"Investor Network" Wu Wei

Edited by Wu Yue

"Build a home for love, let the world fall in love with Chinese ceramics!" With this slogan, in 2021, Marco Polo Holdings Co., Ltd. (hereinafter referred to as "Marco Polo") has achieved a ceramic business of 9.3 billion yuan, which is less than 10 billion yuan. One step away.Although Marco Polo is one of the best in the field of architectural ceramics in terms of revenue, it lags behind its peers such as Dongpeng Holdings (003012.SZ) and Mona Lisa (002918.SZ) in terms of capitalization.

On May 19 this year, Marco Polo submitted its prospectus, finally taking a step forward on the road to capitalization.However, in 2021, Evergrande Real Estate, which has been an important customer of Marco Polo for a long time, will experience a serious liquidity crisis. In addition, the thunderstorms of real estate companies such as Sunac Real Estate and Times Real Estate have also caused Marco Polo to receive a large amount of receivables. The account could not be recovered smoothly, and only in 2021, the company has accrued a credit impairment of 761 million yuan; Affected by this, the company has experienced a situation of increasing revenue but not increasing profits.

Will the spread of the above-mentioned real estate company risks cast a shadow over Marco Polo's initial application?

Project sales revenue declines

Marco Polo focuses on the research and development, production and sales of architectural ceramics, and is one of the largest manufacturers and sellers of architectural ceramics in China; the main products are glazed and unglazed tiles, which are eventually applied to various In the construction and decoration of buildings.As one of the largest manufacturers and sellers of architectural ceramics in China, Marco Polo's main customers include large real estate companies, construction companies, building materials operated by dealer channels, and small and medium-sized decoration companies.

According to reports, as of the end of 2021, the distribution model contributed 5.029 billion yuan in revenue to Marco Polo, accounting for 53.87% of the current total revenue; the direct sales model contributed 4.307 billion yuan in revenue to the company, accounting for 53.87% of the current revenue. was 46.13%.Among them, the engineering sales model in the direct sales model contributed 3.768 billion yuan of revenue to the company, accounting for 40.36% of the current revenue; in addition, the entrusted production sales model, trade customer sales model and retail model also contributed part of the company's revenue .

Image source: prospectus

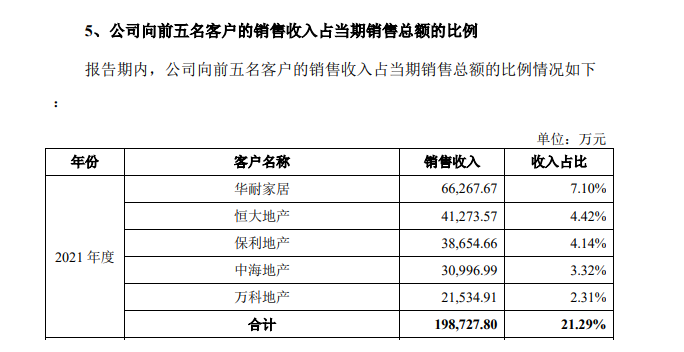

In Marco Polo's project sales model, the main customers include real estate developers, municipal projects, commercial chain projects, home improvement projects, etc.It is worth mentioning that according to Marco Polo's disclosure, in 2019 and 2020, three of Marco Polo's top five customers are real estate companies; Influenced by "Wonderful Decoration"), in 2021, Wonderful Decoration will withdraw from Marco Polo's top five customers list, making the second to fifth largest customers among the company's top five customers in that year all real estate companies, contributing 14.19% of the company's revenue in total .

However, in 2021, Evergrande Real Estate has a liquidity crisis, and its debt default risk shows signs of spreading to the supply chain.Marco Polo’s important competitor, Dongpeng Holdings, terminated cooperation with many real estate customers due to thunderstorms, and made a provision for credit impairment losses of 772 million yuan. In 2021, revenue fell by 81.97% year-on-year.

In addition to the liquidity crisis for some real estate clients, among Marco Polo's clients, the surviving real estate companies also began to shrink their strategies.Under this influence, Marco Polo's engineering sales revenue has also been affected to a certain extent, from 4.088 billion yuan in 2020 to 3.768 billion yuan in 2021, a year-on-year decrease of 7.83%.At the same time, the company also terminated the cooperation with the real estate enterprises of thunderbolt, and made a single accrual and price drop for the commodities issued to these customers.

