On June 13, local time, affected by concerns about a U.S. economic recession, the three major U.S. stock indexes continued to plummet after June 10.On the same day, the US Dow Jones IndustrialAveragefell 876.05 points, or 2.79%, to 30516.74 points; the S&P 500fell3.88% to 3749.63 points, and the Nasdaqfell4.68% to 10809.23 points.Among them, the S&P 500 fell nearly 4%, the lowest level since March 2021, and has fallen more than 21% since January, entering a bear market range (that is, falling more than 20% from the high).

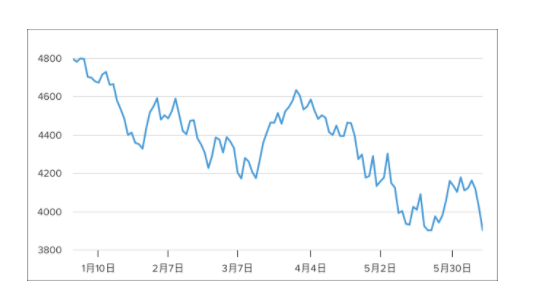

The S&P 500's trend so far this year

The US "Wall Street Journal" reported that the Federal Reserve was considering raising interest rates by 0.75% on Wednesday, which was higher than the expected 0.5%, triggering the market to hit a low half an hour before the close.Meanwhile, investors are still digesting a worse-than-expected U.S. inflation report on the 10th and are bracing for a rate hike.

Also, the tech-heavy Nasdaq fell to its lowest level since November 2020 as recession fears intensified, with tech stocks including Netflix, Tesla and Nvidia falling more than 6%.All major sectors of the S&P 500 were down.

(CCTV reporter Xu Dezhi)On June 13, local time, affected by concerns about a U.S. economic recession, the three major U.S. stock indexes continued to plummet after June 10.On the same day, the US Dow Jones IndustrialAveragefell 876.05 points, or 2.79%, to 30516.74 points; the S&P 500fell3.88% to 3749.63 points, and the Nasdaqfell4.68% to 10809.23 points.Among them, the S&P 500 fell nearly 4%, the lowest level since March 2021, and has fallen more than 21% since January, entering a bear market range (that is, falling more than 20% from the high).

The S&P 500's trend so far this year

The US "Wall Street Journal" reported that the Federal Reserve was considering raising interest rates by 0.75% on Wednesday, which was higher than the expected 0.5%, triggering the market to hit a low half an hour before the close.Meanwhile, investors are still digesting a worse-than-expected U.S. inflation report on the 10th and are bracing for a rate hike.

Also, the tech-heavy Nasdaq fell to its lowest level since November 2020 as recession fears intensified, with tech stocks including Netflix, Tesla and Nvidia falling more than 6%.All major sectors of the S&P 500 were down.

(CCTV reporter Xu Dezhi)