Recently, Shandong Huge Oral Materials Co., Ltd. (hereinafter referred to as "Huge Oral") was suspended from the Shenzhen Stock Exchange due to the expiration of the financial data in the application documents. 's application.

In this IPO, Huge Dental plans to raise funds of 402 million yuan, which will be used for the industrialization project of digital oral medical devices, the project of the oral digital technology research and development center and supplementary working capital.

It is worth noting that Huge Mouth has changed sponsors three times and sought to be listed, and the company's road to listing has been "twisted and twisted". The company's main product, synthetic resin teeth, has attracted much market attention. Synthetic resin teeth are often referred to as "dentures", with a high gross profit margin and an average cost of about 0.23 yuan. In addition, Ye Qiulong, one of the founders of Huge Dental, has twice "take over" the insolvent subsidiary. Due to the above-mentioned equity sale, the company will generate investment income of 1.0786 million yuan and 6.9574 million yuan in 2019 and 2020 respectively.

The gross profit rate of "dentures" is relatively high and the average cost is about 0.23 yuan

Huge Dental was established in 2006. The company is engaged in the research and development, production, sales and service of oral medical device products. The company's main products are divided into three categories: clinical products, technical products and invisible orthodontic systems. Mainly used in oral restoration, implantation, orthodontics and other treatment processes.

In terms of financial data, during the reporting period from 2018 to 2020 and the first half of 2021, Huge Dental achieved operating income of 228 million yuan, 261 million yuan, 233 million yuan and 126 million yuan, and net profit of 26.8072 million yuan and 299.630 million yuan respectively. 10,000 yuan, 40.629 million yuan and 25.3146 million yuan.

Previously, Huge Dental had changed sponsors three times and sought listing. In April 2015, Huge Mouth was listed on the New Third Board and delisted two years later. In July 2017, the company plans to be listed on the Growth Enterprise Market. In January 2019, the company voluntarily terminated the application for listing on the Growth Enterprise Market and terminated the counseling agreement with China Merchants Securities. In the same year, Huge Mouth moved to the Science and Technology Innovation Board, and the sponsor was Haitong Securities. However, in less than a year, the company terminated the listing guidance again. Until December 2021, the company once again entered the GEM, and the sponsor was replaced by Zhongyuan Securities.

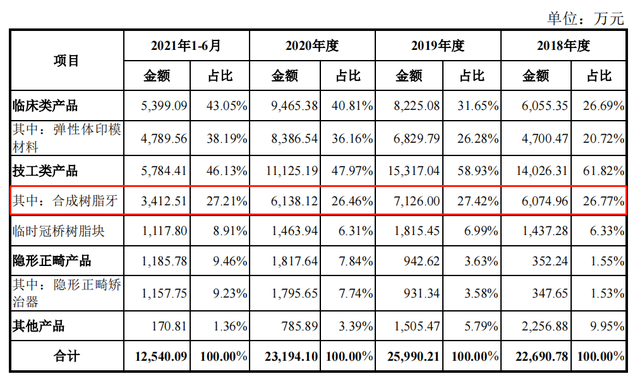

In terms of main business, the main business income of Huge Dental mainly comes from clinical products and technical products. During the reporting period, the total revenue of the above two types of products accounted for 88.50%, 90.58%, 88.78% and 89.18% respectively.

Among the technical products, the company's synthetic resin teeth have attracted much market attention. Synthetic resin teeth are used to make full removable dentures, partial removable dentures and temporary implants. Dentures are often referred to as "dentures". During the reporting period, the company's income from synthetic resin teeth was 60.7496 million yuan, 71.2600 million yuan, 61.3812 million yuan and 34.1251 million yuan, accounting for 26.77%, 27.42%, 26.46% and 27.21% of the main business income in the same period. .

In addition, synthetic resin teeth are products with higher gross profit margins in Huge oral cavity. During the reporting period, the average gross profit margin of synthetic resin teeth was 74.98%. Meanwhile, the average unit cost of synthetic resin teeth is about 0.23 yuan.

The founder "takes over" the insolvent subsidiary twice

It is worth noting that Ye Qiulong, one of the founders of Huge Dental, has twice taken over the insolvent subsidiary, which has attracted market attention. Due to the above-mentioned equity sale, Huge Dental will generate investment income of 1.0786 million yuan and 6.9574 million yuan in 2019 and 2020 respectively.

In November 2006, Rizhao Huge Dental Industry Co., Ltd. (hereinafter referred to as "Huge Co., Ltd."), the predecessor of Huge Dental, was jointly established by Qingdao Lanxin Holdings Co., Ltd. and Brunei Hongjing International Trade Co., Ltd. When Huge Co., Ltd. was established, Qingdao Lanxin was an enterprise controlled by Song Xin, the actual controller of Huge Dental, and Brunei Hongjing was a wholly-owned holding company of Ye Qiulong.

In September 2014, Huge Co., Ltd. carried out the joint-stock system reform and changed into a joint-stock company as a whole. At that time, Brunei Hongjing controlled by Ye Qiulong had disappeared from the list of shareholders. As of December 22, 2021, the actual controller of Huge Dental is Song Xin, who directly holds 23.47% of the company's shares, and Song Xin actually controls 62.51% of the company's voting rights.

According to the prospectus, in March 2018, Huge Mouth acquired a 60% stake in CMP held by Irvine for $550,000. Irvine is a wholly-owned U.S. subsidiary of Qingdao Lanxin, and Song Xin, the actual controller of Huge Dental, is the controlling shareholder of Qingdao Lanxin and serves as an executive director. This equity transfer is a business combination under the same controller, and the above transactions constitute connected transactions and Major asset restructuring.

From 2018 to 2019 and the first half of 2020, the operating income of CMP company decreased year by year, and the company's net profit continued to lose money. The company sold 60% of its equity in CMP company in June 2020. Regarding the decline in CMP's performance and net profit loss, Huge said, "The main reasons are the continuous decline of the company's export business, the unreasonable product structure, the low overall operation and production efficiency caused by the aging of employees, and the impact of factors such as the new crown epidemic."

In June 2020, Huge Oral sold its stake in CMP to LDP at a price of US$500,000. The only shareholder of LDP is Ye Qiulong, one of the founders of Huge Oral. The prospectus shows that in the first half of 2020, CMP was insolvent, and the company's net assets were -4.9097 million yuan. Due to the above-mentioned equity sale, Huge Dental will generate an investment income of 6.9574 million yuan in 2020.

In addition, one of the founders of Huge Dental also took over another wholly-owned subsidiary of the company that was insolvent. In June 2019, Huge Mouth transferred 100% of its wholly-owned subsidiary ODP to LDP at a price of US$100,000. Like CMP Company, ODP Company was also facing insolvency at that time. The year before ODP was sold (2018), its net assets were -43,900 yuan. Due to the above equity transfer, in 2019, Huge Dental formed an investment income of 1.0786 million yuan.

China Net Finance will continue to pay attention to the progress of Huge oral IPO.