The founder and chairman of Huatai Insurance, Wang Zimu, will not be re-elected as a director of the eighth board of directors due to his age. The new board of directors consists of 11 people, among which Wan Feng, a veteran of the insurance industry, has become an independent director, which has attracted much attention.During his tenure at the helm, he successfully reversed the company's losses, and Tan Ning was promoted from the general manager of Xintai Life to the position of chairman.

Changes in insurance executives are as frequent as ever.

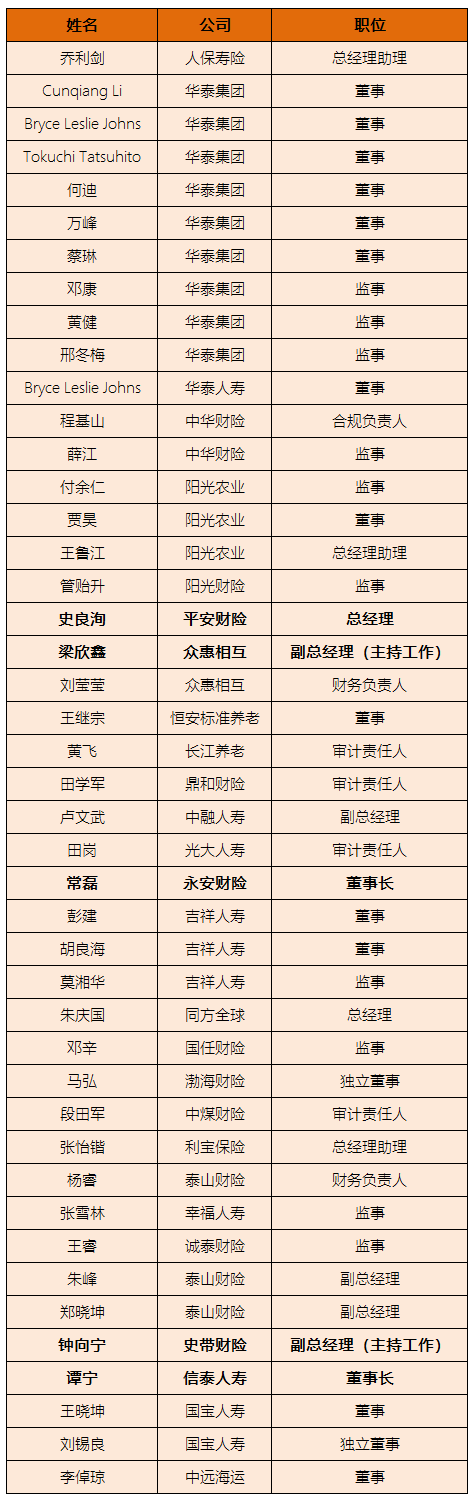

According to statistics from a reporter from the International Finance News, in the past June, the China Banking and Insurance Regulatory Commission and the China Banking and Insurance Regulatory Bureau issued a total of 92 qualifications for directors, supervisors and senior executives, involving 54 insurance companies, including 44 directors and supervisors at the headquarters of insurance companies. Gao and 48 provincial branch executives.

Among them, Tan Ning was promoted to the chairman of Xintai Life Insurance, Chang Lei, chairman of Yongan Property & Casualty Insurance, took office, Shi Liangxun was officially approved as the general manager of Ping An Property & Casualty Insurance; and two deputy general managers in charge of the work were approved, namely Zhonghuicai Liang Xinxin from Insurance and Zhong Xiangning from Starr Property Insurance; in addition, Huatai Group ushered in a new board of directors.

Huatai Insurance's board of directors changed blood

In early June, the China Banking and Insurance Regulatory Commission approved the qualifications of nine directors and supervisors of Huatai Insurance Group.Among them, Cunqiang Li, Bryce Leslie Johns, Tokuchi Tatsuhito, He Di, Wan Feng, and Cai Lin are the directors of Huatai Insurance Group, and Deng Kang, Huang Jian, and Xing Dongmei are the supervisors of Huatai Insurance Group.