It is worth mentioning that in order to cope with the impact of the decline in engineering sales revenue on the company's performance, Marco Polo has significantly increased sales in distribution channels in 2021.In 2020, the company's distribution revenue increased by only 10.1% year-on-year, but in 2021, distribution revenue increased by 40.2% year-on-year, driving a 9% increase in total revenue compared to 2020.

Significant impairment of assets

Affected by the liquidity crisis of a number of real estate enterprise customers, Marco Polo also made provision for 761 million yuan in credit impairment and 110 million yuan in asset impairment in 2021.But even so, as of the end of 2021, the book balance of the company's accounts receivable and notes receivable is still as high as 2.408 billion yuan, accounting for 29.98% of the current assets.Affected by asset impairment, although revenue in 2021 will increase by 15.19% compared to 2019, its net profit will only increase by 1.54% in the same period.

Image source: prospectus

In 2021, Marco Polo made a single provision for bad debts for accounts receivable with Sunac Real Estate, Sunshine City, Times Real Estate and other real estate companies, but there was no Evergrande Real Estate.During the period from 2019 to 2021, the transaction volume between Marco Polo and Evergrande Real Estate was as high as 2.255 billion yuan.

It is understood that as of a few days ago, Evergrande Real Estate has had a serious debt default.The peer company Dongpeng Holdings mentioned in its 2021 annual report that "a relatively sufficient impairment provision (total 772 million yuan) has been made for a large real estate company", without mentioning the name of the company; The real estate strategic engineering business accounts for about 10% of the main business revenue”, and “(the real estate company) average annual business volume accounts for about 3% of the total sales” and the top five receivables disclosed in Dongpeng Holdings’ 2020 annual report Judging from the list of account customers, the "a large real estate company" mentioned by Dongpeng Holdings may be Evergrande Real Estate.

In 2021, among the top five accounts receivable at the end of the period collected by Dongpeng Holdings according to the arrears, the provision for impairment of accounts receivable from customers 1, 2 and 5 in default is generally 80%. about.Coincidentally, after the thunderstorm of Evergrande Real Estate, many suppliers have made a high proportion of credit impairment on their accounts receivable.Customized home furnishing companies such as Piano (002853.SZ) and Wole Home Furnishing (603326.SH) have provided credit impairment of about 80% of Evergrande-related accounts receivable.

Of course, there are also companies like Oriental Yuhong (002271.SZ), whose provision for impairment of accounts receivable with Evergrande is only 5.31%, but before that, Oriental Yuhong (002271.SZ) has received The full amount of real estate provided by Evergrande Real Estate is used as a mortgage, and the corresponding legal procedures for the mortgage have been completed, so there is no need to accrue the full amount.However, in the prospectus submitted by Marco Polo on May 19, Investor.com did not find any statement that customers provided real estate mortgages or mortgages with real estate.Therefore, it remains to be seen whether its provision for accounts receivable from some real estate customers is sufficient.

In fact, the credit and asset impairment losses caused by thunderstorms in housing companies have already had a certain impact on Marco Polo's earnings.From 2019 to 2020, Marco Polo's credit and asset impairment losses were as high as 1.757 billion yuan, which is close to the single-year net profit of 1.9 billion yuan in the above two years.

In fact, before Marco Polo submitted its prospectus, the rumors that it planned to "backdoor" Stone (603838.SH) for listing had already spread in the market.It is understood that Stone Co., Ltd. is mainly engaged in daily-use ceramics, sanitary ceramics and art ceramics, etc., and is in the same industry as Marco Polo.In July 2021, Huang Jianping, the actual controller of Marco Polo, took control of Stone shares through a tender offer, so the market once believed that Marco Polo might “backdoor” Stone shares to go public.

However, with the submission of Marco Polo's prospectus, the possibility of its "backdoor" listing is unlikely, but the thunderstorms of real estate customers have resulted in the reduction of project sales revenue and the adverse impact of large asset impairments, which may cast a shadow on its initial application. shadow.In the face of the follow-up impact of thunderstorms for real estate customers, Marco Polo needs to change the company's revenue structure while controlling credit risks, and find new growth points for the company.(Produced by Thinking Finance)

(Editor in charge: CF001)