Financial Associated Press, June 28 (Reporter Fu Jing) ST Rongtai (600589.SH), who finally responded to the Shanghai Stock Exchange's annual report inquiry letter after four extensions, was inquired a second time.

ST Rongtai faces many doubts about the accounts receivable management system, the occupation of funds of listed companies by the controlling shareholder and other related parties, the provision for bad debts of prepayments, and the provision for impairment of goodwill.Even so, the company's extraordinary shareholders' meeting on June 27 voted to approve the proposal to establish a subsidiary through foreign investment, and the plan behind it has yet to be revealed.

In terms of performance, the company has been losing money for three consecutive years. Last year, revenue "shrinked" by nearly 30%, and the gross profit margins of the two major businesses were negative.Based on factors such as the occupation of funds by related parties of the listed company and the authenticity of accounts receivable in Jieyang, the accounting firm issued a "non-standard" opinion on the company's 2021 annual report, and its annual report has been issued with reservations for two consecutive years.Recently, the website of Guangdong Securities Regulatory Bureau also announced the decision to take corrective measures against ST Rongtai.

The gross profit margin of the main business is negative for three consecutive years

Financial data shows that the company will achieve revenue of 780 million yuan in 2021, a year-on-year decrease of 27.02%; the net profit attributable to the parent is -709 million yuan, a year-on-year increase of 42.15%.2019 is the first time that it has suffered a loss since its listing. The scale of the loss in 2021 will almost double year-on-year, and the company's revenue will continue to shrink from 2019 to 2021.

It is reported that the net loss in 2020 will exceed 800 million yuan due to the provision of various impairment provisions, accounting for more than 60%.For the 2021 annual report, whether the provision for bad debts of prepayments and the provision for impairment of goodwill is reasonable has also become the focus of the Shanghai Stock Exchange.

ST Rongtai takes chemical industry and Internet comprehensive services as its two main businesses.In terms of gross profit margin, chemical gross profit margin was -3.14%, down 15.99% year-on-year; Internet comprehensive gross profit margin was -17.10%, down 26.09% year-on-year.Based on this, the Shanghai Stock Exchange asked it to explain why the relevant data indicators have fallen sharply.

ST Rongtai said that in 2021, under the background of the impact of the epidemic and the unfavorable international trade situation, the company is under the double pressure of rising upstream raw material costs and reduced downstream customer demand, and the chemical business is difficult to operate. Its main products are ML material products and modified polymer products. Both the production and sales of vinyl chloride declined; in terms of comprehensive Internet services, the company's advantages in multi-line bandwidth services were weakened, and due to the impact of the epidemic, large customers could not expand.

Previously, a reporter from the Financial Associated Press learned through the company's performance meeting that because the chemical business's domestic production and competitive advantages are gradually decreasing, the company plans to gradually and orderly withdraw from the investment and operation of the chemical sector while stabilizing the existing chemical business operation capabilities.

The Cailian News reporter particularly noticed that its comprehensive Internet segment is mainly affected by the cabinet bandwidth link business. The unfavorable factors of this business are the rising cost of IDC business leasing, the loss of high-margin stock customers, and the expansion and introduction of large customers, resulting in a significant increase in costs.The company pointed out, "The new customers are mainly mobile phone manufacturers. The gross profit margin of such customer cabinet leasing business is relatively low. As of December 2021, the gross profit margin is about 3.42%. The original customers are mainly Kuaishou, Meitu, OPPO, Baofengyingyin and Tianyu. Cloud and other video, audio and game industries.”

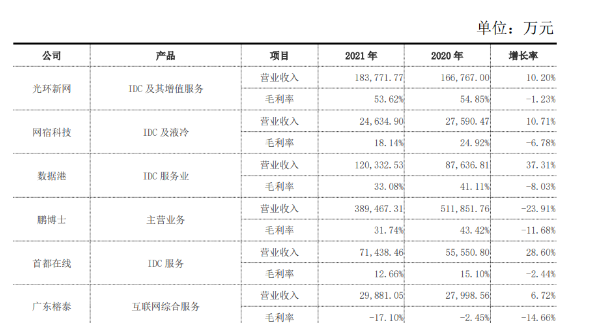

Compared with several listed companies in the IDC industry cited by ST Rongtai, Sinnet (300383.SZ) related businesses have a gross profit margin of 53.62%, while ST Rongtai is the only company with a negative gross profit margin, with the largest year-on-year decline. Significantly.

