China Economic Net, Beijing,July7(ReporterKangBo)In the first half of2022 , theA -share market fluctuated significantly. According to observations,A -shares have experienced a correctionsince the beginning of the year, although afterApril, there has been a sharp rebound under the leadership of new energy and other sectors. , but unfortunately, the decline in the first quarter was relatively large, resulting in many equity funds still closing down in the first half of the year.

As of the closeonJune30, the semi-annual average returns of all equity funds were all negative.Among them, the average performance of stock funds, hybrid funds, international (QDII) andFOFduring the year was-9.44%,-7.13%,-9.32%and-4.84% respectively.

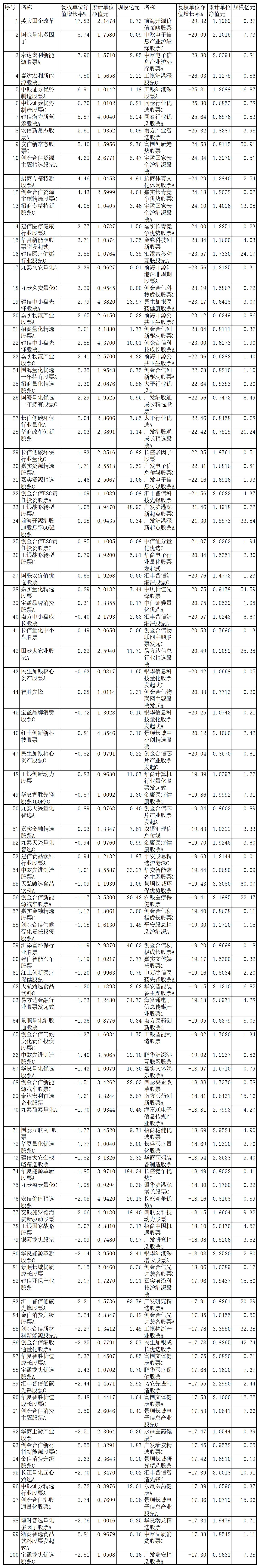

Among the 736common stock fundswith comparable data, only38 rose in performance, accounting for5%.The reform of state-owned enterprises in the United Kingdom leads the way with17.83%. If we look at the previously announced2022first quarter report, the fund mainly allocates two sectors: coal, petroleum and petrochemical. The top ten heavyweight stocks are Shaanxi Coal Industry, Pingmei Co., Ltd., Yanzhou Mining Energy, Zijin Mining, Guanghui Energy, Shanxi Coal International, PetroChina, Sinopec, Jinkong Coal, China Shenhua.In the context of the overall rise in energy prices, the energy sector, dominated by coal stocks, rose significantly in the first half of the year, which became the main reason for the fund's performance to rise.

Guojin Quantitative Multi-Factor, TEDA Manulife New Energy StockA, TEDA Manulife New Energy StockC, BOC Securities Advantage Manufacturing StockA, BOC Securities Advantage Manufacturing StockC, CCB Potential New Blue Chip StockA ,Essence New Normal StockA, Essence New A number of funds such asNormal StockCfollowed closely, and they all rose by more than5% in the first half of the year. Among them, the heavy holding stocks of many funds are upstream energy and mining companies represented by lithium batteries and coal.

For example, TEDA Manulife New Energy's first quarterly report shows that its top ten heavyweight stocks are Huayou Cobalt, LONGi Green Energy, BYD, Weilan Lithium Core, Xingyuan Materials, Zhongtian Technology, Rongjie, German Nano, Quartz, Deye Co., Ltd.; BOC Securities has a strong position in Shanxi Coking Coal, Jizhong Energy, Jianfa Co., Ltd., Zuoli Pharmaceutical, Guanghui Energy, Yunlu Aluminum Co., Ltd., Songyuan Co., Ltd., Shandong Luqiao, Hongri Pharmaceutical, Gemdale Group; CCB Potential New blue-chip heavyweight Yankuang Energy, Yihua,TCLCentral, Shaanxi Coal, Jiangsu Shentong, Pingmei, Zhenhua New Materials, AVIC Xifei, Maiwei, and Narada Power.

