On June 27, 176 million shares of Xiamen Rural Commercial Bank were put up for auction for the second time on the "ICBC Rong e-Purchase" platform.It is reported that the equity has suffered a pass in February this year.

In recent years, Xiamen Rural Commercial Bank has been in constant turmoil.Not only has it faced the auction of its shares many times, but also withdrew its A-share listing application at the beginning of this year, after the bank had been lined up for IPO for more than four years.At the same time, the bank's revenue and net profit have declined for two consecutive years. Last year, the net profit attributable to the parent company fell by more than 15% year-on-year, and the asset quality also deteriorated.

176 million shares face the second auction

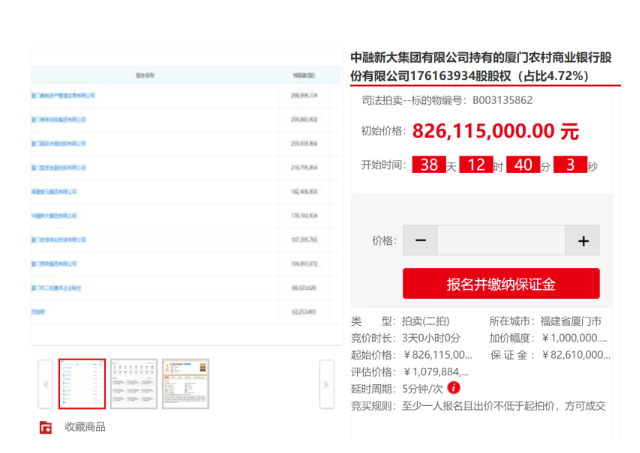

The Rong e-purchase platform shows that the Shanghai No. 2 Intermediate People's Court will auction 176 million shares of Xiamen Rural Commercial Bank held by Zhongrong Xinda Group Co., Ltd. from August 6 to August 9 this year, with a starting price of 826 million yuan. , 4.69 yuan per share.

With the decline in the number of shares held by Fujian Aoyuan Group, Zhongrong Xinda has risen from the sixth largest shareholder of Xiamen Rural Commercial Bank to the fifth largest shareholder last year, holding 176 million shares, with a shareholding ratio of 4.72%. Shares are frozen.Therefore, Zhongrong Xinda's auction of Xiamen Rural Commercial Bank's equity is a clearance auction.

According to the bidding announcement, the appraisal price of the above-mentioned shares of Xiamen Rural Commercial Bank is 1.08 billion yuan, or 6.13 yuan per share.In other words, the auction price is 26% off the appraisal price.

It is worth mentioning that this is the second time the above-mentioned shares have been put up for auction.Just from February 20 to February 23 this year, the equity held by Zhongrong Xinda went through the first auction with a starting price of 972 million yuan, but no bid was finally made.As a result, the price of the second auction has dropped by 15% compared with the first auction.

Tianyancha shows that Zhongrong Xinda is a dishonest company announced by the Supreme People's Court. Since August 2020, it has been listed as a dishonest person subject to execution 12 times, and there are other historical dishonesty subject to execution 5 times.

Blue Whale Finance found that in recent years, Xiamen Rural Commercial Bank has faced auctions of its equity many times.According to the Ali judicial auction platform, in July last year, the bank’s 23.6194 million shares were divided into 47 auctions, involving funds of about 102 million yuan.At the beginning of this year, Xiamen Hongxin Weiye Investment Co., Ltd., the seventh largest shareholder of the bank, split its shares into more than 190 auctions, with a starting price of over 400 million yuan.

Withdrawal of IPO filing after four years in line

Just in February this year, Xiamen Rural Commercial Bank, which had been in the IPO queue for more than four years, withdrew its A-share listing application.

It is reported that in May 2017, Xiamen Rural Commercial Bank conducted IPO guidance and filing in Xiamen Securities Regulatory Bureau.In August and November of the same year, the bank respectively disclosed two filing reports on the guidance work of China Securities Construction Investment for its IPO.On November 24 of the same year, CITIC Construction Investment pointed out in the summary report of the counseling work that it believed that Xiamen Rural Commercial Bank had met the conditions for public offering and listing.

On December 29, 2017, the bank disclosed the prospectus on the website of the China Securities Regulatory Commission, but due to the China Enterprise Hua incident, the bank pressed the pause button on its IPO and updated the prospectus again in June 2018.

Before updating the prospectus, the China Securities Regulatory Commission provided feedback on the bank's IPO application documents.The opinions raised a total of 54 issues in terms of standardization, information disclosure, and financial and accounting information.Among them, in terms of equity, the opinions cover the price and pricing situation of the issuer's previous capital increase and equity transfer and other changes, shareholders and equity transfer, internal employee shareholding and other aspects.

As of January 11 this year, the official website of Xiamen Securities Regulatory Bureau has announced the basic information of IPO companies in Xiamen, and Xiamen Rural Commercial Bank is still among them.In February, the official website of the China Securities Regulatory Commission published a "Basic Information Form of Enterprises Applying for Initial Public Offering on the Main Board of the Shanghai Stock Exchange". As of February 17, 2022, the column of Xiamen Rural Commercial Bank showed that "the withdrawal application has been received".

Two consecutive years of "double decline" in revenue and net profit

According to the official website, Xiamen Rural Commercial Bank, formerly known as Xiamen Rural Credit Cooperative Association, was officially opened on July 16, 2012.The bank currently has 63 sub-branches, 1 directly affiliated business department, and 1 specialized institution (the first inter-bank business center in the country); it has initiated the establishment of 3 village banks and Xiamen Financial Leasing Co., Ltd.

According to the bank's 2021 annual report, there are 4 shareholders holding more than 5% of the bank's shares, namely Xiamen Xiangyu Asset Management and Operation Co., Ltd., Xiamen Port Holdings Group Co., Ltd., Xiamen Construction Development Exhibition Holdings Co., Ltd., and Xiamen International Trade Financial Holdings Co., Ltd. The companies are all state-owned enterprises, holding 8.01%, 6.96%, 6.95% and 5.81% of the shares respectively.

In addition to being blocked from landing in A-shares, Xiamen Rural Commercial Bank's operating performance is not satisfactory, and its revenue and net profit have "doubled down" for two consecutive years.

According to the bank's 2021 annual report, as of the end of last year, Xiamen Rural Commercial Bank's total assets were 133.176 billion yuan, a year-on-year increase of 1.71%.In the whole of last year, the bank achieved operating income of 2.783 billion yuan, a year-on-year decrease of 16.9%; net profit attributable to the parent was 701 million yuan, a year-on-year decrease of 15.37%.

The bank's revenue and net profit in 2020 have experienced a relatively sharp decline.According to public data, the bank achieved operating income of 3.350 billion yuan in 2020, a year-on-year decrease of 8.62%; net profit attributable to the parent was 829 million yuan, a year-on-year decrease of 29.68%.

Not only that, the bank's asset quality also deteriorated last year.As of the end of 2021, the bank's non-performing loan ratio was 1.39%, an increase of 0.45 percentage points from 0.94% in 2020, and 1.01% at the end of 2019.At the same time, the provision coverage ratio was 192.59%, down 66.48 percentage points from 259.07% in 2020, and 301.74% at the end of 2019.

In terms of internal control, the bank was fined 800,000 yuan by the Xiamen Banking and Insurance Regulatory Bureau at the end of last year due to the fact that the borrower's breach of the loan contract was not discovered when it should have been discovered, and the management of some loans was not in place.In addition, he was once fined 500,000 yuan for granting working capital loans to real estate development companies, and a number of relevant responsible persons were given disciplinary action.

(Editor in charge: Guan Jing)