(Tuyuan company's annual report inquiry letter reply)

The accountant's special report pointed out that "the profitability of the company's existing main business has not seen a fundamental improvement." The company's other performance indicators are not very satisfactory. For example, the net assets at the end of 2021 are only 82.0381 million yuan, which is significantly higher than 1.546 billion yuan in 2020. A decrease of 94.69%, of which the undistributed profit changed by 509 million yuan due to large losses; the termination of the equity transfer of Jiafu Industrial Co., Ltd. and its reconsolidation led to a decrease of 954 million yuan in capital reserves.

At the same time, it is worth noting that the lawsuits caused by the overdue debts of the company have resulted in frequent seizures of assets such as the freezing of the company's bank accounts and the land use rights used for mortgage.The reporter sorted out and found that based on this, the company faces repayment of the principal of 624 million yuan and interest, penalty interest, compound interest, and bears litigation costs such as case acceptance fees, property preservation fees, and case application execution fees, which may be detrimental to its performance in 2022.

The 2021 annual report occupied by the controlling party was "non-standard"

Previously, the accounting firm issued a "non-standard" opinion on the company's 2021 annual report, mainly due to the occupation of funds by related parties of the listed company and the authenticity of accounts receivable in Jieyang.

In terms of capital occupation of related parties, in 2021, Yang Baosheng, the actual controller, formed non-operating funds of 912 million yuan through Jieyang Dewang Plastic Co., Ltd. and Jieyang Huiming Chemical Plastic Co., Ltd. under his control, and the balance at the end of the period was 912 million yuan. 328 million yuan, accounting for 400.43% of net assets.As of June 18, 2022, the company's controlling shareholder and its related parties have returned a total of 194 million yuan of occupied funds, and the remaining unreturned balance is 135 million yuan.

The accounting firm pointed out through a special report that "the company has not effectively implemented the internal control system related to preventing the controlling shareholder and other related parties from occupying funds, and cannot obtain sufficient and appropriate audit evidence."

In the face of inquiries from the Shanghai Stock Exchange, the company said that the above-mentioned two companies have relatively small business scale and poor operating performance, and the repayment ability of funds is not sufficient, but the above-mentioned occupied funds are actually dominated by Yang Baosheng, and Yang Baosheng needs to give It is expected to repay the remaining occupied funds before June 30, 2022.A reporter from the Financial Associated Press called the company's securities department as an investor on the 27th. The relevant person in charge told the reporter, "We have signed a repayment plan, and it is completely as planned at present, and we have been urging the controlling party to return it."

The accounting firm also pointed out that there are major deficiencies in the company's accounts receivable management system, resulting in the inability of a large number of customers to collect payments in a timely manner, which has a significant adverse impact on the authenticity of the relevant business.At the end of 2021, the company's accounts receivable from chemical business customers in Jieyang area was 562 million yuan, and the bad debt provision balance was 198 million yuan, corresponding to the realized revenue of 353 million yuan. However, in 2021, the turnover of accounts receivable from customers in Jieyang area was 0.55 times. Significantly lower than the 1.74 times in other regions, the accountant was not able to obtain the above-mentioned circulation documents during the sales of goods.

According to the company, the industries to which relevant customers belong are mainly concentrated in the rubber and plastic products industry and footwear industry, etc., which have been seriously affected by the epidemic. In addition, there are factors such as blocked exports and high export costs, and the credit risk of some customers has increased significantly.

In addition, the reporter noticed that due to the fact that the related party's capital occupation has not gone through the approval procedures, and has not been disclosed in a timely manner, and Yang Baosheng has not fulfilled his duty of diligence, the Guangdong Securities Regulatory Bureau recently decided to take administrative supervision measures to order ST Rongtai and Yang Baosheng to make corrections; Failure to disclose major lawsuits and progress in a timely manner, and the inaccurate and timely correction of the 2021 performance forecast, the Guangdong Securities Regulatory Bureau issued a warning letter to ST Rongtai, Yang Baosheng, and Wu Zhiping (then chief financial officer).It is reported that on May 21, 2020, ST Rongtai was investigated by the China Securities Regulatory Commission. It is the first A-share company to be punished by the discretionary standards of the new securities law.