Produced | Sohu Finance

Author | Wei Ru

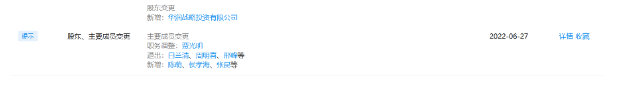

On June 28, Sohu Finance found from the company's investigation that after China Resources Strategic Investment officially held a 49% stake in Anhui Golden Seed Group Co., Ltd. (hereinafter referred to as "Golden Seed Group"), the relevant industrial and commercial information has been officially registered.

Among them, the senior management and shareholder members were adjusted.Jia Guangming stepped down as the general manager of the group and only served as the chairman of the group. The new general manager was served by "China Resources Department" Chen Meng.

Image source: Qichacha

Eleven former directors and supervisors of Golden Seed Group, including Bai Lanqing, Zhou Mingxi, and Xing Feng, withdrew, CR Snow CEO Hou Xiaohai, CR Snow Chief Financial Officer Wei Qiang, and Fuyang CR Power Chief Zhang Kun served as group directors, and CR Snow Supervisor Li Xiaodong served as Jin Supervisor of Seed Group.

After the above-mentioned personnel transfer is completed, it also marks the official entry of China Resources senior executives into the Golden Seed Group.There are currently 7 directors, supervisors and high schools in the Golden Seed Group, and 5 senior executives from the "China Resources Department". In addition to the chairman of the Golden Seed Department, Jia Guangming, the board of directors has only one director, Wu Yongbin.

It is reported that a large proportion of senior executives are stationed, which is not common in the wine companies invested by China Resources.

According to public information, in February 2018, Fenjiu Group transferred 11.45% of its shares in Shanxi Fenjiu to Huachuang Xinrui, a holding company of China Resources Venture. Later, due to Shanxi Fenjiu’s expansion of the share capital, Huachuang Xinrui held the same number of shares and held the same number of shares. Shares fell to 11.38%.

According to the 2021 annual report of Shanxi Fenjiu, among its 25 directors, supervisors and senior high schools, only 2 "China Resources Department" such as Chen Ying, assistant general manager of China Resources (Group) Co., Ltd., and Yu Zhongliang, senior strategic expert of China Resources Group's strategic management department of China Resources (Group) Co., Ltd. "Senior executives, respectively serving as vice chairman and director of Shanxi Fenjiu.

On August 26, 2021, China Resources Beer announced that it plans to invest in Shandong Jingzhi Liquor Co., Ltd. (hereinafter referred to as "Jingzhi Liquor Company"), a subsidiary of Shandong Jingzhi Liquor Co., Ltd. (hereinafter referred to as "Jingzhi Liquor"). ) into the Chinese liquor business.

According to the company's investigation, Jingzhi Liquor Company was established on May 8, 2021. At present, Hou Xiaohai is the legal representative and chairman, and is the ultimate beneficiary.Among the controlling shareholders, Jingzhi Wine Industry and Huachuang Beverage Trading Co., Ltd. each hold 40% of the shares, Jiaxing Dinghui Zunke Equity Investment Partnership (Limited Partnership) holds 17.9646%, and British Autumn Eternity Limited holds 2.0354%.

After China Resources officially entered Jingzhi, the legal representative of Jingzhi Liquor Company was changed from Lai Angui, general manager of Jingzhi Liquor Industry, to Hou Xiaohai. Lai Angui and Wang Fenghui resigned as the main members of the company. Among the 11 new directors, supervisors and high schools, only Hou Xiaohai He and Zeng Shenping are from the "China Resources Department" and serve as the chairman and director respectively.

In contrast, this is the only liquor company in the China Resources Liquor territory that currently has a large proportion of senior executives.

On February 16 this year, China Resources Department of liquor sector took another step, and invested in Golden Seed Wine.

According to the announcement issued by Golden Seed Wine, Fuyang Investment, a shareholder of the controlling shareholder Golden Seed Group, intends to transfer 49% of the shares held by Golden Seed Group to China Resources (Group) Co., Ltd.'s wholly-owned subsidiary China Resources Zhan by means of a non-public agreement transfer. cast.

After the equity transfer is completed, Fuyang Investment Development and China Resources Strategic Investment will hold 51% and 49% of the shares of Golden Seed Group respectively, which will not lead to changes in the company's controlling shareholder and actual controller.

According to the 2021 annual report of Golden Seed, its revenue was about 1.211 billion yuan, a year-on-year increase of 16.70%; the net profit attributable to shareholders of listed companies was about -166 million yuan, a year-on-year decrease of 339.76%, and about 69.4061 million yuan in the same period last year.

In the opinion of Baijiu marketing expert Cai Xuefei, China Resources' move may be aimed at replicating Fosun's investment path. While investing in capital, it also deeply intervenes in management.At present, although Golden Seed is in a trough period, no matter from the capital market or the sales market, it is located in the East China market, has the genes of famous wine, and the production capacity of old wine is relatively sufficient. It is expected that its rebound potential will be great.

At the same time, the Golden Seed Group also changed its business scope.In addition to the original liquor production and operation, plastic products, paper products and metal packaging, etc., new drug production, wholesale, retail, and intelligent agricultural management are added.