Regarding the future of the coal industry, some brokerage analysts said that thePMIreturnedto more than50% inJune, the manufacturing industry has recovered, and the demand for coal will also increase accordingly.In addition, Zuo Qianming, an analyst at Cinda Securities, reiterated his view in a recent research report: "We are currently in the early stage of a new round of upward cycle of the coal economy."

Zuo Qianming's team pointed out that with the continuous high temperature and summer weather and the accelerated process of resumption of work and production, the demand for thermal coal will continue to be strong, especially the demand for non-thermal coal will be released in the future.

The Zhou Tai team of Minsheng Securities is also optimistic about the continued upward trend of coal prices. It said in a recent research report that it is expected that with the price rebound in the peak season, the third-quarter reports of spot-based thermal coal companies will still rise sharply month-on-month.

Essence's new normal stock is heavy on the real estate sector. In terms of quarterly performance, the fund rose1.67% in the first quarter of this yearand continued to rise3.87% in the second quarter.Regarding the future performance of the real estate sector, Wanjia Fund Huang Hai said that in the past two or three years, the financial and real estate sectors have experienced less growth. In the past period, funds have flowed into the growth stocks sector, which has a siphon effect on the financial real estate sector, and the market is underweight on these sectors.However, under the background of clearing the supply side, the high-quality enterprises in these industries will have a more optimized industry structure and stronger competitiveness. When the economy is at an upward inflection point, it is expected to usher in an increase in profitability.

On the other hand, there were as many as 698common stock bases whose performance fell in the first half of the year, accounting for95% of the total, of which47fell more than20% ,includinginformation technology, software, consumer electronics,5G, non-ferrous metals, etc. The underperformance of the sector dragged down the performance of many funds.In addition, although the Hong Kong stock market rebounded in the second quarter, it still failed to make up for the decline in the first quarter. As a result, funds with heavy holdings in Hong Kong stocks also performed poorly in the first half of this year.

Among the common stock bases with the highest declines, Tongtai Industry Preferred StockCand Tongtai Industry Preferred StockAfell by25.80%and25.64%in the first half of the year. From the first quarterly report, the fund mainly holds non-ferrous metals and chemicals.Sevenof the top ten holdings arefrom the non-ferrous metal sector, including sub-sectors such as gold, aluminum and copper.

The top ten heavyweight stocks previously disclosed by Golden Eagle Technology Innovation Stock are SuperMap Software, Baotong Technology, Changying Precision, Powerland, Shenzhou Information, Flush, Torsi, Arcsoft Technology, Hanwei Technology, and Danghong Technology.Chen Ying, the fund manager of the fund, has7years of experience in public offering management. In the first quarterly report, Chen Ying said: "Looking forward to the second quarter, we believe that the economy is expected to bottom out and the market will usher in an opportunity for a bottom reversal. In the past three years, the market has been dominated by track-style investment, with a large number of high-quality sub-industry leaders.Due to insufficient market value and difficult research, there has been a long-term lack of institutional funding. We have observed thatsome companies with specialization and new characteristics After several years of business growth and stock price consolidation, the company already has strong long-term investment value. We will still focus on digging deep into the value of individual stocks and looking for high-quality targets that have been mistakenly killed by the market." But in the first quarter of the fund Afterfalling19.76% , it continued to fall by5.08%in the second quarter.

In terms of specific sectors, the chief economist of Great Wall Fund Xiang Weida said that he is optimistic about the three major industrial chains of vehicle electrification and intelligence, new energy and military industry for a long time, and possible future shocks may provide cost-effective participation opportunities.Relatively speaking, the military industry chain is not affected by economic fluctuations, and the long-term prosperity of the industry is highly certain. The recent increase in the share price of the military industry sector has lagged, and themilitary industry may be about to face a valuation switch inJuly .

In addition, the current market expectations for the performance of pharmaceutical, liquor and other sectors are not high, but the performance of these sectors can often have relatively stable growth performance, and the actual data may be better than market expectations.The current valuation and institutional allocation of medicine and medical care are in the low range for many years, and you can consider paying attention.

List of top100common stock funds in the first half of the year