the price of raw materials for wiper assemblies has continued to rise, which has a negative impact on its gross profit margin; at the same time, the price of raw materials for seat motors has increased significantly, resulting in the product's gross profit margin in 2021 compared with 2020 decline.In view of the above factors, the company's main business in 2021 will encounter difficulties in increasing revenue and increasing profits.

Why does the provision for bad debts exceed 100 million year after year?

As Shenghuabo said, "the company has established stable cooperative relations with domestic vehicle manufacturers and auto parts suppliers". During the reporting period, the company's top five customers have also been stable.

According to the prospectus, the top five customers of Shenghuabo are Faurecia, SAIC, Great Wall Motor, Lear and Geely Automobile.In addition, no other company made it into the top five customers.At the same time, the sales contribution rate of the five major customers also remained stable. Among them, the sales contribution rate of Faurecia and SAIC Group exceeded 10% for three consecutive years, and the remaining three were all around 5%.

At the same time, the amount and proportion of the top five accounts receivable of Shenghuabo also correspond to its top five customers one by one.At the end of each period of the reporting period, the balance of accounts receivable of Shenghuabo was 780 million yuan, 913 million yuan and 1.07 billion yuan respectively, accounting for more than 40% of the operating income of each period.

Chart 3: Shenghuabo accounts receivable and bad debt provision

It is worth noting that during the reporting period, Shenghuabo’s annual bad debt provision was around 100 million yuan. The customers who were accrued bad debt provisions included Beiqi Yinxiang, Hafei Automobile, Brilliance Automobile, and Zotye Automobile.

According to multiple media reports, these companies are currently in bankruptcy or reorganization proceedings.Shenghuabo said frankly, "The company's single provision for bad debts mainly comes from downstream vehicle manufacturing customers, (these customers) due to poor operation, this part of the accounts receivable is not expected to be recovered."

Although accounts receivable are high, Shenghuabo believes that "the company's downstream customers are mainly large domestic automakers and world-renowned multinational auto parts suppliers, and the main objects of accounts receivable have strong capital strength and credit records. Good, and the company has established long-term and stable cooperative relations with these customers, and the risk of bad debts is relatively small."

It is planned to raise 400 million only to expand production capacity

The purpose of fundraising shows that Shenghuabo plans to raise 402 million yuan in this IPO, of which 178 million yuan will be used for the annual production of 4.5 million sets of wiper expansion projects, 173 million yuan will be used for the annual output of 15 million sets of seat motor expansion projects, 50.95 million yuan was used for the intelligent transformation project of key components of the wiper assembly.

Figure 4: Details of Shenghuabo's IPO fundraising purposes

Shenghuabo told Investor.com, "The company's existing production capacity can no longer meet the needs of the company's future business development, and the capacity utilization rate is at a high level."

Financial data shows that among the two main products of Shenghuabo, the capacity utilization rate of wiper assemblies will increase from 86% in 2019 to 99% in 2021, and the capacity utilization rate of seat motors will increase from 92% to 96% in the same period.

As for how to digest the new production capacity, Shenghuabo said that the target customers of this fundraising project are the same as the company's existing customer groups, and the company will further explore new product supporting projects for existing customers and actively explore domestic New customers in foreign markets have laid a solid foundation for capacity digestion.

Before this, Shenghuabo has also invested a lot of money to increase production capacity.Financial data shows that the net cash flow of Shenghuabo due to investment activities during the reporting period was -0.99 billion yuan, -255 million yuan and -141 million yuan respectively.

Why has net investment cash flow increased significantly?Shenghuabo told "Investor.com" that in order to increase production capacity and deepen mechanization and intelligence, the company invested in the construction of Shenghuabo's Chuzhou and Zhejiang Tebo factories and new production lines during the reporting period, so it paid a lot of investment funds. Net cash flows from investing activities tend to be outflows.

It is worth mentioning that Shenghuabo currently has abundant cash flow, but still plans to raise funds through IPO.As of the end of 2021, Shenghuabo's monetary funds and trading financial assets totaled about 76.8 million yuan, a year-on-year increase of 96% from 39.21 million yuan at the end of 2020.Shenghuabo said that the company attaches great importance to prudent cash flow management and will reasonably expand production capacity according to relevant capital arrangements.(Produced by Thinking Finance)■

(Editor in charge: CF001)