"China Science and Technology Investment" Zhang Ting Long Qiuyue

Recently, a number of users reported to reporters that after applying for a consumer loan from Home Credit Consumer Finance Co., Ltd. (hereinafter referred to as "Home Credit Consumer Finance"), they found out when checking the details of the specific loan contract that in addition to paying the loan interest, they also paid the loan interest. There are various fees such as customer service fees, flexible guarantee service package fees, etc. to be paid.The consumer loan interest rate announced on the official website of Home Credit is 24% of the annualized comprehensive interest rate and simple interest, while the converted annualized comprehensive interest rate shown in the actual loan contract is generally 32%-36%.Users questioned that Home Credit has pushed up the comprehensive rate level by charging customer service fees and other fees in disguise.

In addition, in 2019, relying on a wide range of offline business layout, Home Credit Consumer Finance achieved an asset scale of 104.536 billion yuan, leaping to the top licensed consumer financial institution in China.At the end of 2020, the size of Home Credit's assets fell to 65.207 billion yuan, a year-on-year decrease of 37.62%.Earlier, Lianhe Credit issued an announcement saying that after comprehensive consideration, it was decided to include the main body of Home Credit Consumer Finance and "19 Home Credit Consumer Finance Bond 01" on the credit rating watch list.

The comprehensive loan rate breaks through the regulatory red line

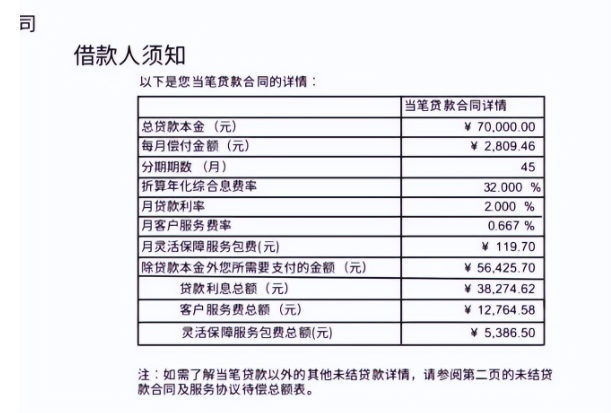

The user Mr. Liu reported to reporters that he borrowed 70,000 yuan from Home Credit for decoration on April 25, 2019, and repaid it in 45 installments, with each repayment of 2,809.46 yuan.In addition to paying the loan interest of 38,274.62 yuan, Mr. Liu also needs to pay a customer service fee of 12,764.58 yuan and a flexible security service package fee of 5,386.5 yuan, which is converted to an annualized comprehensive interest rate of 32%.

*Mr. Liu's loan contract details

"At that time, the loan officer said that if you choose to purchase a flexible security service package, you can reduce a lot of interest by repaying in advance, so I did it," Mr. Liu told reporters.In fact, Mr. Liu's choice of early repayment shows that the deductible interest is only about 3,000 yuan, which is less than the flexible guarantee service package fee.According to relevant information on the official website of Home Credit, at present, the flexible guarantee service package service has been offline.

Previously, Mr. Liu called Home Credit to apply for negotiated repayment, but he was unable to get through the phone normally in the early stage.Until recently, Mr. Liu successfully called Home Credit, and the company's customer service replied that the interest fee could not be reduced or exempted, and overdue repayment would affect personal credit.After Mr. Liu complained to the third-party platform, the customer service responded that he suggested that Mr. Liu go to the sub-district office to apply for a low-income certificate, which can be used as the basis for interest reduction and exemption, and try to apply for interest reduction or exemption for him.

On the whole, the consumer loan interest rate announced on the official website of Home Credit is 24% of the annualized comprehensive interest rate and simple interest, but users report that the actual converted annualized comprehensive interest rate in their loan contracts is generally 32%-36%. Therefore, users questioned that Home Credit has pushed up the comprehensive rate level by charging customer service fees and other fees in disguise.

The "Several Opinions of the Supreme People's Court on Further Strengthening Financial Trial Work" (hereinafter referred to as the "Opinions") stated that the people's courts should strictly regulate usury in accordance with the law, and set an annualized 24% for the upper limit of interest rates for financial institutions.If the borrower requests a reduction of the part exceeding 24% of the annual interest rate on the grounds that the interest, compound interest, penalty interest, liquidated damages and other expenses claimed by the lender at the same time are too high and significantly deviate from the actual loss, it shall be supported.On July 29, 2021, there was news in the industry that according to the window guidance of the regulatory authorities, consumer finance companies, banks and other financial institutions in various places should fully control the personal loan interest rate within 24%.