The company's official website shows that the new (eighth) board of directors of Huatai Insurance Group consists of 11 people, including 2 executive directors: Zhao Minghao and Cunqiang Li (Li Cunqiang); 5 non-executive directors other than independent directors: Zhang Bei, Rainer J. Kirchgaessner, Bryce Leslie Johns, Tian Jun, Li Yanfang; 4 independent directors: Tokuchi Tatsuhito, He Di, Wan Feng, Cai Lin.

The addition of Wan Feng, a veteran of the insurance industry, has attracted much attention.Wan Feng joined the insurance industry in 1982 and has been in the industry for 40 years. He is the first life insurance cadre in the domestic life insurance industry to send overseas studies and promote actuarial technology in the industry. He has successively moved to PICC, China Life Hong Kong Branch and Taiping Life Insurance Hong Kong. Branches, China Life Insurance, New China Insurance, and Dingcheng Life Insurance will officially retire in September 2020.Recently, Wan Feng also published a new book called "Post-Critical Illness Era".

It is worth noting that, as the soul of the group, Wang Zimu, executive director and chairman of the seventh board of directors of Huatai Insurance Group, will not be re-elected as a director of the eighth board of directors due to his age.

Wang Zimu founded Huatai Property & Casualty Insurance, the first national joint-stock property insurance company in China in 1996. Since then, he has led Huatai Insurance to gradually develop from a single property and casualty insurance company into a property insurance, life insurance, asset management and fund management company. Comprehensive Insurance Group.The company has also developed from a capital of 1.3 billion yuan in the year of its establishment to a medium-to-large insurance company with a net asset of 17.8 billion yuan, total assets of 64.2 billion yuan, and management assets of 560 billion yuan (as of the end of 2021).

Recently, Wang Zimu expressed in his speech when the director of the Yabuli Entrepreneur Forum visited Huatai that he believed that the American Anda, as the world's top insurance company, would empower Huatai and push Huatai to a new stage of development.He also revealed that he will do some impact investing and public welfare after retirement.Wang Zimu is the husband of former CCTV host Jing Yidan.He said that after retirement, he will spend more time with his family and friends, earnestly live every day, and live every day well.

Xintai Life's coaching change

At the end of June, Xintai Life announced that, with the resolution of the company's board of directors and the qualification approval of the Zhejiang Regulatory Bureau of the China Banking and Insurance Regulatory Commission, from June 28, 2022, Tan Ning will serve as the company's chairman and will no longer serve as the company's general manager.At the same time, Zoupingsheng no longer serves as the chairman of the company.

According to public information, Tan Ning was born in October 1969 and is 53 years old this year. He holds a master's degree in monetary banking from Nankai University. He is the first actuary in China to obtain the qualification of a North American associate actuary, and one of the first 43 Chinese actuaries. Senior executive of Insurance, Sunshine Insurance, Yingda Taihe Life, and has nearly 30 years of experience in the life insurance industry.

In 2018, Tan Ning joined Xintai Life Insurance as the executive deputy general manager; he has been appointed as a director of the company since June 2019, the general manager of the company in August of the same year, and the chairman of the company from June 2022.

The reporter noticed that in the nearly four years that Tan Ning took the helm of Xintai Life Insurance, the company has reversed the previous situation of continuous losses and achieved profitability for four consecutive years.From 2018 to 2021, Xintai Life's net profit was 32 million yuan, 35 million yuan, 75 million yuan, and 102 million yuan, respectively.

In addition, Xintai Life Insurance has also accelerated its exploration of an independent agent model based on the optimization of traditional bancassurance and brokerage channels in recent years.On August 25 last year, the Xinhui exclusive agency of the company's independent agent Guo Huaxiang completed the registration in Shenzhen, becoming the first independent agent enterprise established by a sole proprietor in China.

However, according to the solvency report for the first quarter of 2022, Xintai Life's insurance business revenue in the first quarter was 20.39 billion yuan, with a net loss of 374 million yuan.

Xintai Life Insurance was founded on May 18, 2007, registered in Hangzhou, Zhejiang, with a registered capital of 5 billion yuan. It can operate various life insurance businesses, and holds a concurrent agency business license. It has equity, real estate and other fields. Investment ability, the annual scale premium exceeds 50 billion yuan.

Attachment 1: List of 44 Headquarters Executive Changes in June 2022 (in no particular order)