Another batch of dividends from listed insurance companies is coming!

On July 8, China Pacific Insurance will conduct the 2021 annual profit distribution equity registration; on July 11, the company will issue annual cash dividends with a total amount of about 9.62 billion yuan.

Ping An of China has recently completed the annual dividend distribution, with a total of more than 40 billion yuan.China Life, PICC, and New China Insurance have all reviewed and approved the 2021 profit distribution plan at the recent shareholders' meeting, and will soon enter the dividend distribution stage.

China Pacific Insurance, China Life Insurance, PICC, and New China Insurance plan to share nearly 40 billion yuan in dividends.

The five major insurance companies issued a total of more than 80 billion yuan in red envelopes

Listed insurance companies have always been big players in giving back to investors with "real money".

According to China Pacific Insurance's 2021 Annual Dividend Distribution Implementation Announcement, the company will distribute a cash dividend of 1.0 yuan (tax included) per share, with a total cash dividend of 9.62 billion yuan. July 11.Based on this calculation, the cash dividend ratio of CPIC in 2021 is 35.9%.

Before China Pacific Insurance, Ping An’s cash dividends have been implemented, and its total cash dividends in 2021 will be 43.136 billion yuan (including mid-term dividends in 2021), and the proportion of cash dividends in 2021 will reach 42.45%.

In addition to the above two insurance companies, the other three of the five major A-share insurance companies, including China Life Insurance, PICC and New China Insurance, currently have cash dividend plans approved by the general meeting of shareholders.

Specifically, China Life plans to distribute a cash dividend of 0.65 yuan per share to all shareholders in 2021, totaling about 18.372 billion yuan, with a cash dividend ratio of 36.08%.

PICC plans to distribute a cash dividend of 0.164 yuan per share in 2021 (including the 2021 interim dividend), with a total of about 7.253 billion yuan, and the annual cash dividend ratio is 33.52%.

New China Insurance plans to distribute a cash dividend of 1.44 yuan per share in 2021, totaling about 4.492 billion yuan, and the annual cash dividend ratio is 30.05%.

This means that the five A-share listed insurance companies are expected to distribute a total of 82.879 billion yuan in cash dividends in 2021. Among them, Ping An of China has already implemented it, and nearly 40 billion yuan of dividends are on the way.

"Listed insurance companies are relatively high-quality high-dividend assets. From the perspective of dividend rate, most of them have stabilized at a relatively high level in recent years. Under the condition of relatively stable profit growth, insurance companies are undoubtedly high-dividend assets worthy of attention." Industrial Securities Research Report pointed out.

Thickened Solvency Cushion

In fact, compared with 2020, China Pacific Insurance's 2021 dividend ratio will be appropriately reduced.In this regard, one of the reasons given by Fu Fan, President of China Pacific Insurance, at the 2021 performance meeting is that the implementation of the second phase of C-ROSS this year will have a certain impact on the solvency adequacy ratio of major insurance subsidiaries. The 2021 dividend has been adjusted appropriately.However, he said that the company's dividend rate and dividend rate have maintained a high level in the industry for a long time, and this year, the company's dividend rate and dividend rate are still in the first echelon of the industry.

Starting from the first quarter of this year, the insurance industry will implement the C-ROSS Phase II rules.The second-phase rules are stricter on capital identification, improve the actual capital and minimum capital measurement standards for long-term equity investment, and greatly increase the risk factor. The principle of "comprehensive penetration, penetration to the end", the minimum capital is measured based on the underlying assets of actual investment.

Previously, industry insiders generally expected that the solvency of the insurance industry would decline, and some insurance companies' risk resistance and dividend space would also be under pressure.

"Under the C-ROSS Phase II rules, insurance companies must strengthen their research and planning capabilities in terms of future business development and capital consumption, retained benefits and shareholder dividends," said a person from a large insurance company.

However, most listed insurance companies said that under the C-ROSS II rules, although the solvency adequacy ratio of the company or its subsidiaries has declined, and the solvency adequacy ratio will decrease slightly with profit distribution, it can still remain high. level and comply with regulatory requirements.

In order to improve the company's solvency adequacy ratio and thicken the solvency buffer, many insurance companies, including listed insurance companies, have begun to seek "blood supplementation".For example, PICC and Xinhua Insurance both reviewed and approved the relevant proposals for the issuance of capital supplementary bonds at the shareholders' meeting held recently. The proposed issuance amount is 18 billion yuan and 20 billion yuan respectively.Since June, CPIC Property & Casualty Insurance and CPIC Life Insurance under China Pacific Insurance have also successively issued announcements to increase their registered capital, with a total capital increase of nearly 3 billion yuan.

Insurance stocks are expected to usher in a rise in valuations

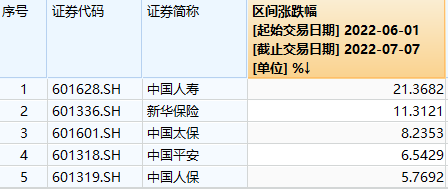

Insurance stocks have been sluggish this year, but have recovered since June.Data show that as of the close on July 7, the Wind Insurance Index has risen by 7.93% since June.

Specifically, the cumulative increase in the above-mentioned ranges of the five insurance stocks exceeded 5%. Among them, China Life Insurance and New China Insurance achieved double-digit range increases, 21.37% and 11.31% respectively.

Looking ahead, industry insiders believe that insurance stocks are expected to usher in upward valuations.

In the opinion of Sun Yin and Xu Yizhou, analysts of Industrial Securities, the trend of insurance sector valuation repair may be strengthened with the bottoming out of the economy and the improvement of the epidemic situation, "The current valuation has bottomed out due to the recovery of interest rates and insurance premiums, and it is expected that in the third quarter, with the The impact of the epidemic has weakened, the trend of premium recovery has strengthened, and the performance of the interim report has improved month-on-month, and the valuation has gradually bottomed out and repaired. At the same time, the insurance companies have started off well in the fourth quarter, and the sales situation is expected to improve. Repair forms catalysis."

The asset side is also worth looking forward to."Because insurance companies have allocated a large number of equity assets, their volatility and flexibility are relatively large, so they have a strong beta attribute. The continuous improvement of market prosperity can effectively drive insurance companies' investment yields to rise and improve ROE levels." Huachuang Securities It is pointed out that the rapid recovery of the equity market is expected to drive the valuation of insurance stocks to continue to rise together with the expectation of debt-side repair.

The non-bank team of China Merchants Securities concluded that from a marginal point of view, the liabilities and assets, the core elements that affect insurance stock prices, will continue to decline and narrow in the short term.Entering July, the performance of the interim report has become the most important variable affecting the stock price.

(Editor in charge: Hua Qingjian)