As early as 2015, the "Regulations on Several Issues Concerning the Application of Law in the Trial of Private Lending Cases" (hereinafter referred to as the "Regulations") were released. The Supreme People's Court divided the loan interest rate into "two lines and three districts", of which the annualized interest rate was 24%. Debts in the -36% range are natural debts, and the law for the debtor to pay is not prohibited, and the law for the creditor to request compulsory performance is not protected.In August 2020, the Supreme People's Court issued the newly revised "Regulations" to uniformly set the upper limit of the private lending interest rate at 4 times the LPR interest rate.

Han Lu, a financial technology researcher, told the reporter of "China Science and Technology Investment", "It is a common phenomenon for consumer finance companies to charge borrowers for service fees, but in general it does not meet the regulatory direction of reducing borrowers' interest rate burden. Calculated according to the comprehensive rate, charged Various service fees have indeed pushed up borrowers' borrowing costs. The "Opinions" also stipulates that if the total amount of interest, compound interest, penalty interest, liquidated damages and other expenses exceeds the annualized 24%, it should be reduced and adjusted. Support. At present, many courts have supported the reduction or exemption of part of the fee rate of more than 24%. The supervision window for licensed consumer gold companies guides the IRR to be controlled at 24%, and many institutions are gradually making adjustments. "

In addition, the user Mr. Li also reported to the reporter of "China Technology Investment" that in recent years, he had applied for several loans from Home Credit, and after repaying all the company's loans in March this year, he and his wife continued to Received the collection call and text message from Home Credit, and said that Mr. Li still needs to repay 3,540 yuan.In this regard, Mr. Li was puzzled and called the official customer service number of Home Credit several times, but he was not connected. At present, Mr. Li can only publish complaint information on multiple platforms to protect his rights.

*Mr. Li's loan settlement certificate and the collection text message received, the picture is provided by the interviewee

Asset size has shrunk significantly

It is understood that among the 30 consumer finance companies established in China, only Home Credit Consumer Finance has yet to announce its 2021 performance report.According to the "2020 Audit Report of Home Credit Consumer Finance", as of the end of 2020, the size of Home Credit Consumer Finance's assets was 65.207 billion yuan, a year-on-year decrease of 37.62%; the net loan and debt scale were 57.632 billion yuan and 53.761 billion yuan, respectively There was a contraction at the end of last year.Previously, Home Credit mainly relied on offline channels for business expansion. In 2019, its asset scale reached 104.536 billion yuan.

However, due to the impact of the new crown epidemic, the credit scale of Home Credit, which relies on the offline business layout, has shrunk significantly, and both operating income and profitability have declined.According to the information disclosed in the company's annual report, from 2018 to 2020, the operating income of Home Credit Consumer Gold was 18.516 billion yuan, 17.322 billion yuan, and 11.232 billion yuan, respectively, up 39.69%, -6.45%, and -35.16% year-on-year; net profits were 1.396 billion yuan, 1.14 billion yuan, and 136 million yuan, up 36.56%, -18.36%, and -88.04% year-on-year respectively.

In terms of credit quality, from 2018 to 2020, the non-performing loan ratios of Home Credit Consumer Gold were 3.98%, 3.6%, and 2.8%, respectively, and overdue loans accounted for 21%, 16%, and 21.87% of total loans, respectively.Lianhe Credit pointed out in the rating announcement that the quality of credit assets has declined and the pressure on provision for provision has increased. Affected by the sharp contraction in the scale of credit, the company's operating income has declined significantly.

In addition, in 2020, the operating income of Home Credit Group, the parent company of Home Credit Consumer Gold, was 3.199 billion euros, a year-on-year decrease of 24.71%; the net loss was 584 million euros.In this regard, Home Credit Group stated that the main reason for the large-scale loss is that under the influence of the epidemic, the credit demand of Home Credit Group's major global operating areas has declined significantly, and the scale of credit business has shrunk significantly.Lianhe Credit believes that the substantial loss of the parent company may affect the parent company's support for Home Credit to a certain extent.At the same time, many senior executives of Home Credit have changed.From 2020 to 2021, important positions such as the company's chairman, general manager, and chief risk officer and general manager have all changed.

Han Lu further told reporters that the pricing structure of consumer gold products generally includes capital cost, system technology cost, bad debt cost, customer acquisition cost, data risk control cost, labor cost, etc.Home Credit Consumer Gold relied on offline operations in the early stage, and the pressure on labor costs increased; in addition, Home Credit Consumer Gold's cumbersome fees and the recent falling stock price have put it under great pressure on cost control and profitability goals.

In response to the multiple rates and operating performance of Home Credit Consumer Gold, the reporter sent a letter to Home Credit Consumer Finance. As of press time, no reply has been received.

(Editor in charge: Han Yijia)